Pimco’s parent details the bond-trading giant’s rough year

People don’t mention it very often, but Pimco—the bond trading and money management giant piloted by Bill Gross—is actually a subsidiary of the German insurance giant Allianz, which bought it in 1999. Allianz reported profits this morning and the results were disappointing. Analysts were expecting a 9% profit year-over-year, but the Munich-based insurer was only able to generate 1% in profit growth. (paywall)

People don’t mention it very often, but Pimco—the bond trading and money management giant piloted by Bill Gross—is actually a subsidiary of the German insurance giant Allianz, which bought it in 1999. Allianz reported profits this morning and the results were disappointing. Analysts were expecting a 9% profit year-over-year, but the Munich-based insurer was only able to generate 1% in profit growth. (paywall)

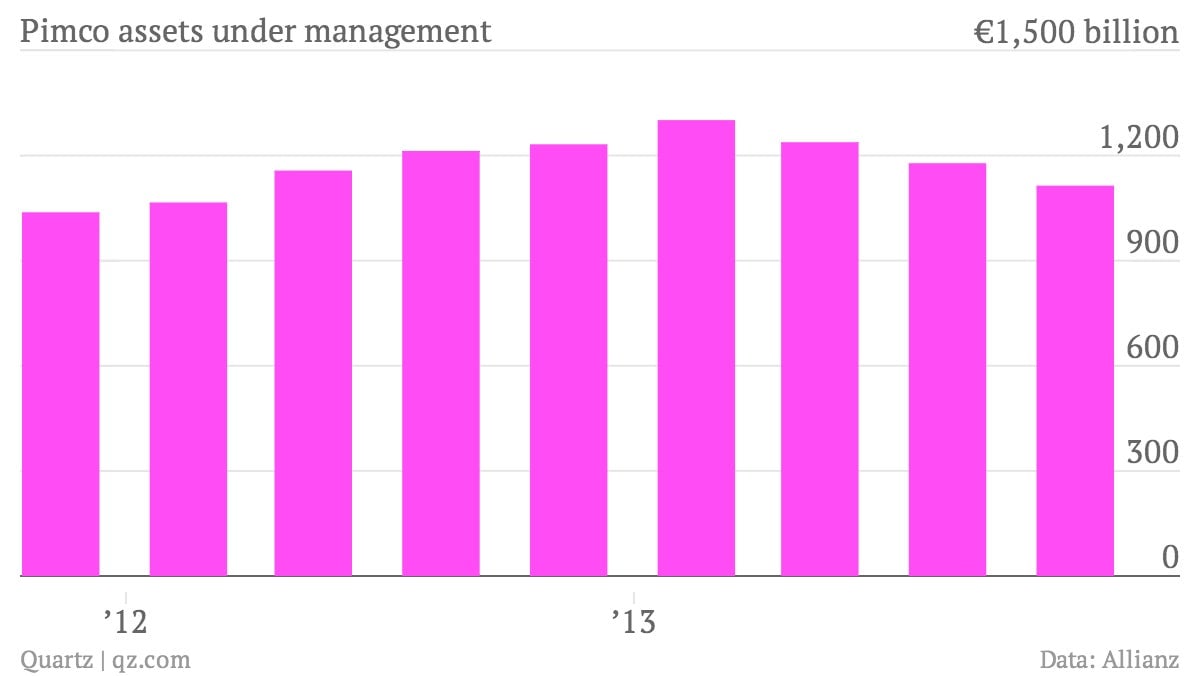

The report also provided some good numbers on how things are going for Pimco, which has been dealing with difficult market conditions, as well as a messy—and high-profile (paywall)—management soap opera. “Following an exceptionally good first half-year, the debate surrounding the timing and extent of a tapering in the Fed’s bond purchases in the second half of the year led to significant net outflows for traditional PIMCO products,” said Allianz CEO Michael Diekman in a prepared statement.

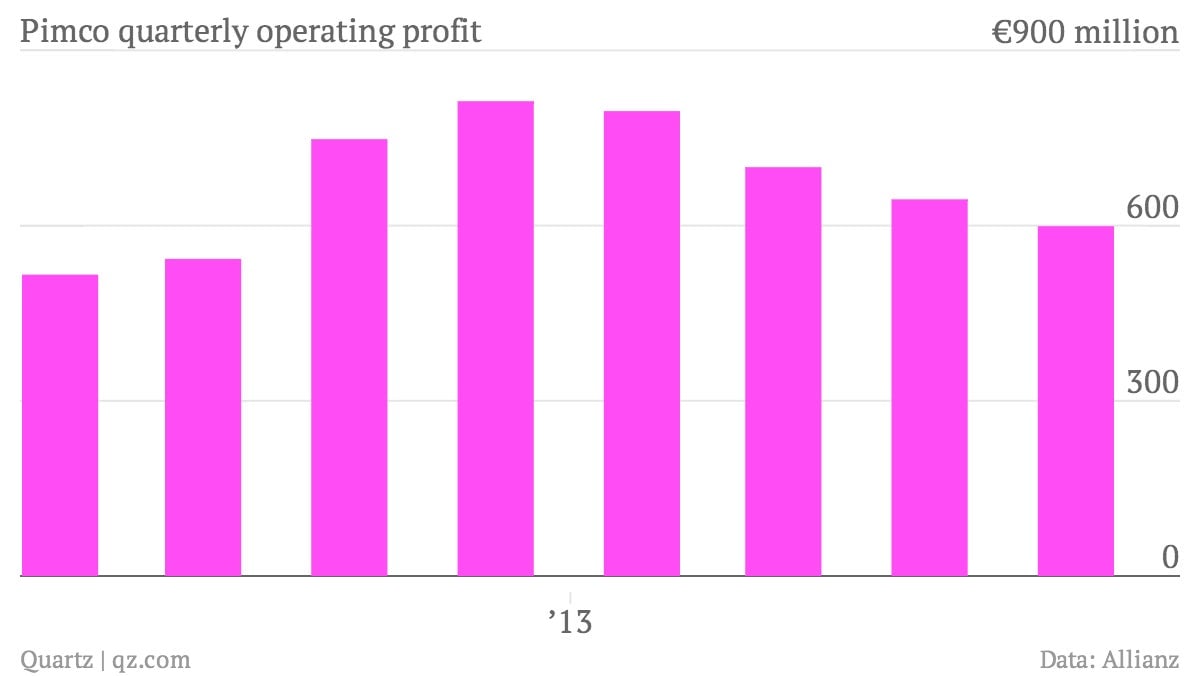

In euro terms, fourth-quarter operating profits at Pimco fell 26%, compared to the same quarter the prior year.

And the firm saw roughly €118 billion in outflows from third-party assets under management.

Yes, Pimco’s had a rough run. And the recent management soap opera has exposed a key vulnerability for the firm, an excessive reliance on Bill Gross. But part of this is just an asset class story. Bond funds, which Pimco specializes in, have attracted gobs of money in the years after the financial crisis as investors burned by stocks in 2008 vowed “never again.” Time marches on, and with the Federal Reserve ever-so-gently beginning to shift away from ultra-low interest rates, many have decided to get out of the bond market while the getting is good.