Energy events are having enormous geopolitical consequences, Secretary of State Hillary Clinton said in an Oct. 18 policy speech at Georgetown University in Washington, DC. A global surge of oil and natural gas discoveries stands to make some countries potent and influential, and others weak and marginal, she suggested; it may trigger war, or drive a country to strike peace; and it may contribute to devastating whole regions, and the planet as a whole.

Clinton was describing the rationale behind a full-time team she has appointed to monitor the fresh global surge of oil and natural gas discoveries and production, and suggest strategies for US foreign policy to adapt to it. But this is a tricky task. How do you distinguish between a passing oil price spike, and one that can shake the world? In war, how do you discern between an ordinary shoot-‘em-up, and one that can disrupt geopolitics? When does a new technology, an outbreak of corruption, or the construction of a pipeline impact events thousands of miles away?

Such is my own lens on global events, too, and the subject of a class I teach at (as it happens) Georgetown. Crunching energy events is more art than science, and there are many ways to do it. Here is mine.

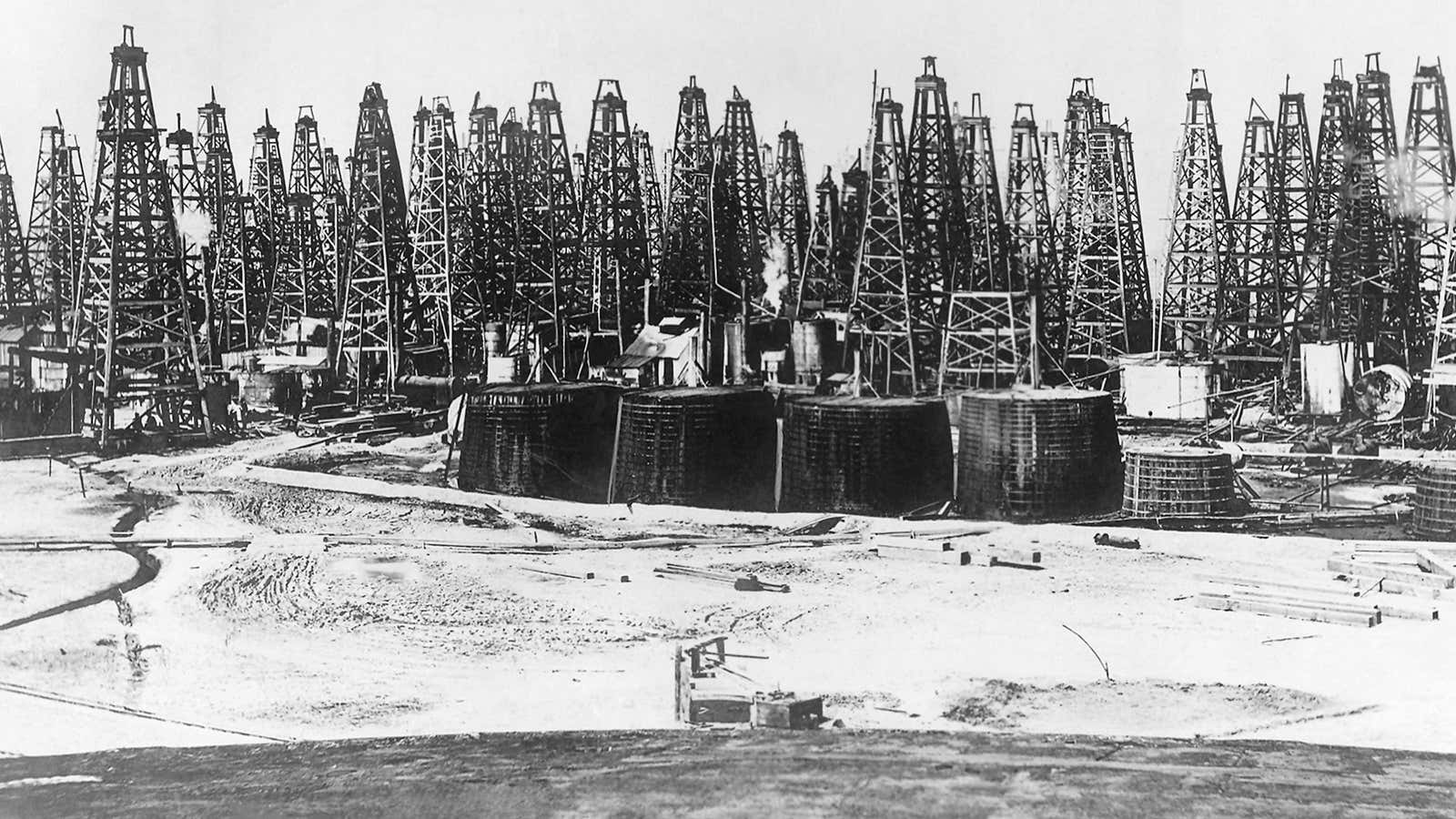

If you scrutinize, as Clinton noted, almost everything we are observing has happened in another form in the century-and-a-half-long era of modern energy. That era began in 1865 with the launch of John D. Rockefeller in the oil business. Oil had been drilled in the United States for a little over a decade prior to Rockefeller, and scooped out in bags in Baku, the capital of Azerbaijan, for centuries before that. But in terms of industry-scale energy with the potency to disrupt events on a global scale, Rockefeller is the dividing line. Everything we see today—price swings, energy gluts and droughts, wars over oil, environmental disasters, races to find new technologies—has been happening in some form or other for the past century and a half.

But not all events in energy’s history have had geopolitical impact. In order to cut away the underbrush and irrelevant trees, we require a set of indicators, guideposts to a potential geopolitical disruption.

What follows are 10 indicators. These are just a guide; the graduate students at Georgetown spend 14 weeks learning to interpret them. If one or more of these factors are involved in an event, it is likely to have ripples around the world.

1. Oil prices

The surge of oil prices in the 1970s pushed the Persian Gulf monarchies into the uppermost sphere of global power. Similarly, high oil prices weakened the relative leverage of big-consuming countries such as the United States by burdening their balance of payments. The same circumstances play out today, making price perhaps the most important indicator of potential geopolitical impact.

2. Transportation

