The newest streaming competitors worrying Netflix

For a long time, Netflix was not worried about its streaming rivals. Most competitors were either US-centric plays, like Hulu, or much smaller offerings, like HBO. There was enough room for everybody to win. “We compete with (and lose to) Fortnite more than HBO,” Netflix told investors last year.

For a long time, Netflix was not worried about its streaming rivals. Most competitors were either US-centric plays, like Hulu, or much smaller offerings, like HBO. There was enough room for everybody to win. “We compete with (and lose to) Fortnite more than HBO,” Netflix told investors last year.

But that’s changing. Already competing with the likes of Amazon for eyeballs, Netflix is now being hit with a new wave of global streaming services, built and backed by massive media companies with infrastructures capable of striking fear into the hearts of Netflix executives. That doesn’t mean these new platforms will necessarily impact Netflix’s 182 million subscribers—or that they’ll even be successful at all. But for the first time, Netflix is acknowledging the potential headwinds to its growth.

It took Disney only about a month to get Netflix to address its competition in a way it had never done in nearly a decade of streaming. In a letter to shareholders (pdf) last quarter, shortly after the launch of Disney’s new streaming service, Disney+, in the US, Netflix admitted: “Our low membership growth in UCAN [United States and Canada] is probably due to our recent price changes and to US competitive launches.”

These are the five new streaming services that Netflix will be keeping a close eye on:

Disney+

- Owner: Disney

- Notable content: Star Wars films and TV series (The Mandalorian), Pixar films, Marvel movies and shows, a growing library of family-friendly Disney content.

- Price: $7 per month, or $13 when bundled with Hulu and ESPN+, which Disney also own.

- Ads: No

- Pitch: All of your favorite Disney content in one place.

Never before has Disney offered its robust catalog of world-famous brands on a single platform. But Disney+ is what former CEO Bob Iger was always building toward when he bought Lucasfilm, Pixar, Marvel, and, most recently, 20th Century Fox’s entertainment assets. He not only wanted to better position the Mouse House for the future, but also to make a real dent in Netflix’s hold over the global streaming market, and remind us all what the top entertainment brand in the world really is. The service is aimed at families, and while it’s had some trouble figuring out exactly what that means, it’d be unwise to bet against the company. Disney+ already has 54.5 million subscribers as of May 6, well on pace to meet its own forecast of 60- to 90-million subscribers by 2024. - Launch date and availability: Already available in the US and several countries in Europe; launching in more European and Latin American countries sometime in 2020.

- Threat level: Medium to high. Disney has the global infrastructure to compete with Netflix outside the US like no other competitor can. It has tentacles in every market. Its brands are universally beloved. And its price point is about half that of Netflix’s. But Netflix has a huge head start in the streaming industry, and a much bigger library.

While Netflix has admitted the launch of Disney+ affected its US growth (which was grinding to a halt anyway), it’ll take longer for Disney to slow Netflix’s international expansion. Disney also needs to find more hits outside of The Mandalorian, or it’ll risk a high churn rate as viewers subscribe solely to watch one or two shows before unsubscribing. The coronavirus pandemic has already delayed the production on several shows, including the highly anticipated Marvel series The Falcon and the Winter Soldier.

(For a much deeper dive into the threat Disney poses to Netflix’s growth, read our State of Play.)

HBO Max

- Owner: WarnerMedia (AT&T)

- Notable content: All of HBO (Game of Thrones! Veep! The Sopranos!), Warner Bros. movies (Joker, A Star Is Born, The Lord of the Rings, etc.), every season of Friends and South Park, a number of new shows and movies made exclusively for the service (called “Max Originals.”)

- Price: $15 per month, $12 for the first year if you preorder before May 27.

- Ads: No

- Pitch: HBO series + popular movies + lots of other stuff = Netflix competitor. That’s the theory anyway. WarnerMedia thinks that combining culture-defining TV with blockbuster films at a premium price (slightly more than Netflix) will give consumers a better bang for their buck. Putting “HBO” in the service’s name is a calculated risk. It will leverage HBO’s globally respected brand to draw subscribers at the risk of diluting it to a point in which it no longer carries the kind of weight that attracted viewers in the first place.

