The numbers: The banking giant reported a net profit of 917 million Swiss francs ($1.02 billion) in the fourth quarter, more than double the average analyst estimate. This was enhanced by a one-off tax benefit, but even without it the bank managed to beat expectations. Investors pushed up UBS’s shares by more than 5% in early trading.

The takeaway: UBS dubbed 2013 a “transformational year,” launching an aggressive turnaround plan featuring a much smaller investment bank and tighter focus on wealth management. The bank’s latest results are encouraging in this regard; its wealth management business posted strong growth in assets and profits, particularly in the US, while the slimmed-down investment bank turned a profit thanks to growth in its equities and advisory businesses.

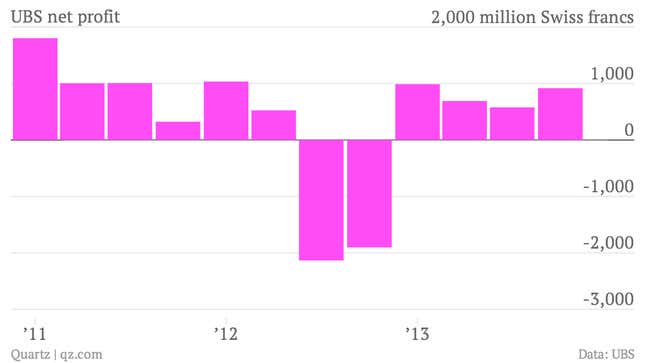

What’s interesting: Much is being made of the 28% rise in the bank’s bonus pool for 2013, a function of its return to an annual profit—3.2 billion Swiss francs, versus a loss of 2.5 billion francs in 2012. If it can keep this up, the rewards per employee will only grow more enticing; the bank employed just over 60,200 people at the end of 2013, 2,000 fewer than a year earlier, and aims to slash headcount to 54,000 in 2015. But UBS’s ongoing legal problems are still a drag on fatter banker paychecks, including the unresolved probe into foreign-exchange trading and the 210.5 billion Swiss francs in dud debts in its “Non-core and Legacy Portfolio” (otherwise known as a bad bank) that will drag down profits for years to come.