You’re going to have to tear it from their cold, dead fingers.

Goldman Sachs’ head honchoes—president Gary Cohn and chief executive Lloyd Blankfein (pictured above)—aren’t giving up the ghost on the firm’s bread-and-butter business of trading fixed income, currencies and commodities. At least that’s the statement the firm made in its most recent letter to shareholders, published on its website today:

Some of our competitors may elect to deemphasize or exit some FICC businesses, given their particular circumstances. But, we believe this is likely to increase the value that clients place on the services provided by those who remain, especially as broader economic activity rebounds and the trading environment improves.

Goldman’s comments in its annual letter are its clearest signal yet that it isn’t shying away from one of the investment banking franchise’s most lucrative business lines over the past few years. That’s despite new regulation, including the Volcker Rule, which limits a bank’s ability to use its own money to invest in the market, and despite regulatory watchdogs investigating the role of banks in the the commodities business. Goldman rivals JPMorgan Chase and Morgan Stanley are planning to offload huge swaths of their commodities units, due in part to the tougher rules and increased scrutiny.

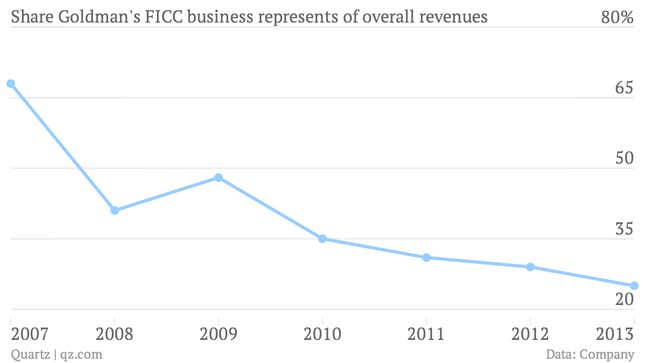

Goldman’s reluctance to “deemphasize” FICC trading comes as the partnership is struggling to find its way in a post-crisis Wall Street, in which trading volumes haven’t shined. Goldman’s own performance in the FICC space, which once comprised nearly 70% of its business, now represents a quarter of the firm’s overall revenues.

That figure isn’t likely to change this coming quarter, based on indications by a number of other firms that trading revenues are looking lighter than usual. JPMorgan and Citigroup have said trading revenues may be down by some 15% to 20%. But that’s where Goldman’s primal contrarian instincts kick in: zig when others zag. Their letter continues:

We remain committed to our FICC businesses, which, here again, reflects the value our clients place on the services that we provide in these markets. And, our commitment has allowed our client franchise to grow. Over the past three years, for example, the number of corporate and growth market relationships have each grown by approximately 30 percent.

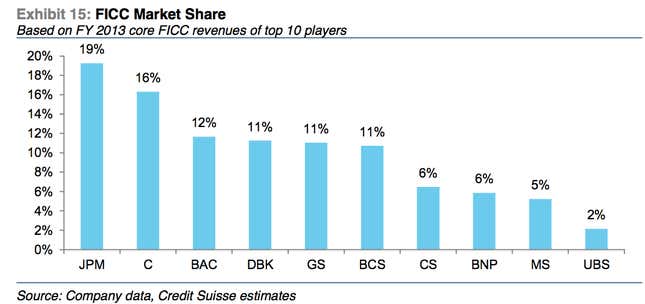

Until now, JPMorgan has been the biggest US player in FICC trading, according to the chart below, from a recent Credit Suisse research report. Shareholders may have a better sense of how much marketshare Goldman can grab from JPMorgan and other banks leaving the sector when the the firm reports its first-quarter results April 17.