Every year for five years, corruption in Angola has become steadily worse, according to Transparency International’s corruption perceptions index of 182 nations. In 2007, the oil-rich southwest African country was 32nd from the bottom. By last year, it had plunged to the 14th most-corrupt nation on the Earth.

That’s not surprising. Oil and corruption have gone hand in hand since the industry was pioneered a century and a half ago. But more recently, experts have added a corollary—that an oil-producing country that channels some of its wealth into an independently run sovereign wealth fund is likely to rank better on the corruption scale than one that does not. Angola announced Oct. 17 that it is launching such a fund—it plans to invest $5 billion from its 1.8 million barrels a day of oil production into infrastructure, hotel and other diversified projects at home and in the region. So we thought we would examine whether the second theory works: that is, will Angolan corruption probably lessen in coming years as measured by Transparency International (TI)?

A caveat is that the TI index only indirectly ranks corruption—as its name implies, it judges the perception of people who interact with the country, not necessarily actual graft, skimming, extortion or theft. Still, there may be no better publicly available tool, and most others appear to be less accurate.

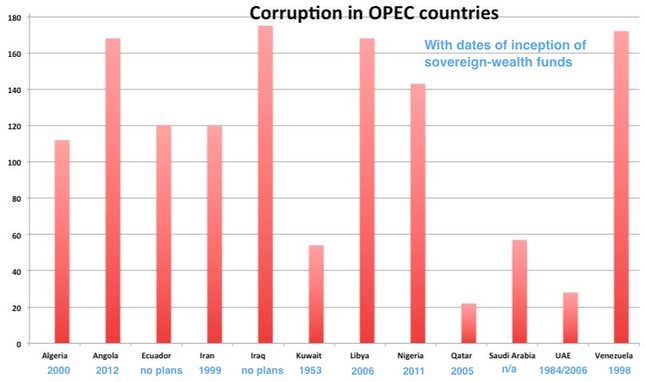

For convenience, let’s look at the dozen members of OPEC. As you see in the chart below, five of them are near the bottom—among the worst corruption offenders. As it happens, two of those have no active plans for sovereign wealth funds—Ecuador and Iraq. Nigeria launched a small fund only last year, and Angola’s is coming soon. As for Venezuela—let’s ignore it as an outlier. All the rest—those that have had sovereign wealth funds for some time—are doing much better on the corruption index. (Saudi Arabia doesn’t have a formal fund, but the central bank, established in 1952, manages government assets the way a fund would.) So from this we have a simple affirmative—Angola might be poised for some level of corruption cleanup.

But what about a before-and-after snapshot of the OPEC countries individually—have sovereign wealth funds improved their corruption outlook over time?

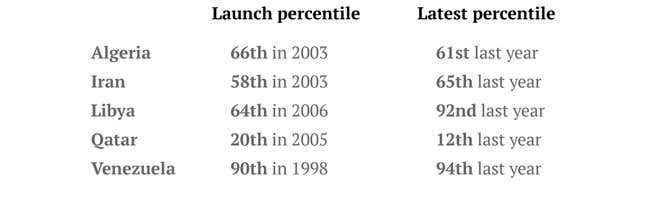

Five of the OPEC countries established their funds since the TI index began in the mid-1990s. From there, it’s difficult to produce a single simple chart because the number of countries indexed has more than doubled, from 85 in 1998 to 182 today. So what we did was assign percentile values to the countries pegged to where they stood in the corruption rankings when they were first included, and where they were last year. The larger the percentile, the greater the corruption.

The takeaway is pretty simple—sovereign wealth funds don’t seem to lead consistently to less corruption. Qatar moved up from the 20th to the 12th percentile, and Algeria got a little bit better too. But Iran and Venezuela both became a little worse. Libya meanwhile dived into the abyss, though last year’s civil war no doubt has much to do with that.

Of course, many things determine an oil-producing country’s level of corruption besides whether or not it has a sovereign wealth fund. But those that establish such a fund ought to have better governance in general, so there should be a correlation. But another factor might be that it depends on how the fund is set up.

This is especially the question in Angola’s case. Witney Schneidman, a former US deputy assistant secretary of state for African affairs, says that long-time Angolan President José Eduardo dos Santos is looking to establish a “ring fence” around some of his country’s oil revenues. But he wondered whether the government could execute. “Does Angola actually have technical capacity to deliver on projects?” Schneidman asked.

And Philippe de Pontet, head of Eurasia Group’s Africa practice, says that currently the country’s state-owned oil company, Sonangol, is effectively a sovereign wealth fund. Dos Santos, he said, is now shifting Sonangol to its core mission in oil, and having the new sovereign wealth fund assume the duties of diversified investment. “The process will be streamlined,” de Pontet said. “But there will be less accountability and transparency, and you are likely to find that some parts will be a patronage vehicle for leaks.”