“It’s cost, cost, cost,” Tesla CEO Elon Musk told investors in January just before losing $1.1 billion in the following months. “I think we’re way smarter about how we spend money and we’re getting better with each passing week.”

That was premature, but Tesla finally made good on Musk’s words on Wednesday (Oct. 23) by posting a surprise $143 million profit (pdf).

It’s good news for the electric carmaker which has been fighting off rumors that demand for its vehicles, and profits, were in jeopardy (domestic sales in the US have slackened). It was also unexpected: Analysts polled by FactSet expected Tesla to lose $253 million this quarter. The company has only posted four profitable quarters before now, and never recorded an annual profit. The stock price soared 20% in after-hours trading to around $307.

Tesla pulled it off by focusing on efficiency, the company said. Its $6.3 billion in quarterly revenue is actually lower than the same period last year (mostly due to more cars being leased), which marks the first time year-over-year revenue has declined in more than five years. But the company was able to eke out a profit by lowering manufacturing and capital expenditures, and getting more for its money.

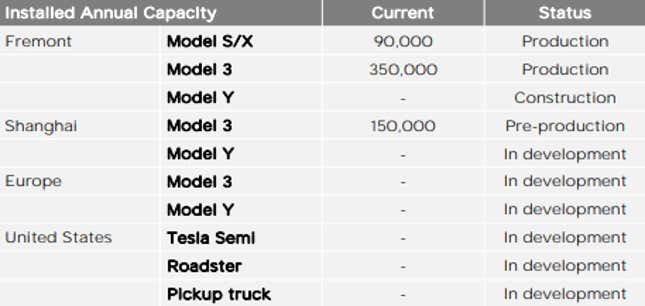

The company said it was focusing on making its new factories, the latest now under construction in China, far cheaper than its original problem-plagued assembly lines in Fremont, California. Tesla claims its Shanghai factory was about 65% less expensive (per unit of capacity) to build than its first Model 3 production line in the US. The feat was particularly impressive as Tesla has been steadily reducing the average selling price of its vehicles.

The company now has $5.3 billion on hand, up 8% over the previous quarter. It also plans to recognize about $500 million of deferred revenue from sales of Autopilot and self-driving features such as Smart Summon over time.

The company is confident it will exceed its target guidance of 360,000 deliveries this year.

But if you expect Tesla to stay in the black, don’t get too excited. Musk told investors earlier this year that he was “optimistic about being profitable in Q1, and for all quarters going forward.” Today, the company struck a more measured tone in its earnings note. It predicted profits going forward “with possible temporary exceptions, particularly around the launch and ramp of new products.”

Buckle up.