Give me that customization, baby

As you may have noticed, we’ve got a new format! It’ll be easier to forward and less likely to break in your inbox. Feel free to send us your thoughts by using the link at the end of this email!

In a world where you can have pretty much anything you want at just about any time of the day, it should come as no shock that investors, even smaller ones, want that same level of autonomy in their portfolios. As a result—well, and for tax reasons—many are turning to direct indexing.

Direct indexing is an investment strategy that allows investors to basically build their own index from scratch, rather than buying a mutual fund or an exchange-traded fund (ETF) that tracks a predetermined index. This lets people tilt their investments toward whatever sector they please. Want to pick up more exposure to energy stocks as gas prices rise? You can do that. Want to avoid oil companies altogether to help fight climate change? Go ahead, let those ESG views be known.

Beyond customization, direct indexing has been how a small portion of rich investors have approached tax-efficient investing for 30 years. These ultra-wealthies would sell more underperforming assets and pay less capital gains tax. But after nearly a dozen Wall Street investment companies purchased companies in this space and lowered account minimums, the investment strategy is growing with smaller investors.

Let’s take a look at where this new (but actually old) investment strategy is going.

By the digits

250: Number of securities an asset manager has to hold to mimic an index

12%: Estimated annualized rate of growth for direct indexing over the next five years, starting in 2021

$350 billion: Total assets under management in direct index funds in 2020

$1.5 trillion: Oliver Wyman/Morgan Stanley estimate for how large the direct indexing space could grow by 2025

$100,000: The typical minimum required to open a separately managed account for direct indexing. Some firms offer limited versions of direct indexing for a lot less.

How direct indexing works

To direct index, investors buy the stocks that exist in a particular exchange-traded fund or mutual fund directly. Then they sell off the stocks that don’t perform as well, and they remove stocks that don’t fit within their investing thesis.

This way, the investment strategy mimics the stability of an ETF that captures the market broadly, but it gets more tax breaks because of the sales of underperforming stocks.

Investors can’t get these tax breaks in a traditional ETF because the fund doesn’t sell underperforming stocks for them. They’d have to wait for the entire fund to fall to get these kinds of tax breaks.

Unfortunately, minimums tend to be pretty high on the separately managed accounts needed to direct index, since investors have to buy a large number of stocks to make up an index. Generally they’re about $100,000 minimum with a higher management fee—usually between 0.15% and 0.35%.

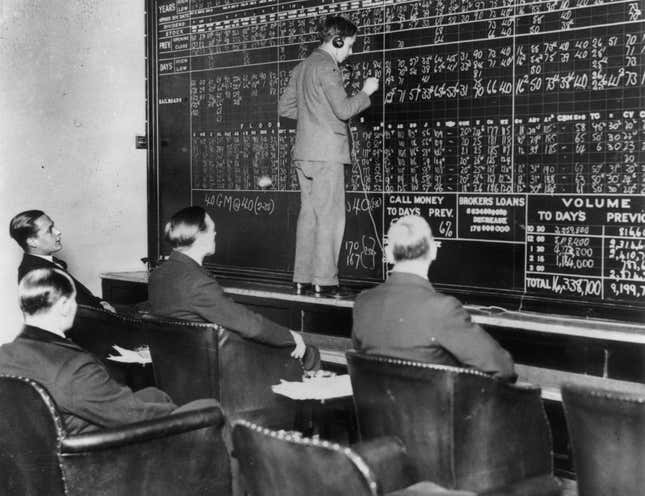

Brief history

1976: Vanguard Group founder Jack Bogle invents index investing, which allows pretty much anyone to put money in mutual funds and make more money.

1992: Parametric, an investment provider, releases the first direct indexing product. The company is largely seen as the brains behind direct indexing.

2003: Parametric is acquired by mutual fund Eaton Vance.

2020 to 2022: Eleven major investment companies—including Goldman Sachs, BlackRock, and JP Morgan—make 12 big acquisitions in the direct indexing space. Morgan Stanley acquires Eaton Vance. Vanguard makes its first-ever acquisition by purchasing direct indexing fintech Just Invest. And Fidelity builds its own direct indexing product and tests it in beta.

It’s always about money

ETFs largely failed to democratize finance as they haven’t reversed wealth inequality, and so far direct indexing has been dominated by rich Americans as well. With a recent spate of investment companies buying firms in the space, several companies are trying to offer the product to smaller investors.

Direct indexing often requires high minimums, making the strategy better suited for wealthier investors (pdf) who have a higher marginal tax rate, according to asset management research firm Cerulli. While people with less money may benefit from some of the tax breaks and ESG perks of direct indexing, it still costs a lot to buy an entire index.

And let’s be real—ESG is important, but it’s still not the driving force behind why people chose direct indexing. When Cerulli asked managed account sponsors, like large broker dealers, what the biggest opportunities were for direct index portfolios, a whopping 93% said tax optimization. Far less (60%) said ESG investing.

“When we talk to financial advisors, a high, high percentage of them are saying that we use this for tax optimization and nothing else,” Matt Belnap, an associate director at Cerulli, said. Saving money is apparently more of an incentive than saving the planet.

Quotable

“Everyone’s values are slightly different. So a fund is rarely the best way to get pinpoint accuracy in expressing your values.”

— Adam Grealish, head of investments at fintech company Altruist, in an interview with CNBC, on how value-based investors may find more meaning out of direct indexing than using a predetermined fund

Pop quiz

Selling underperforming stocks to get a tax break is called…

A. Capital-gain gardening

B. Tax-loss harvesting

C. Standard-deduction digging

D. Filing-status farming

Find the answer at the bottom!

Fun fact!

ESG investing was first brought to global attention in 2004 when former UN Secretary General Kofi Annan asked 50 CEOs of the biggest financial institutions to incorporate the ideology into capital markets.

💬 Let’s talk

In last week’s poll about pet grooming, 42% of you are willing to groom your animal pals when necessary and 18% of you said you’re regular claw-stomers. We now regret some of these puns.

🤔 What did you think of today’s email?

💡 What should we obsess over next?

Today’s email was written by Nate DiCamillo (wouldn’t know what to do with all that customization) and edited by Morgan Haefner (not very direct).