- Launch date and availability: May 27 in the US, Latin America and other parts of Europe at a TBD date in 2021.

- Threat level: Medium. HBO Max isn’t going to be a truly global service. It’s focused mostly on the US and in a few territories where HBO already has a streaming presence (like Mexico and the Nordic countries). So it’s already aiming lower than Netflix. Its high price point might turn away consumers who aren’t already subscribed to HBO, capping its membership ceiling. But it’s hard to argue with the quality of content HBO Max will offer. It could further slow Netflix’s momentum in the US, providing an alternative to those who are either tired of Netflix or haven’t yet signed up for it.

Peacock

- Owner: NBCUniversal (Comcast)

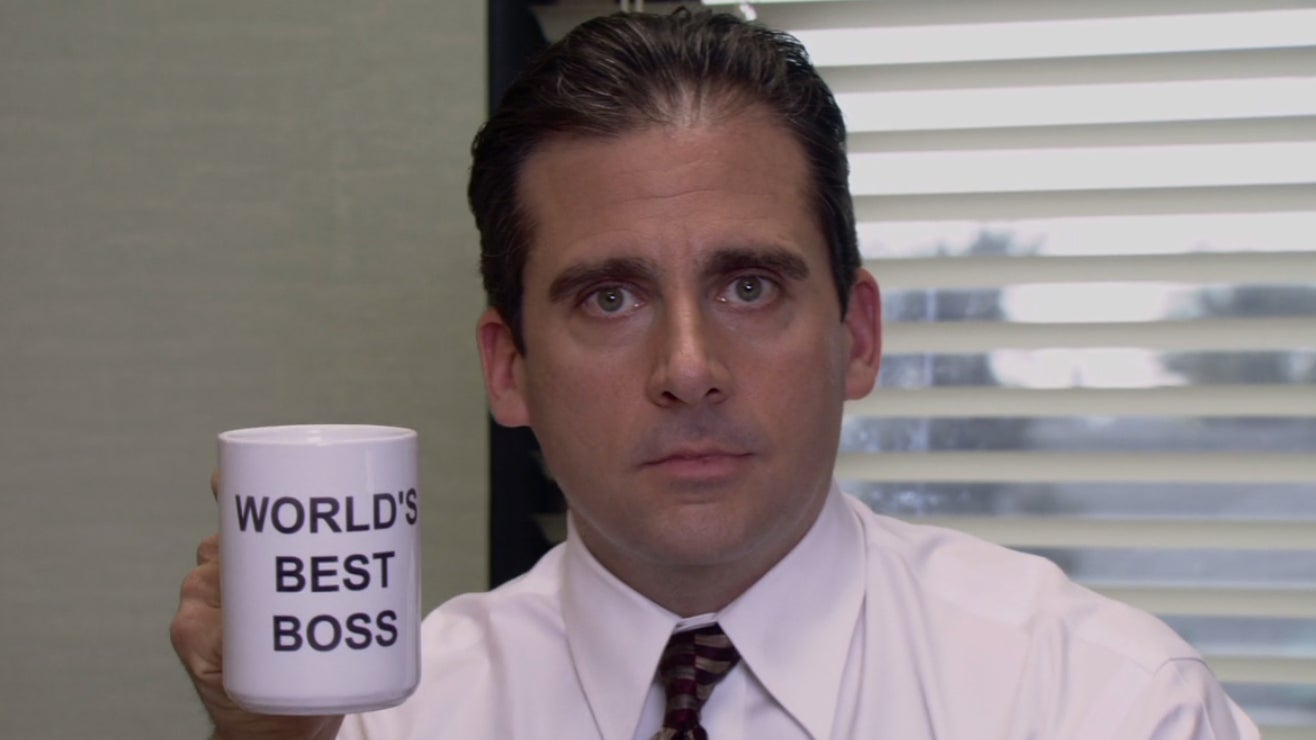

- Notable content: A few legendary sitcoms (The Office, Parks and Recreation, etc.), Universal Pictures movies, new original series, and an array of late night, reality TV, and live sports.

