This post has been corrected.

Many Koreans who rent apartments don’t actually pay rent.

You read that right. They don’t make monthly rent payments.

Don’t start planning your move to Seoul just yet. There’s a catch. To get one of those apartments, on average, you need to plunk down the equivalent of almost $300,000.

Under the country’s Jeonse—or Chonsei—system, tenants lend significant chunks of money to landlords in lieu of rent. (Jeonse is usually translated as “key money.”) It works like this. In exchange for access to the property for specified term—usually two years—tenants make a lump sum deposit to the landlord, based on a percentage of what it would cost to buy the property. The transaction is essentially a loan, with the tenant as the lender, the landlord as the borrower, and the house as the collateral.

Jeonse contracts have deep roots in Korea. (They can be traced back several hundred years, according to this paper.) But their popularity grew sharply in the 1960s and 1970s. Amid the country’s rapid transformation into an urban, industrialized economy, Korea faced two large problems: Housing rural Koreans arriving in cities, and financing economic activity. The Jeonse system was an elegant solution to both.

“On the one hand, it’s a household rental system,” said Hyun Song Shin, a professor of economics at Princeton who has studied the Jeonse system. “But actually it’s an informal lending scheme as well.”

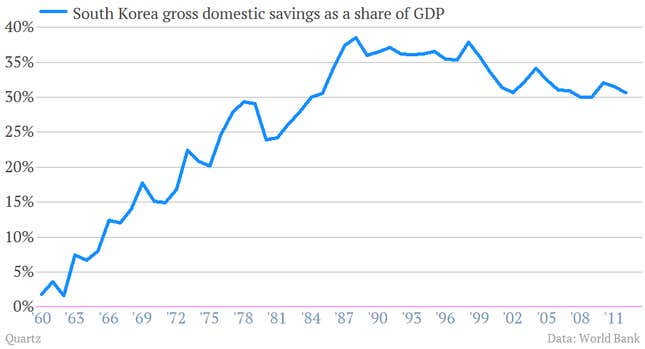

Shin has a hunch that the Jeonse system might have been something of a secret weapon powering Korea’s rapid economic development. He argues that Korean savings rates surged from 1960s into the 1990s, in part, because people socked away significant sums for Jeonse money. The system efficiently channeled that money to Korean landlords, many of whom were also small business owners and entrepreneurs, and happy to forgo rent in favor of a lump sum to invest in their businesses. During the financial crisis of the 1990s, the system only became more entrenched as it allowed Koreans to bypass a deeply troubled banking system.

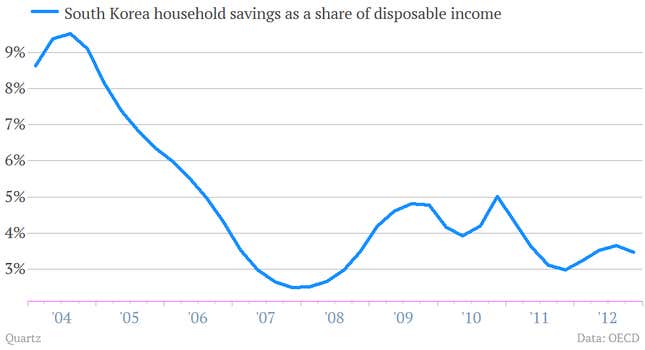

But recently something has changed. For example, household savings rates have collapsed.

And levels of household debt have moved sharply higher. In 2012, South Korean household debt hit 163.8% of disposable income, far higher than the OECD average of 135%. What happened?

Well, the short version is, in the wake of the Asian financial crisis, Korea’s banks started lending big. According to the IMF, between 1998 and 2009 household debt increased by about 13% annually. (At the end of 2009, household debt as a share of GDP was about 70%. By the end of 2011, it was 82%, pushing up against the 85% threshold some see as the point where high household debt hurts growth. )

In other words, as it’s gotten easier to borrow, Koreans have had less of an incentive to save. And that’s completely transformed the Jeonse from a vehicle to build savings into something quite different.

“If you don’t have the Jeonse deposit you actually go and borrow it from the bank,” said Shin, the Princeton economist, who later this year will take over as chief economist at the Bank for International Settlements in Basel, Switzerland. “And that used to never happen.”

Now it does.

For instance, when Minwoo Park (his homepage, in Korean) rented his three-bed room apartment in Seoul’s Yeongdeungpo section, the 33-year-old software engineer borrowed money for the lump sum he needed for his Jeonse contract. From his perspective, it makes a ton of sense. Interest rates remain very low in Korea. And his monthly interest payments to the bank amount to roughly 25% of what it would cost him to pay monthly rent for a comparable apartment, he says.

“It’s a better deal,” Park said. “In Korea everyone prefers Jeonse.”

Not everybody is eligible for the same deal as Park, who was easily able to get a loan thanks, in part, to the solid salary he earns working in the mobile advertising industry. (He declined to offer specifics.) But the current economics of the Jeonse are a clear win for tenants. As a result, the demand is sky high. And that’s leading to some to worry.

“Now the Jeonse is kind of a problem,” said Dongrok Suh, a Seoul-based partner at McKinsey and Company.

Jeonse’s aren’t risk-free. They’re loans. And sometimes loans don’t get paid back. Now, Jeonse tenants have some protection. In fact, they are living in the collateral. If the landlord defaults, and doesn’t give them their money back, they are entitled to get it when the house is sold.

But remember, the Jeonse is the lump sum payment, based on a percentage of the house’s value. Traditionally, that percentage was somewhere between 40%-60%. That provided the tenant with a large margin of safety. (Should anything go wrong, and the house had to be sold to cover the loan, there should be plenty of cash to pay the tenant back.) But as demand for Jeonse apartments has risen, so has the percentage landlords are asking tenants to pay. In some instances, the Jeonse percentage is now often between 70% and 80% or even higher than 90%, leaving a much smaller safety cushion.

That’s something worth considering. Especially if you’re wondering why any landlord would be willing to continue on a Jeonse system with tenants when they could potentially make more money by collecting monthly rent. Well, some are. In fact, the share of Korean apartments rented under monthly payments is increasing, though Jeonse contracts still account for a little over half. But many landlords simply don’t have the cash they need to pay back their tenants. In other words, they are stuck in the Jeonse system, because they need to find another Jeonse tenant, and use that deposit to pay off the previous occupant.

Citing a Bank of Korea report, the Economist recently noted that 10% of the country’s 3.7 million Jeonse landlords could have difficulty repaying the Jeonse money they owe to tenants.

Think that over, before you fork over the equivalent of a few hundred thousand dollars in order to live the rent-free dream.

Correction (March 10): A previous version of this post said that no other countries rents housing the way South Korea does. It turns out that Iran’s has an apartment rental system, known as the rahn, in which tenants effectively loan lump sums to landlords.