The working world is undergoing its biggest change in generations. Only around 60% of the core skills required to perform jobs today will be crucial by 2022, according to the World Economic Forum. But education is only just starting to catch up.

The great challenge of the coming decades will be how to train hundreds of millions of new workers efficiently and affordably. The answer will not look like a conventional college.

Instead, hundreds of alternatives are popping up, from coding bootcamps in San Francisco, to classrooms in Amazon warehouses. The promise and peril for students are great. Here’s what lies ahead for the future of education in the digital economy.

Returns on education

The returns on higher education have never been higher. Neither has the gap between college graduates and those without a degree.

In the US, the prosperous post-war world increasingly looks an aberration for workers. In the 1960s, workers without high school diplomas could find a job in a factory, purchase a home, and support a family. That’s virtually impossible now. Today, two parents would each need to work two full-time minimum-wage jobs (77-hour work weeks) just to support a family.

That’s because the returns on education are diverging. Incomes across the educational spectrum climbed in parallel until the mid-1970s. But then those without a college degree saw their fortunes plummet. A graduate degree holder today has effectively doubled their earnings potential, while a graduate with a Bachelor’s degree earns nearly 50% more than they would in the early 1960s. For everyone else, wage growth has flatlined, or even fallen into negative territory.

That’s created an enormous gap between the top and the bottom, a microcosm of the US economy which has the highest level of inequality in 50 years. The average college graduate now earns more than double those without a high school degree.

This is not a US phenomenon. Around the world, wages for workers at the bottom have largely flattened out (despite a recent bump). And the share of people working for low pay—the “working poor”—has grown across Europe, Japan, and other wealthy countries.

Labor demands

Soon, every country will have to deal with the structural changes in their economies driven by automation, artificial intelligence, and globalization. A 2018 World Economic Forum survey on the future of jobs estimated that almost half of the core skills required to perform jobs would shift by 2022. Among the most anticipated skills are designing and programming technology, as well as high-level systems understanding and analysis. The least were anything that could be automated or outsourced to the cloud: installing and maintaining technology, memory and verbal abilities, and physical dexterity and endurance.

That demand for more skilled labor, combined with rising education levels, has pushed down the number of hours worked by those without higher education to its lowest level on record: about 10% in 2017.

Paying for school

Since the 20th century, most governments have funded universal education through high school. Today, workers need more advanced training to have a chance at competing and entering the middle class. Countries are searching for ways to support retraining the workforce, especially those with fewer skills.

Countries differ not only in how much they charge for college, but how students can pay for it. In Germany, higher education is effectively free. That hasn’t proved a panacea. After reintroducing tuition charges in 2006, and rolling them back in 2014, the public is split on how to pay for swelling enrollment without excluding or miring students in debt.

A second model is loan subsidies, popular in England and Australia, tying debt repayments to graduates’ salaries. Defaults are almost unheard of, since payments only consume a predefined share of someone’s salary.

That’s not the case in the US, the second most expensive country to get a college degree, where student loans now account for a record $1.6 trillion in household debt, the largest category behind home mortgages. The average US undergraduate now leaves school with $29,000 in student loan debt—and even more at for-profit schools, where graduates sometimes leave with degrees less likely to translate into higher salaries.

It’s easy to see why. In 1987, an undergraduate degree cost about 80% of a graduate’s average annual salary in the years following graduation. By 2016, the number had climbed above 200% and rising (you can find the most comprehensive data at CollegeBoard.org).

Every age group is feeling the strain. Defaults are rising 12 to 20 years after entering college, according to The Brookings Institution, which estimates that 40% of borrowers will default on their student loans in the future (defined as not making a payment for more than a year). The US does offer income-adjusted repayment schemes, but due to their complexity and a lack of promotion by government agencies, few use them. That’s finally changing. Direct loans repaid through income-driven repayment programs have more than doubled from 12% in 2010 to more than 45% in 2017, according to the Congressional Budget Office.

Finding a job

Few degrees stand out in the workplace today like computer science (CS). In hubs like the Bay Area, a persistent talent shortage in tech has pushed the average annual salary in the industry to more than $142,000, the country’s highest. But the gap between candidates and job openings hasn’t narrowed much. Last year, the number of college graduates with CS degrees was 71,416, according to the National Center for Education Statistics. Yet job openings in computer-related occupations stand at around 500,000.

