If the BRICs are crumbling, nobody told their stock markets

Brazil was just downgraded. Russia’s profitable oil-and-gas pipelines are under threat after its Crimea caper. India’s growth rate is half what it was a few years ago. China is trying to forestall a possible “Bear Stearns moment.”

Brazil was just downgraded. Russia’s profitable oil-and-gas pipelines are under threat after its Crimea caper. India’s growth rate is half what it was a few years ago. China is trying to forestall a possible “Bear Stearns moment.”

Investing in the club of large, up-and-coming nations known as the BRICs is not looking particularly attractive.

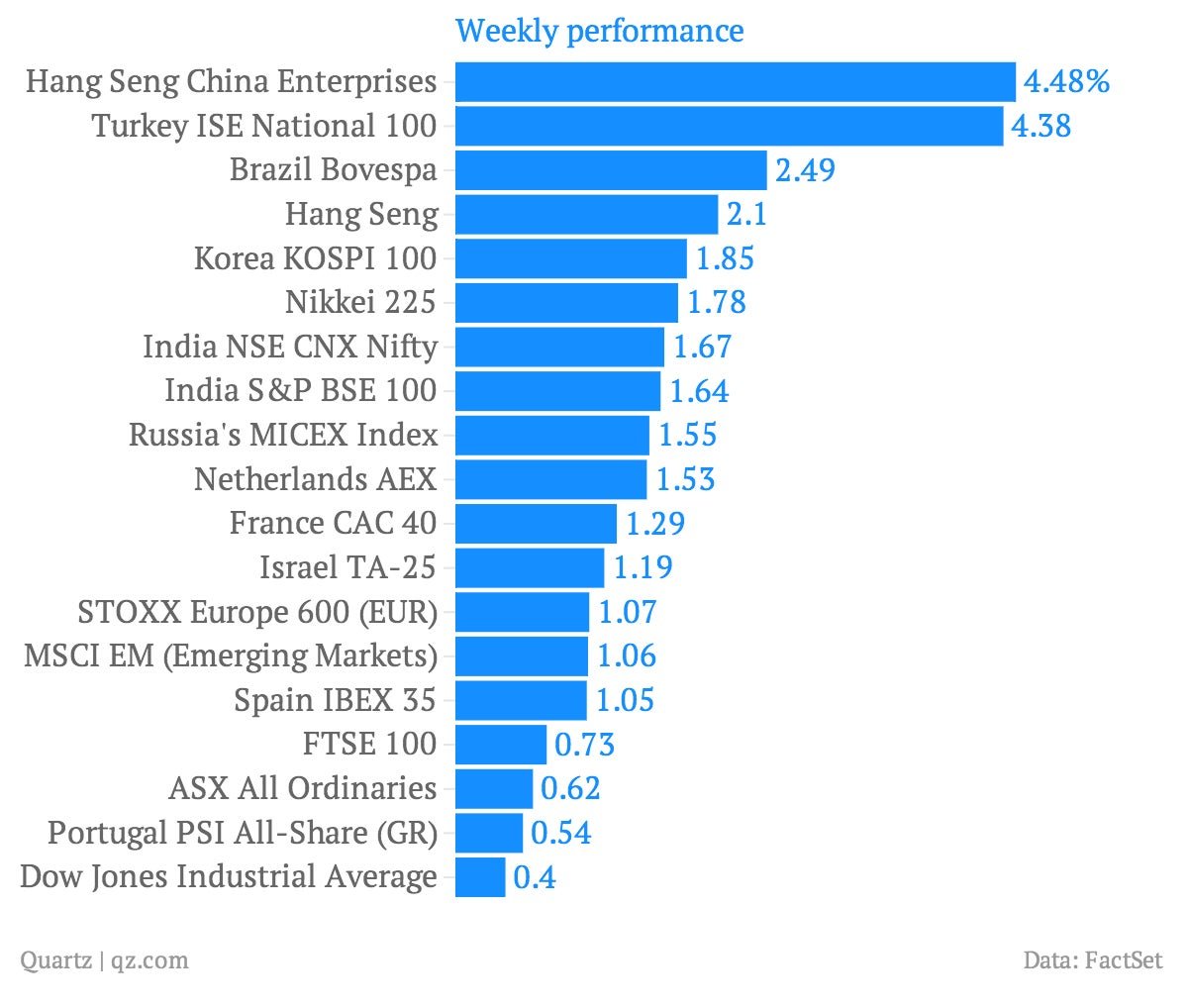

And yet, their respective stock markets are some of the best performers of the week. Here’s a snapshot of where selected markets stand midway through Wednesday.

What’s going on here? Several different things.

Some of these markets are just recovering from recent selloffs. For instance, Russia’s benchmark MICEX index is snapping back after a nasty fall. (It’s still down more than 8% over the last month.)

Optimism around India’s looming elections seems to be driving stocks in the world’s largest democracy higher. (India’s benchmark Sensex hit a record high recently.)

The buoyancy in shares of mainland Chinese firms—captured by the Hang Seng China Enterprises index—and Brazil’s Bovespa seems a bit more speculative. It’s basically the old “bad-news-is-good-news” rationale, where economic weakness is viewed as a reason to expect imminent government intervention to prop up growth. Brazil’s commodity-heavy corporations would also benefit from a push by Chinese policymakers to keep the economy growing at a health clip. But if the government doesn’t show up on cue—look out below.