With storefronts largely empty of customers for the last 10 months, some fear a commercial real estate apocalypse is upon us. But one sector has thrived before Covid-19, during the pandemic, and likely will after: commercial lab space.

According to an October report from CBRE, a commercial real estate company based in Washington DC, commercial lab space for US biotech and life science companies has grown by about 12% this year. Labs currently occupy about 95 million square feet, with 11 million more under construction.

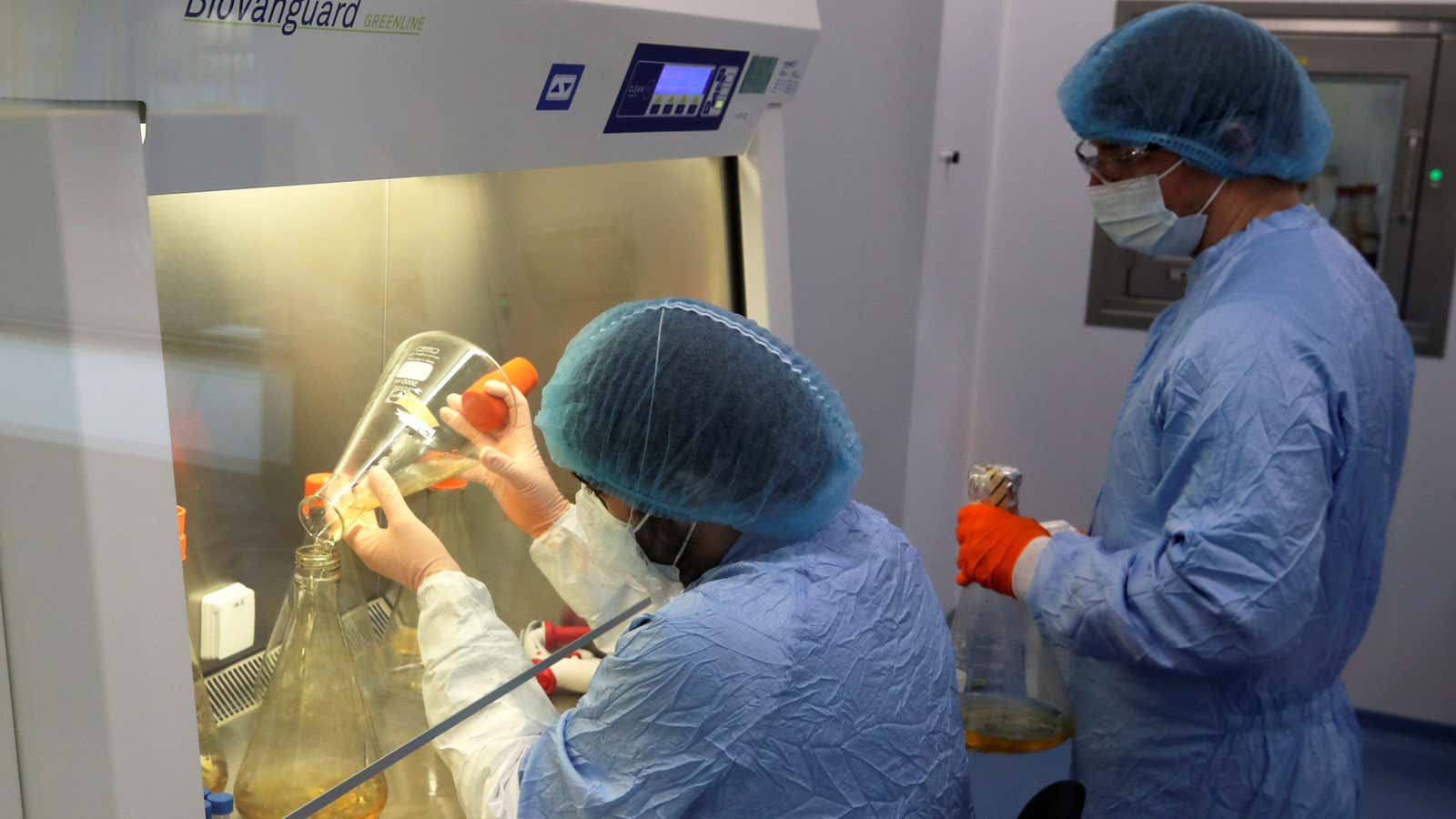

The top five regions for “wet” labs—the kinds of spaces with benches, petri dishes, and designated sterile areas—were Boston and Cambridge, Massachusetts; San Francisco, California; San Diego, California; Washington DC and Baltimore, Maryland; and Raleigh and Durham, North Carolina.

A snapshot of submarkets from CBRE’s analysis shows that labs in these areas have seen low vacancy rates, which reflect how much space in a region is available for rent. Demand for these limited spaces has increased the average asking rent over the last year and a half, even as vacancy rates for other offices increase. The vacancy rate for general office space in San Francisco, for example, is nearly 22%—a record high for the city.

In general, biotech companies have been growing over the past five years, says Mary Hines, executive managing director of Newmark, a global commercial real estate company. And during the pandemic, “life science and biotech companies were deemed essential,” she says, allowing labs to stay open. “Lab space cannot be replicated at home,” Hines explains, leading many life science companies to create socially distanced work environments.

One reason commercial labs were able to stay open is that they’re laid out differently from other workplaces. “The main physical differences…are really all borne out of the work that happens inside the space,” says Stephen Faber, a vice president at the Boston-based commercial real estate company Related Beal.

Lab spaces typically have higher ceilings and require more power for running HVACs, due to the air filtration and drainage needed for certain experiments. Regular commercial office spaces are adding or updating HVACs to lower Covid-19 risk to employees; in most labs, however, these systems were already in place.

Commercial labs also tend to have fewer elevators and bathrooms—a.k.a infection vectors—than other corporate spaces. Individual lab benches are bigger than office cubicles, Faber explained, so fewer people work in a lab than an office of the same size. That makes it easier to implement social distancing within the workplace.

But in the end, most labs were able to stay open simply because they had enough runway. “The majority of life science companies don’t have a product on the market,” say Hines. Instead of using product sales to pay for their rent, companies rely on investments—which didn’t disappear like the revenue that props up so many other commercial storefronts.

And the pandemic shows no signs of slowing investment in the field. According to CBRE, by the end of the second quarter venture capitalists had invested $17.8 billion into the life science industry. Given the pandemic’s booster to biotech, those companies can likely safely resign their leases for the next few years.