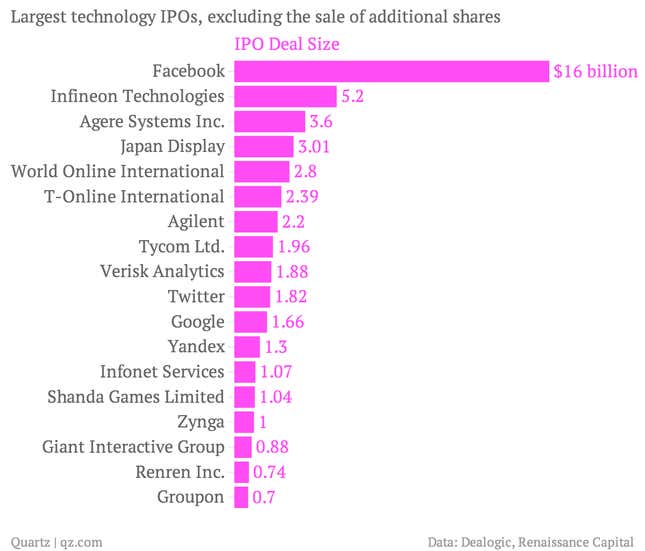

Alibaba’s much-ballyhooed stock has been ballyhooed for a reason. The US equity offering of China’s Alibaba Group Holdings is aiming to raise roughly $15 billion, putting it within shouting distance of the all-time largest US tech IPOs.

But the stock offering could also be an important opportunity for Credit Suisse. The Swiss banking giant is expected to share in the prestigious lead management position on the giant offering. According to several reports, Credit Suisse could be among a handful of banks (paywall), including Goldman Sachs, Morgan Stanley, Deutsche Bank and JP Morgan Chase, that would share important roles in the IPO of Alibaba—China’s equivalent of Amazon and eBay, only bigger than both combined.

The Alibaba IPO could mean hundreds of millions in fees for the lead banks. Maybe even more importantly, it could mark the start of a comeback of sorts for the Swiss bank, which dominated the deal rankings back in in the mid-2000s. Credit Suisse was first- and second-placed among firms in global tech IPOs in 2004 and 2005, until giving up ground in the following years, Dealogic data shows. This year so far, the bank is not even in the top six (the firm has not done a tech IPO in 2014), and Goldman Sachs and Morgan Stanley rank No. 1 and No. 2, respectively. A Credit Suisse spokesman declined to comment for this story.

During the 1990s tech boom, CSFB (informally known as Credit Suisse First Boston until dropping the “First Boston” moniker in 2006) reliably landed important chunks of tech business, thanks to CSFB investment banker Frank Quattrone, who was considered one of the top tech rainmakers on Wall Street. Quattrone left the firm under a cloud in 2003 (he was subsequently convicted in 2004 of obstructing a federal probe into how shares of hot public offerings were allocated, but that conviction was overturned on appeal). Since his departure from Credit Suisse, the bank’s tech dominance faded.

Although it would share the spotlight on the Alibaba deal, the IPO could be Credit Suisse’s most prominent role in a major tech stock offering since it was lead underwriter along with Morgan Stanley on Google Inc.‘s stock deal eight years ago. Credit Suisse was passed over for a lead role in Facebook’s $16-billion offering and it played no significant role in Twitter’s IPO.

With tech IPOs reaching heady levels, Credit Suisse appears to be making a concerted effort to step up its game in technology. Bloomberg reported that Credit Suisse moved a pair of its top bankers—Anthony Armstrong, its co-head of Americas mergers and acquisition, and David Wah, its global co-head of the technology, media and telecom group—from New York to San Francisco, and made significant hires on its tech team.

But nothing succeeds like success, and Alibaba may give Credit Suisse just the boost it needs.