In 1878, Ludvig Nobel (the brother of Alfred, the Nobel prize founder) invented the modern oil tanker, an advance that in the subsequent 130 years allowed petro-states to become rich, and super-charged global economic growth. The invention also signaled the role of transportation—the ability to move and choke off energy—in big geopolitics. In 2006, this axiom was reinforced with the launch of the U.S.-backed Baku-Ceyhan oil pipeline, which eliminated Russia’s stranglehold on energy and political independence for the Caucasus region.

3. Big personality

Without Vladimir Putin, would petro-charged Russia be a menacing specter in Europe and elsewhere? The question is answerable in the shape of his presidential predecessor, Dmitry Medvedev, who cut a neat form eating burgers with Barack Obama in Arlington, Virginia, but never rattled neighbors as could Putin with his vitriol-laced sneer. Rockefeller, Churchill, Muammar Qaddafi, Hugo Chávez—big personality has been a geopolitical indicator since the advent of the age of big energy.

4. Technological shift

Winston Churchill’s conversion of the Royal Navy from coal- to oil-burning vessels fundamentally altered the course of World War I, and helped seal the Entente victory. Henry Ford’s creation of the industrial-scale assembly line triggered the 20th-century industrial boom. More recently, George Mitchell’s refinement of hydraulic fracturing has disrupted the global oil and natural gas market, and threatens to shake up geopolitical power.

5. Supply

An examination of OPEC policies over the last four decades shows it: Tight oil and gas supplies make producer nations more powerful. Surpluses reduce their influence, and increase the leverage of consumer nations.

6. Public opinion

Public opinion has been a leading geopolitical indicator in the energy sector ever since muckraker Ida Tarbell’s takedown of Rockefeller led to the 1911 breakup of Standard Oil. More recently, Middle Eastern public opinion about economic opportunity has shaken Persian Gulf oil regimes, and what ordinary Chinese think about pollution is driving worried Chinese leaders to shift economic policy.

7. War

Wars often threaten energy supplies, and this in turn can affect the outcomes of the wars. Daniel Yergin, an oil historian and energy consultant, argues that petroleum was a pivotal factor in deciding World War II: An ample supply made the Allies mobile, and an Axis shortage (“the Squeeze”) stopped Germany in its tracks. More recently, the Taliban chronically frustrated NATO forces in Afghanistan by blowing up their fuel convoys. Al Qaeda and other forces used similar tactics in Iraq. And even when oil supplies have not been explicitly threatened, prices have surged on the mere possibility that they could be. Nigeria’s civil war and general instability have roiled oil prices for a half-decade; the Arab Spring has had the same impact.

8. Local politics

When the 1970s began, petroleum-producing Arab nations were seriously riled up. For several decades, Big Oil and consuming nations such as the United States had treated them as inferiors. So it was that, when the 1973 Arab-Israeli war broke out, they were already conditioned to convert their local row into a geopolitical affair. The result: four decades of accommodating OPEC as a global player. The lesson is not to dismiss “local” or “domestic” politics as unimportant; they can be momentous.

