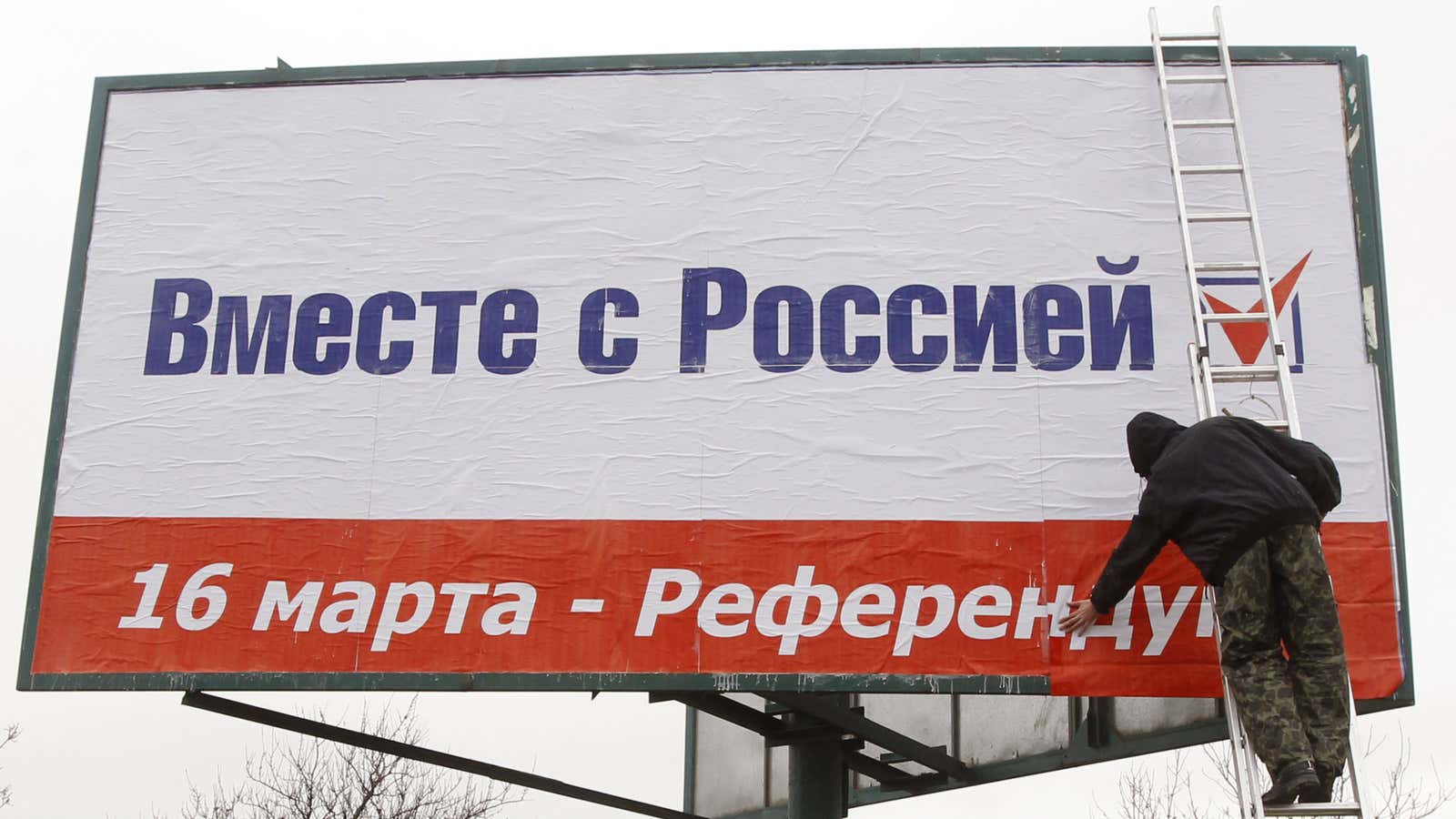

Barring a last-ditch breakthrough in international diplomacy, it looks like this weekend Crimea will vote in a referendum to leave Ukraine and join Russia. The region is on edge in the run-up to the vote, with Russian and Western troops amassing on their respective borders with Ukraine.

The uncertainty over Russia’s motives in Crimea and other Russian-speaking parts of Ukraine has spooked financial markets, with a variety of Russian assets coming under renewed pressure today. The threat of Western sanctions against Russia, and of Russian sanctions against the West, has convinced many investors in Russia to sell up and sit on the sidelines.

