Bubbly home prices Down Under are leaving young Aussies increasingly embittered. ”Owning a home in [Sydney] is as remote to me as getting a seat next to Lady Gaga on the first commercial space flight,” writes Bridie Jabour, a twenty-something reporter, in The Guardian. “And that would be a hell of a lot cheaper anyway.”

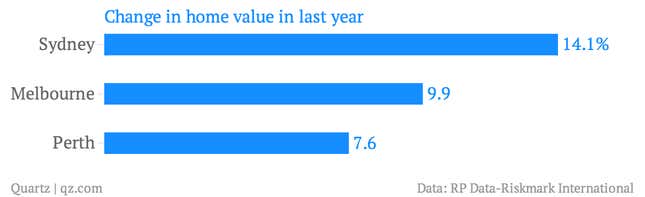

That’s hyperbolic, of course—but only just. Prices in Sydney were up 15% annually in January, and rose around 10% nationwide. In New South Wales, the share of first-time home buyers taking out housing loans are at a record low of less than 7%, down from 34% in 2009. And Chinese investors are to blame, according to a recent Credit Suisse report, which declared that “a generation of Australians are being priced out of the property market.”

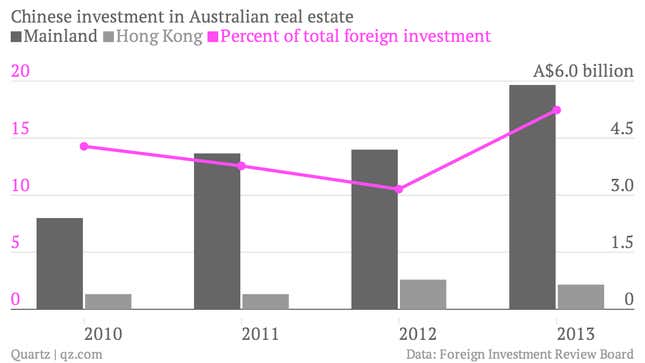

Chinese investors buy about 12% of new Australian homes, and account for nearly a fifth in Sydney, Credit Suisse notes. As overall foreign investment in Australia has dropped, mainland Chinese buyers spent A$5.9 billion ($5.5 billion) in the year ended June 2013—a 40% increase (pdf). To address growing public outrage at this problem, the government is now launching investigation that could result in limits on foreign investment.

That would be unwise. Though Chinese buyers might be part of the problem, Australia’s laws make them a crucial part of the solution. That’s because foreign investors can buy only new homes, which encourages construction of new developments and boosts the overall housing supply.

Recent history bears that out. In 2008, Australia’s government responded to housing market crashes in US and Europe by relaxing rules on foreign investment and development, allowing, among other things, parents of foreign students to buy property. But Australia’s economy didn’t implode the way Western countries’ did (in no small part due to Chinese demand for Australia’s natural resources). By 2010, housing prices had leapt nearly 30% annually in Melbourne and 15% in Sydney.

It wasn’t clear exactly why, though that didn’t stop people from blaming foreigners (or “Asian raiders,” as one Melbourne paper had it). So in early 2010, the government abruptly tightened investment rules, which included setting up a community hotline for locals to report on questionable foreigner buying behavior.

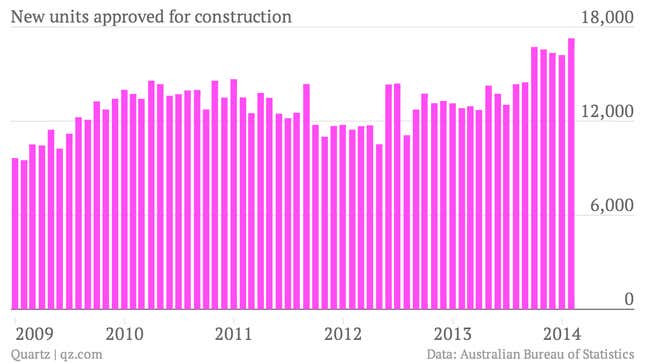

As hotline receptionists fielded tips—often about “suspicious” behavior of Australians of Asian heritage—new building approvals plunged (paywall), bottoming out in October 2011 at a 25% year-on-year decrease. The problem was most acute in New South Wales. Though a third of the population lives there, the state accounted for only one-fifth of the entire country’s newly built homes.

Foreign investment rules haven’t changed since 2010. Interest rates have, though, dropping to 2.5% today from 4.75% in November 2010. That’s encouraging developers to borrow (paywall) and build, which means the supply squeeze will let up… eventually. But while they work, low mortgage rates will continue to stoke buyer demand.

Whisking Chinese capital into that frothy cocktail definitely won’t cool home prices in the short term. In the longer term, though, for Australians who dream of owning their own place, China is of the most promising forces in the market.