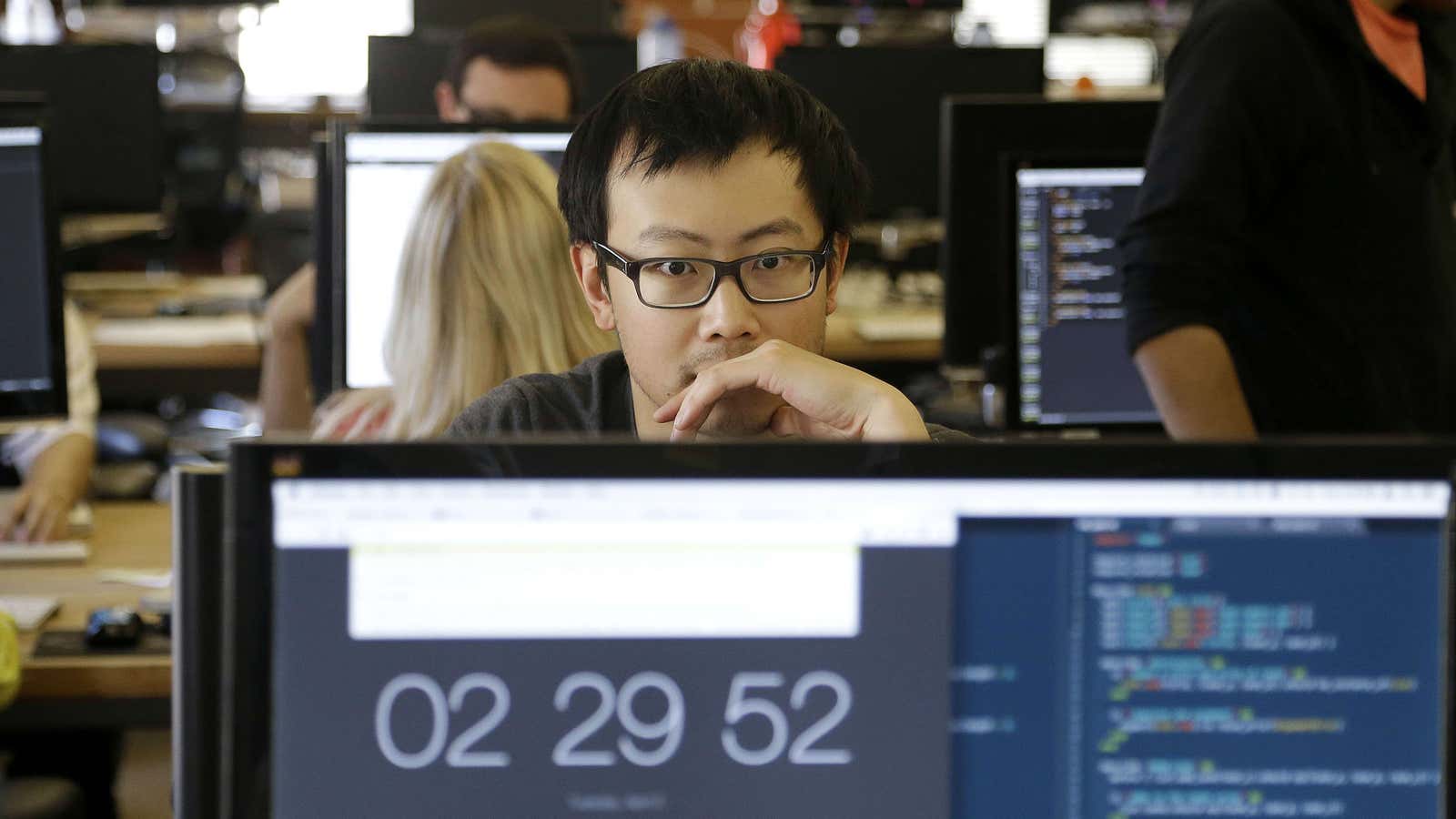

Universities struggle to teach all the students who want to enroll in CS programs, a shortfall exacerbated by a lack of faculty. CS enrollment surged so much after the introduction of the personal computer (1980s) and the web (2000s), that universities capped admissions into many computer science programs, according to the National Academy of Sciences. By 2011, coding bootcamps had emerged as an alternative pathway for learning software development at a fraction of the cost. Since then, the number of bootcamp graduates has soared to more than 33,000, just under half the number of computer science major graduates.

Bootcamp participants often learn only a basic understanding of concepts and coding skills. Still, many can fill junior software development roles before rising through the ranks, unburdened by the debt associated with a degree. A four-year, out-of-state tuition bill for a computer science degree can exceed $171,752. At $15,000 to $20,000 for a few months, bootcamps appear to be many to be a steal.

Many bootcamp graduates dream of being hired to work at Google, Facebook, and other top tech giants where median incomes can exceed $200,000. Most won’t. Last year, the top ten employers hired only 2,415 bootcamp graduates, according to CareerKarma (pdf), or about 7% of the total. Some students report schools failing to deliver credible courses or job prospects.

Many graduates are hired as junior employees who face years in the trenches building basic skills before they can graduate into the next tax bracket. That’s not to say they don’t earn more at the start. In a study of 1,862 students by Course Report last year, bootcamp graduates reported an average starting salary of $66,694, a 51% increase over their previous one.

Just as technology has transformed how we do our jobs, it is remaking how we train and educate the next generation of workers. A defining challenge of the next decade will be to ensure the benefits accrue to those at the bottom, rather than continuing to flow disproportionately to those at the top.