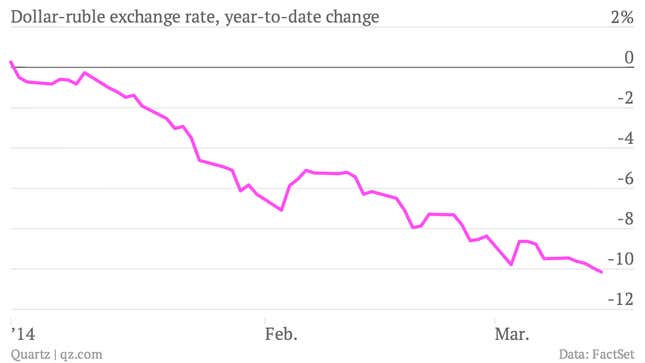

The ruble has lost more than 10% of its value against the dollar so far this year:

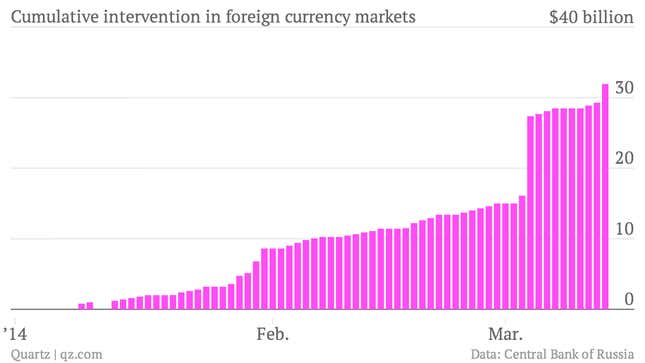

To defend the ruble from further declines, Russia’s central bank has been intervening heavily in currency markets. On the day it unexpectedly hiked interest rates earlier this month, the bank spent $11.3 billion propping up the currency. So far this year, Russia’s central bank has burned through $32 billion defending the ruble (not counting another few billion today). With some $450 billion in foreign exchange reserves, this is affordable, so far, but a sustained run of multi-billion-dollar days would see the country’s currency buffers quickly erode, at which point the ruble could fall further, faster.

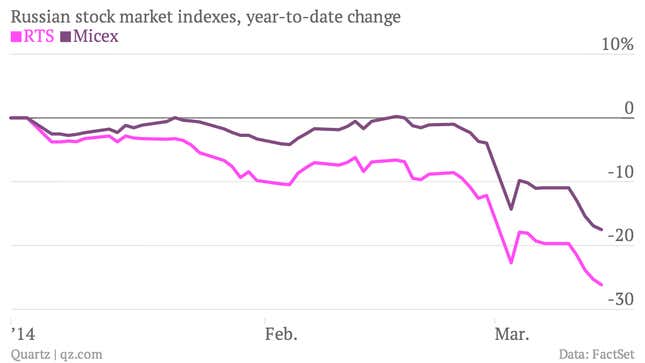

Russian stocks have also taken a beating recently, with the ruble-denominated Micex and dollar-denominated RTS indexes both lurching downwards in recent weeks. Signs of retaliation against Western businesses and other firms deemed unfriendly to the Kremlin, including deportations, tax audits, and asset seizures, have put investors on edge. “Russian businessmen are very scared,” one prominent banker told Bloomberg.

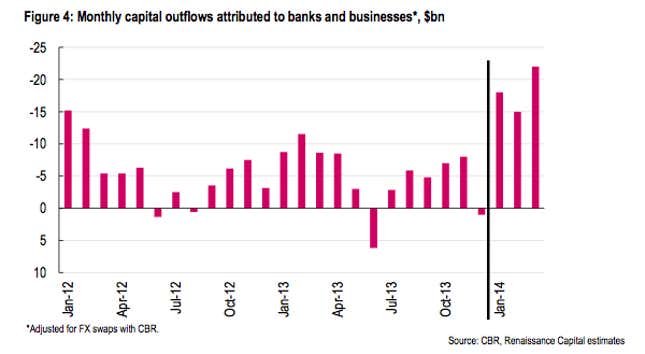

Reflecting the unstable business climate, companies have been yanking their capital out of Russia in haste. Over the past two weeks, net capital outflows have been more than $15 billion, according to estimates from Renaissance Capital (RenCap). In the first quarter of this year, capital flight could reach $55 billion, or nearly 3% of GDP, versus $63 billion in the whole of 2013.

In RenCap’s “base case” scenario—in which Crimea votes to join Russia, Western sanctions are ratcheted up, but the turmoil does not spread to Eastern Ukraine—the financial damage to Russia remains significant:

Reputational risk becomes an issue, particularly for non-dedicated international investors; higher returns (or lower valuations) are demanded to compensate for the risk of investing in or lending to Russia; decisions are delayed; risk managers and trustees ask more questions; dedicated Russia funds suffer redemptions (particularly from retail money); and non-benchmarked investors become more inclined to sell—the market stays nervous and capital flight from Russia accelerates, fearing a renewed escalation/repeat at some stage in the future.

As nervous investors pull their money out of Russia, the country’s authorities are responding in kind. A big drop this week in foreign-owned US treasury bonds on deposit at the Federal Reserve is widely attributed to Russia, as officials may be moving these assets away from where they could be frozen by potential sanctions. Public and private, in Russia and beyond, all of the players affected by the crisis in Ukraine are rounding up their resources and digging in for safety—in the global financial markets as well as on the ground in Crimea.