Markets found the US Federal Reserve’s statement less supportive of the economy than expected. When the central bank issued its monetary policy statement this afternoon, stocks fell, the US dollar strengthened, and yields on interest rates rose. All of that is consistent with a market that’s bracing for slightly higher interest rates.

Why the surprise? First off, it’s not about the taper. The Fed decided to continue to taper off its bond purchases. But that was expected, and shouldn’t have resulted in a sharp move in markets. The Fed also tweaked its forward guidance, saying essentially, that it will keep a close eye on economic data before it decides raise interest rates. That’s a bit fuzzier than expected, but not exactly earth shattering.

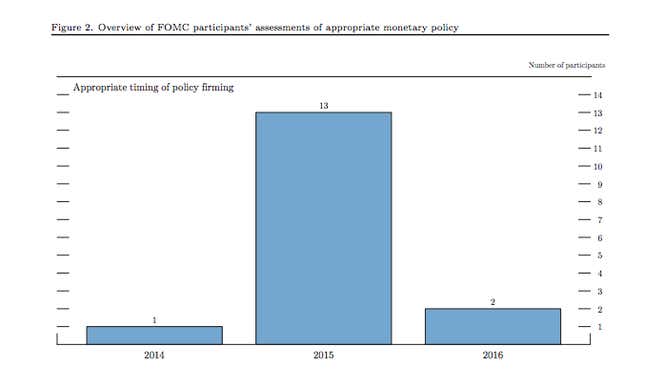

No, the main thing that seemed to get the attention of markets was this chart. It a growing consensus among FOMC participants that 2015 will somewhat higher interest rates.

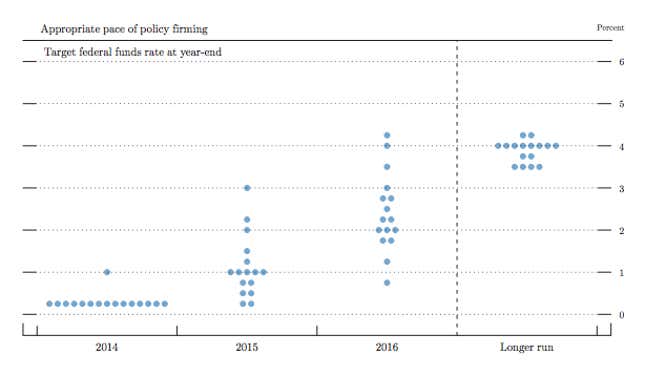

A separate chart showed that consensus expectations for interest rates at the end of 2015 are now 1.13%, according to Jefferies bond market analysts.

Now, in theory this isn’t a huge move. (The last time the Fed offered these kinds of forecasts, the consensus for 2015 was 1.07% among FOMC participants.)

But the Fed funds rate has been between zero and 0.25% since early 2009. So, some suggest that to be at 1.13% by the end of 2015, the Fed would have to start raising rates sometime later this year. (Of course, that’s not exactly true. When the Fed starts raising rates it doesn’t have to do it slowly.)

At any rate, in her post statement press conference, Fed chair Janet Yellen downplayed the importance of these charts.

“I think that one should not look to the dot plot, so to speak,” she said, adding, “The FOMC statement is the device that the committee as a policy-making group uses to express its opinions.”