Why so many “activist” investors are barraging companies with money-making schemes

It’s not just Carl Icahn. Activist investors are everywhere at the moment. They’re agitating for change at companies as diverse as Darden Restaurants, the owner of the Red Lobster and Olive Garden restaurant chains, and Dow Chemical Co, the 116-year-old conglomerate.

It’s not just Carl Icahn. Activist investors are everywhere at the moment. They’re agitating for change at companies as diverse as Darden Restaurants, the owner of the Red Lobster and Olive Garden restaurant chains, and Dow Chemical Co, the 116-year-old conglomerate.

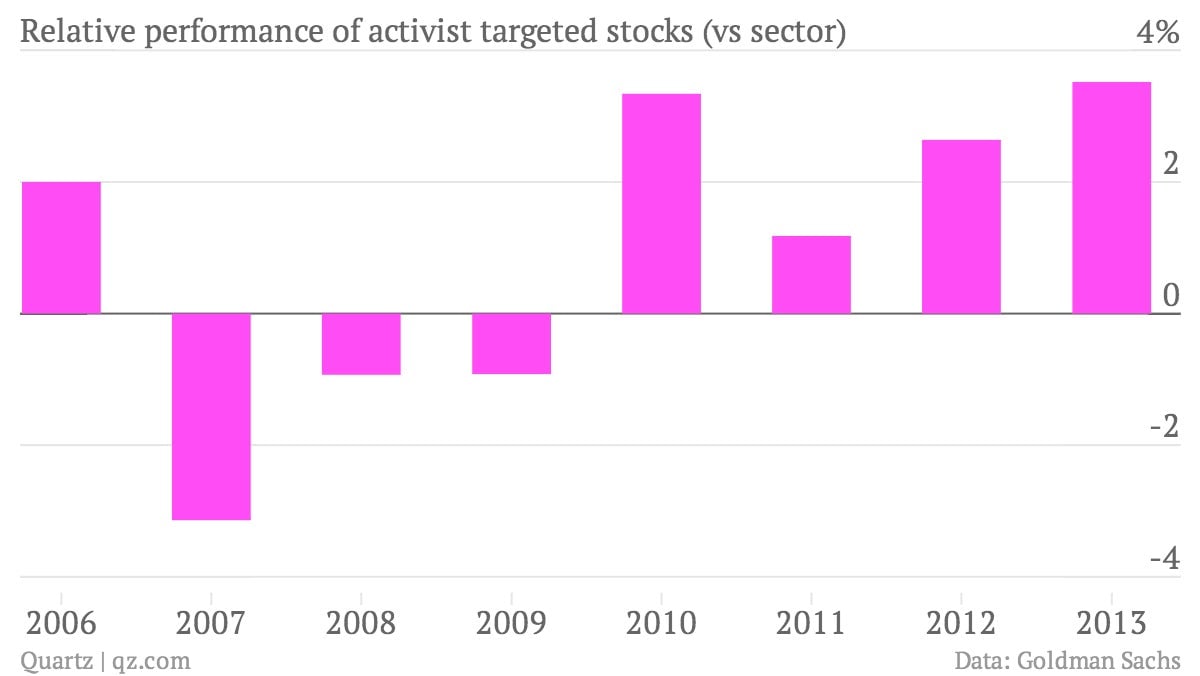

The chart above explains why. Put simply, campaigns by activist investors are working, in the short term at least. The chart shows the median performance of stocks targeted by activist investors three months following the announcement of a campaign to press a company to take particular actions to increase value for shareholders. In 2013 these targeted stocks outperformed their sectors by 3.52%. It’s worth noting, however, that from 2007 to 2009, those stocks performed worse than their sectors. This suggests that the strategy works well when the markets are doing well and poorly when they aren’t.

Overall, activist hedge funds returned 21% last year, compared to 7% for the broader HFR Equity Hedge Index, Goldman says.

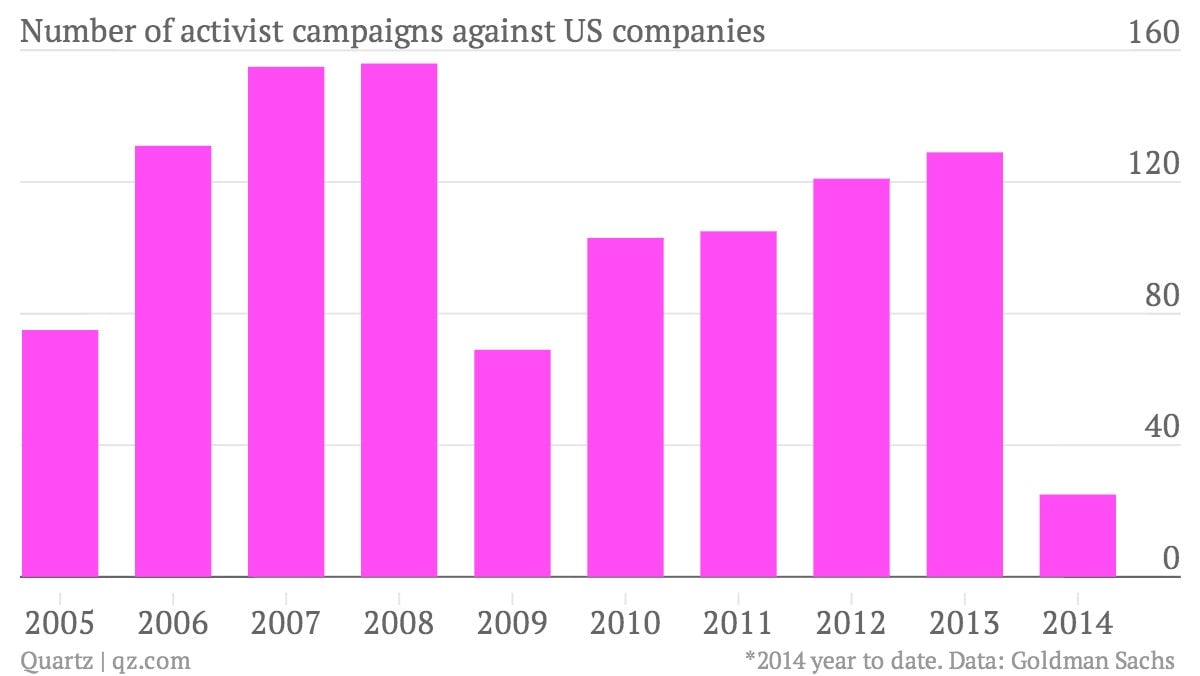

The number of activist campaigns against US companies has actually moderated since a peak in 2008, according to Goldman. But with 2014 less than two months old, and returns from the strategy on the rise, don’t be surprised to hear more bluster from hedge funds agitating for change at what they consider underperforming companies.

As you can see from comparing the two charts above, it takes a few years of sub-par or above-average returns for the volume of activist activity to ramp down or up.