US credit card companies are pouncing on fewer gullible college freshmen

The shrinking of Americans’ credit card debt is one of the least-appreciated changes set in motion by the global financial crisis.

The shrinking of Americans’ credit card debt is one of the least-appreciated changes set in motion by the global financial crisis.

And perhaps the biggest contributor to the shift is that US companies have drastically cut back on their shameful practices of signing up young, financially inexperienced Americans at colleges.

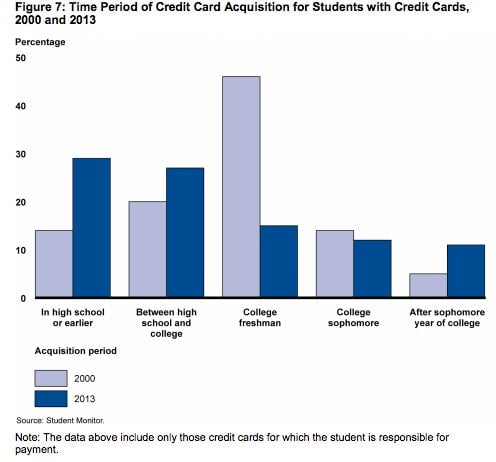

The US Government Accountability Office just published a great report documenting the shift in business practices, including these charts.

They show that credit card companies have cut their marketing efforts to college students.

Those marketing efforts seemed to be especially effective in getting doe-eyed freshmen to sign up for cards.

And as a result, fewer students have credit cards.

So is a more prudent generation—which took to heart the foolish debt acquisition of it spendthrift parents—coming of age?

No. The CARD Act in 2009 changed the rules for card issuers, placing new restrictions on how they’re marketed to young people. This is an example of good policy in action.

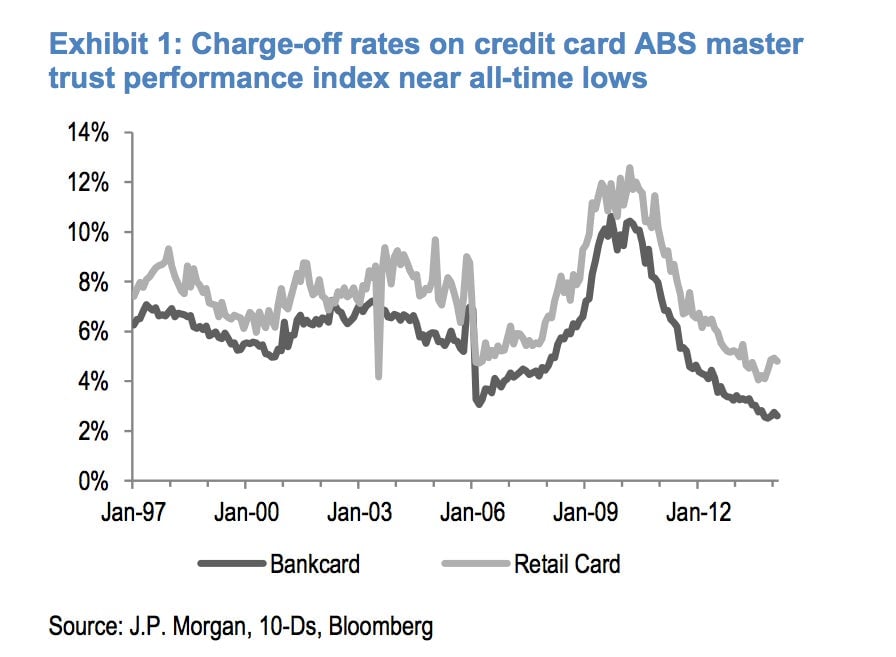

And for the record, it’s not just good for consumers. College kids happen not to be the most responsible borrowers in the world. And since young people have a smaller and smaller share of US credit cards outstanding, that means that the overall credit quality of US credit card holders has improved markedly. Rates of losses on credit-card-asset-backed securities have fallen sharply in recent years.

In other words, Americans are repaying their credit card bills on time, suggesting that they’re not overspending. That’s a very good thing.