- Price: Free for limited version, $5 per month for premium.

- Ads: Yup.

- Pitch: NBC, but on the internet. NBCUniversal is leaning into nostalgia around its famous peacock brand with a bunch of beloved sitcoms and reboots of beloved sitcoms (Saved by the Bell, for instance). It’s not so much to rival Netflix as it is to escort NBC into the future, putting much of the legacy media company’s best content on a single streaming platform for the first time. It hopes to be the streaming equivalent of turning on your TV and channel surfing. “We’re creating the equivalent of a 21st century broadcast business, delivered on the internet,” Steve Burke, chairman of NBCUniversal, said at a presentation for journalists and investors in January.

- Launch date and availability: July 15, available only in the US and to Sky customers in Europe (for now)

- Threat level: Low. Peacock could make some noise in the US, but it poses virtually no threat to Netflix on a global level. NBC has not said much about if the service will be made available in some form in countries outside the US, beyond promising it will be offered through Sky in Europe. (Sky operates in the UK, Ireland, Germany, Italy, and Spain.) It’s also being marketed as a very different experience than Netflix, akin more to a group of branded TV channels (including live content), rather than a vast library of exclusively TV series and films.

Apple TV+

- Owner: Apple

- Notable content: The Morning Show and not much else, though Apple has inked content deals with Oprah and a few other Hollywood producers. It has no existing library; everything on the service is new and made for it exclusively.

- Price: $5 a month

- Ads: Nope.

- Pitch: Big stars, big budgets, high-quality programming, all on your iPhone or iPad. Apple’s early pitch to consumers was reminiscent of HBO in several ways, including marketing itself as a tightly curated list of top-tier content featuring the biggest celebrities in the business. But we all know Apple’s real goal here isn’t necessarily to win Emmys. It wants to sell more devices, and original content is one way to do that (while simultaneously ingratiating itself with the Hollywood elite).

- Launch date and availability: Currently available virtually everywhere Apple devices are sold

- Threat level: Low—with the potential to become medium. Right now, the service is generating almost no buzz. It has about 34 million subscribers (far less than Disney+) despite being available in more than a hundred countries. It is also unclear how many of those 34 million are users on free trials who will cancel when the deal expires. (Anyone who bought a new Apple device after Apple TV+ launched was gifted with a free year of the service.) But, over time, as Apple builds out a bigger and better library of content and continues forging alliances in Hollywood, it could begin to threaten Netflix since it already has such a massive global distribution system. The Apple brand is already in, quite literally, billions of hands.

Quibi

- Owner: Independent (raised ~$2 billion in funding from companies like Disney, WarnerMedia, NBCUniversal, Sony Pictures, and ViacomCBS)

- Notable content: Yeah, about that…

- Price: $5 per month with ads, $8 without.

- Ads: Indeed.

- Pitch: Fancy YouTube for your phone, aimed at the 18- to 34-year-old demographic of young professionals and students. All episodes on Quibi are fewer than 10 minutes. Its executives hope you’re watching Quibi on the go—the only problem is that not many Americans are on the go right now. Will we still Quibi in quarantine?

- Launch date and availability: Available now only in the US and Canada, though some consumers in other countries can download and use the US version of the app.

- Threat level: Infinitesimal. Quibi’s real competition is YouTube, Tik Tok, Snapchat, and Instagram—not Netflix. Though it boasts a roster of Hollywood stars and impressive budgets, the content thus far leaves a lot to be desired. In fact, it’s difficult to call Quibi content even “television” in the first place. The experience of watching something on Quibi is so different from what Netflix acolytes are likely used to. Even if Quibi is successful with its targeted audience, Netflix won’t bat an eye.