Do you have $1 to spare? If so, you have no excuse for not investing.

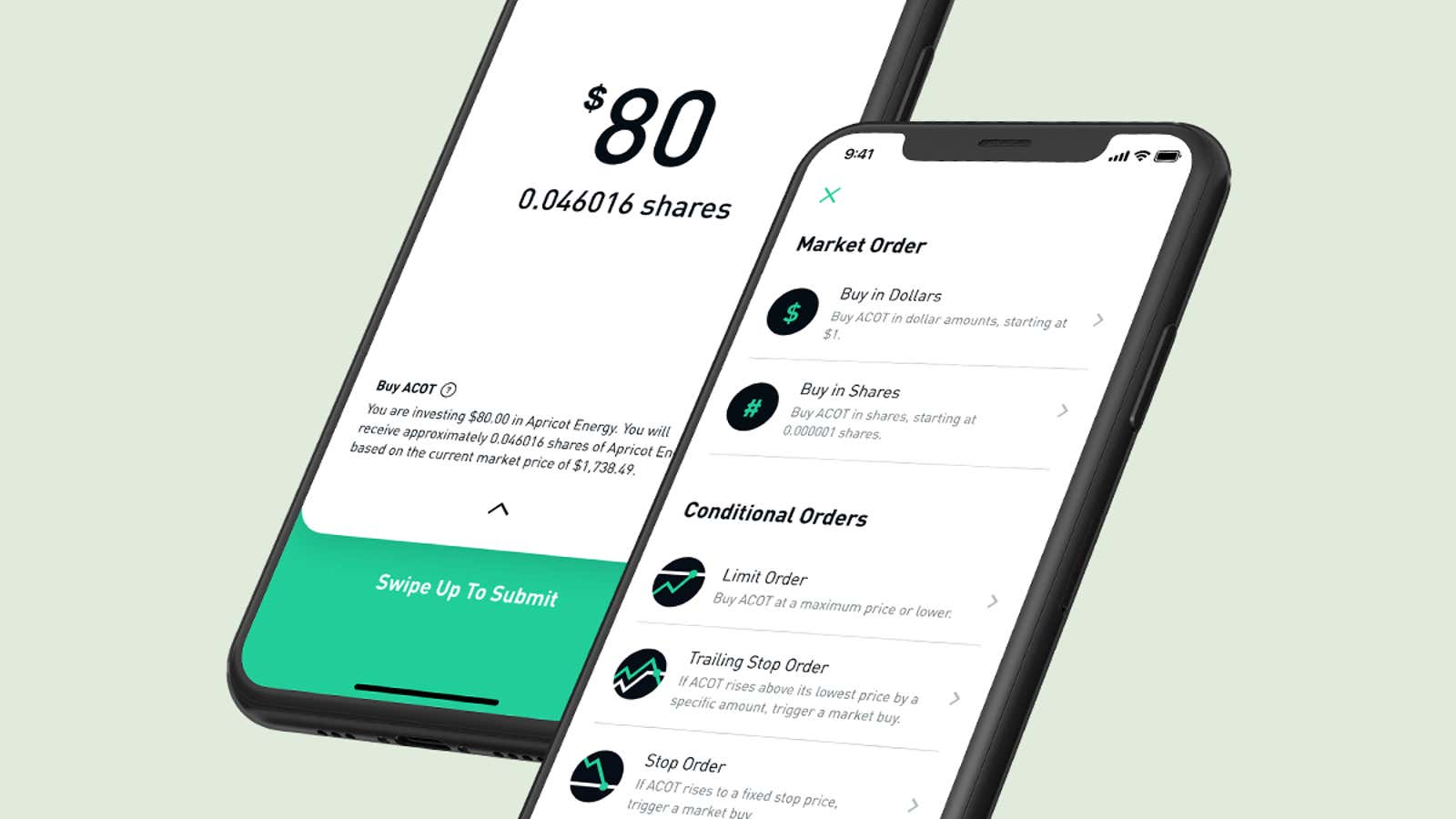

Robinhood, the six-year-old Bay Area startup that pioneered zero-fee stock trading, announced today (Dec. 12) that it will soon allow customers to buy and sell tiny increments of equity—so-called fractional shares—in their favorite companies. The feature is expected to begin with a limited rollout to US customers next week.

“We’re really excited about this because we believe it will empower even more people to invest,” Vlad Tenev, one of Robinhood’s founders, told Quartz. Fractional shares mean investors don’t have to be constrained by whole share prices. If you want, you’ll be able to buy just $1 worth of Apple stock, rather than saving up the $270 for one full share.

If you’ve ever stopped short of buying a full tank of gas because you’re running low on cash, you’ll recognize the value in fractional shares. Pumping just a little bit at a time doesn’t change the value of what you’re buying; just like a volume of gas, the value of a fractional share is fixed to its market price at the time you purchase it. You can buy gas a tenth of a gallon at a time; Robinhood will allow customers to buy as little as one millionth of a share, with purchases rounded to the nearest penny.

For Robinhood’s customers, fractional shares could be a chance to own a slice of glitzy but pricey companies like Amazon (share price: $1,740) and Google ($1,350). Rather than setting aside large sums of money to buy whole shares in these high-flyers, mom-and-pop investors might purchase just a bit.

This is a tantalizing possibility, especially for first-time investors, who make up the bulk of Robinhood’s customer base. If they’re immediately able to buy into high-tech companies, Robinhood’s users might be more excited about investing. Customers will be able to buy fractions of exchange-traded funds, or ETFs, as well.

Even if you can cough up the $1,740 for a full share of Amazon, fractional shares can still be a useful tool. They could make it easier for small-time investors to dollar-cost average, buying small amounts of stock at regular intervals to reduce the impact of price volatility.

While Robinhood revolutionized the brokerage industry with zero-fee investing, making it an industry standard, this latest feature is less groundbreaking. That’s because other US-based brokerages have already wised to the popularity of fractional shares. SoFi launched the feature in July. Charles Schwab announced its own initiative in October, with plans to launch fractional shares for individual stocks “sometime in 2020,” said Michael Cianfrocca, a company spokesperson. Last month, Schwab announced the acquisition of rival TD Ameritrade, part of a continued trend of consolidation that presents Robinhood with stiff competition.

As Robinhood competes against large incumbents, it’s racing to add more conventional features, too. In early 2020, the company plans to introduce dividend reinvestment plans and recurring investments, helping customers put money into stocks and ETFs on a regular basis (daily, weekly, biweekly, or monthly). Despite the fact that the company recently surpassed 10 million customer accounts, Robinhood still has some catching up to do before it becomes a one-stop shop for investors.

A note on fractional share investing:

If you’re buying or selling fractional shares in dollar amounts, you must enter an amount of at least $1, says Robinhood. However, you’ll have the option to “Sell All” if you have less than $1 of any fractional share. Robinhood doesn’t charge a commission for buying or selling shares.