9. Corruption

Corruption and natural resources tend to go together, and while many resource-rich countries go to some lengths to dole out some of the benefits to the masses, the enrichment of the few at the top can still breed resentment. Long-term, deep-seated corruption underlie the fuming anger in the Arab Spring and this year’s protests in Russia. And when protests spawned by corruption threaten to destabilize the country’s energy output, there can be geopolitical consequences.

10. The Mountains—Russia, China, Saudi Arabia and ExxonMobil

Some countries and enterprises are so large and their behavior so singular that their actions can create and disrupt economic and geopolitical trends. China, Russia, Saudi Arabia and ExxonMobil are four entities that can affect supply, price, demand and more simply by stepping into the picture.

A case study

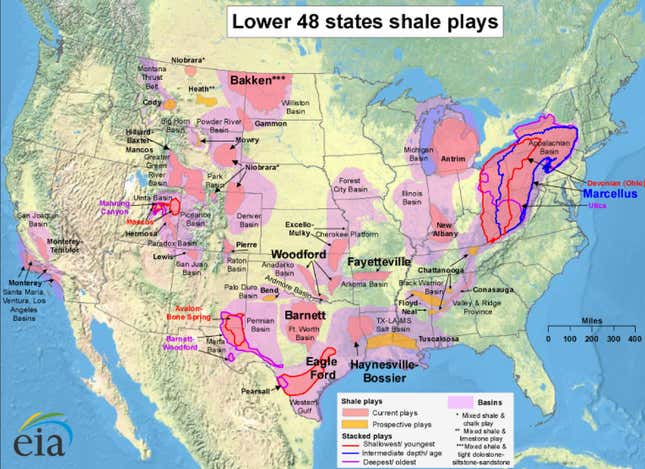

For a sense of how the indicators work, consider Houston wildcatter George Mitchell. In 2002, the octogenarian businessman sold his energy company, Mitchell Energy, to Devon Energy for $3.1 billion. For Mitchell, it was a gratifying payday for two decades of determined tinkering with an old, inefficient and expensive oilfield drilling method called hydraulic fracturing. For a long time, oil experts had known that a bonanza of oil and natural gas was locked into almost non-porous shale. Mitchell’s technique, carried out near Fort Worth, Texas, extracted those hydrocarbons in great volumes, and at a profit. That triggered a frenzy of drilling: on this map, the purple and pink areas denote the spread of Mitchell’s “fracking,” as it came to be known.

The result was that estimated US reserves of natural gas ballooned from a two- or three-decade supply to more than a century of the fuel at current consumption rates.

But Mitchell’s breakthrough also had a geopolitical impact, 5,000 miles to the east. The victim: Gazprom, the state-controlled Russian natural gas company.

Until Mitchell’s advance, the impending US natural gas shortage had led to a flurry of projects intended to import liquefied natural gas (LNG) into the country—16 approved and proposed LNG import terminals on the US east and west coasts. Much of the LNG was to come from Qatar, the biggest exporter in the world. The fracking frenzy rendered those projects obsolete. But Qatar still needed a market for its gas. It found one in Europe.

Qatar’s diversion of its LNG created Europe’s first spot market for natural gas. Often sold at cut-rate prices, the gas was a gargantuan challenge to Gazprom, which controlled 27% of Europe’s market for gas, and sold it in long-term contracts whose prices were linked to those of oil, keeping them high. Gazprom supplied 100% of the gas for six European states, and well over half the market for six more. That made Gazprom a powerful tool of Russian foreign policy because these European nations were reluctant to displease Moscow. Now, that influence was undercut, all thanks to fracking.

This is easy to see in retrospect. How might one have guessed the impact of Mitchell’s discovery at the time? Four of the indicators are involved.

One is big personality: fracking would not have had a breakthrough anytime close to when it did had it not been for Mitchell’s stubborn perseverance. When you notice a personality moving with such verve and success, it is worth looking for a potential big knock-on impact.

Another is the technological shift. Fracking was clearly a big advance in that it unlocked large volumes of heretofore inaccessible hydrocarbons. Again, it signaled the potential for a distant chain-reaction.

Supply is another indicator. When the hydrocarbon supply grows in one locale, there is bound to be an impact elsewhere, given the fungibility of fossil fuels.

Finally, politics. Many Europeans, particularly ex-Warsaw Pact countries, bristle at Russia’s behavior. They were bound to seek political mileage from the new gas supply. They haven’t managed it yet—Europe’s internal gas pipeline system is not yet well enough connected to most of the eastern nations, which hence are still in Gazprom’s grip. But we are watching.