The results of the Federal Reserve’s latest test of the US financial system’s ability to withstand severe shocks are in. While 29 out of 30 institutions passed muster, some looked stronger than others.

Simply stated, the annual test administered by the Fed since 2009, is meant to evaluate a bank’s ability to withstand severe economic disruptions and still maintain healthy enough levels of capital to continue to lend.

A key measure of capital is something known as the “tier 1 capital ratio.” The Fed requires that banks maintain a minimum tier 1 capital ratio of 5% under their stress test. That means the bank’s highest quality assets, such as its holdings of highly rated government bonds, must represent 5% of the its total “risk-weighted” assets. (An article in the Financial Times here does a good job of explaining capital ratios.)

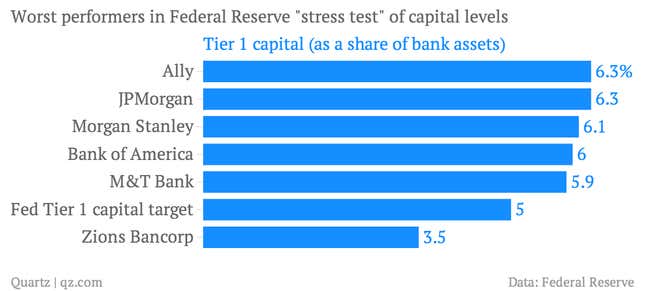

Of the 30 banks the Fed looked at, only Zions Bancorp fell short of the Fed’s 5% target for tier 1 capital ratios. Under the extreme market and economic conditions the Fed used for the test, Zion’s tier 1 capital ratio fell to 3.5% Here’s a chart of some of the other lower performing firms.

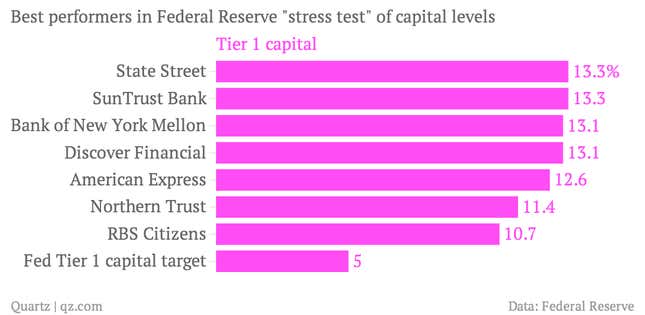

On the other hand, here’s a look at some of the financial institutions that fared the best in the Fed’s test. The entities that topped the rankings are credit card companies, such as American Express, and custodial banks—such as State Street. The Fed found that these financial companies benefitted—among other things—from the fact that they had less exposure to potential trading losses than large Wall Street banks.