Back in 2018, Elon Musk negotiated a controversial pay package (pdf). The Tesla CEO agreed to receive no salary or bonuses in exchange for a purely performance-based compensation plan. Each time Tesla’s market capitalization crossed a milestone, starting at $100 billion, Musk would receive Tesla stock options up to a market cap of $650 billion. Each payday would be worth hundreds of millions—or even billions—depending on the stock’s fortunes.

At the time, observers doubted the $54 billion electric automaker could enrich Musk as much as the pay package envisioned. Those doubts are gone.

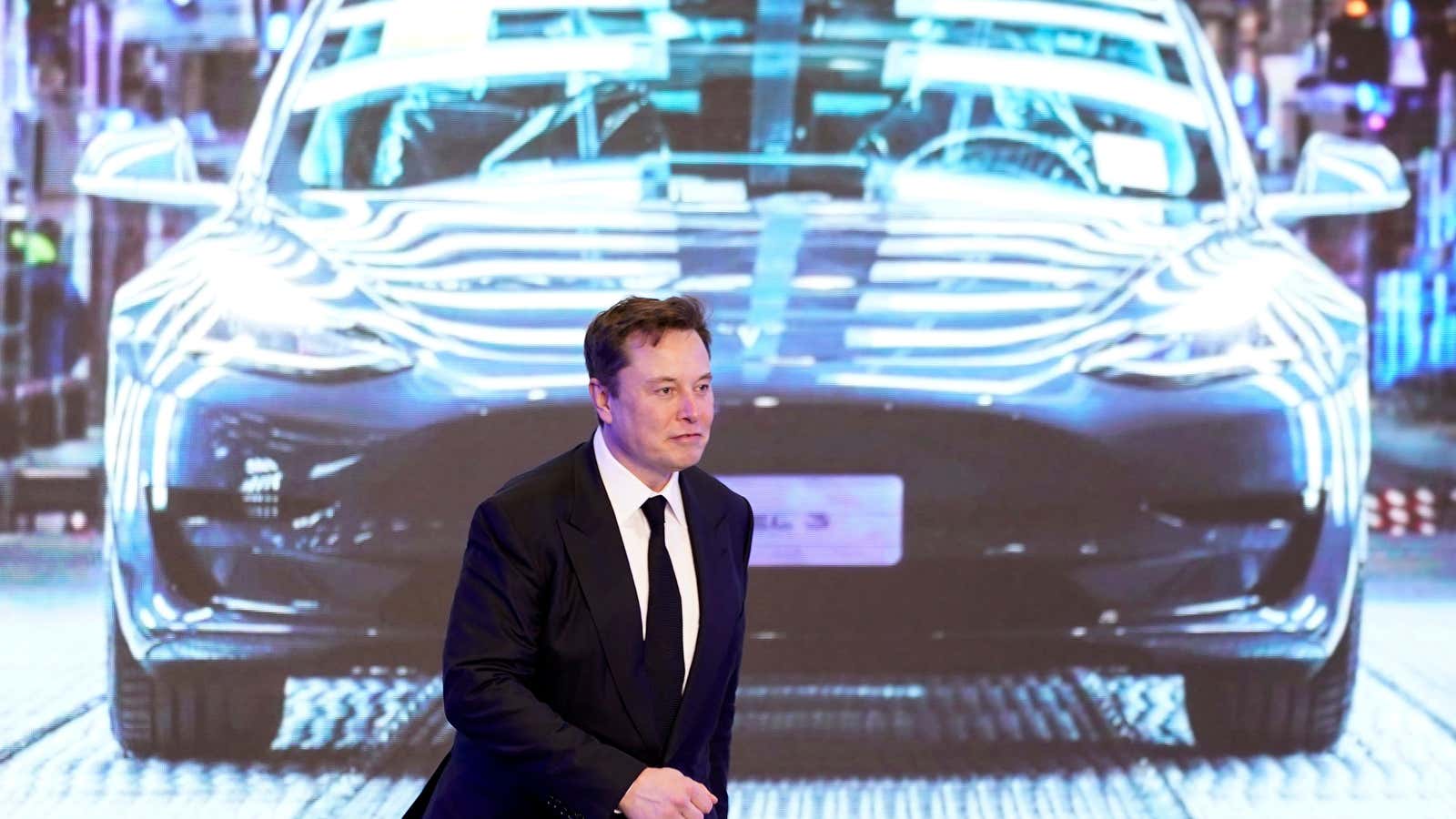

On Jan. 7, Elon Musk surpassed Jeff Bezos as the world’s richest human with an estimated net worth of $185 billion, up from just over $27 billion in 2020. His wealth has been driven by meteoric stock price of Tesla, now valued at $773 billion, up seven-fold since last year.

Bezos’s wealth has tracked Amazon’s valuation in a long steady climb, but plateaued along with the company’s stock price.

Tesla, meanwhile, has ascended on the strength of its global auto sales, wildly popular brand, and Musk’s vision for a global energy and transportation powerhouse. Today, the company is now worth more than all nine of the world’s largest automakers—combined. It’s all part of Musk’s “secret” 2006 master plan to sell affordable electric vehicles along with zero-emission energy. And let’s not forget Musk’s Master Plan, Part Deux: ubiquitous electric vehicles, solar roofs, and safe self-driving robo-taxis.

Although the company’s financials don’t necessarily support such a stratospheric valuation, Musk has argued the company’s stock price is about the future. “Tesla is absurdly overvalued if based on the past,” Musk tweeted in 2017, a time when Tesla was worth just $37 billion. “A stock price represents risk-adjusted future cash flows.”