A global commodities giant in less than a decade. That’s where Mercuria Energy Group is headed.

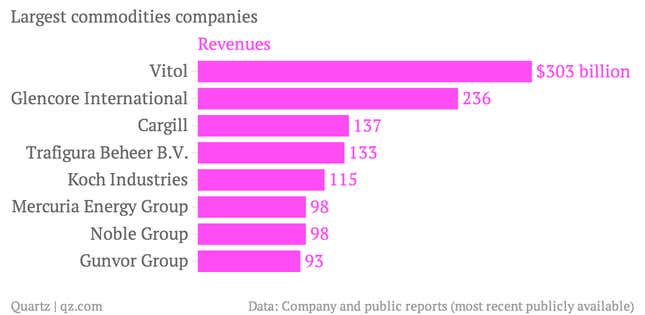

Launched in 2004 by former Goldman Sachs traders Marco Dunand and Daniel Jaeggi, the Geneva, Switzerland-based company was the sixth biggest commodities firm last year, with revenues of $98 billion. With today’s news that Mercuria will purchase JP Morgan Chase’s commodities business for $3.5 billion, it’s likely to overtake Koch Industries and move up a spot.

The Financial Times reports (paywall) that Mercuria’s deal for the lion’s share of JP Morgan’s commodities franchise (the giant US bank will still broker commodities transactions on behalf of its clients) will give the firm gas and power trading operations in North America and Europe.

Regulators have been pressuring large banks to temper their involvement in risky businesses like commodities trading. The US Federal Reserve also has been reviewing the practice of big banks maintaining control of physical assets, such as aluminum, while making bets on financial instruments linked to the metal. A recent piece in the New York Times suggests that banks can exert significant influence over the price of some commodities when it also owns large swaths of physical assets.

Deutsche Bank announced that it was getting out of the commodities trading business altogether last year. And Morgan Stanley announced late last year that it was selling a part of its commodities platform to the Russian-owned oil giant Rosneft. (Sources tell Quartz that the Rosneft deal may now be in question, given tensions between the international community and Russia. A Morgan Stanley spokesman said the firm intends “to submit the transaction for all necessary regulatory approvals, and are targeting a close in the second half of 2014.”)

At any rate, global commodities trading firms such as Mercuria and Glencore appear perfectly positioned to pick up the assets that banks are relinquishing.