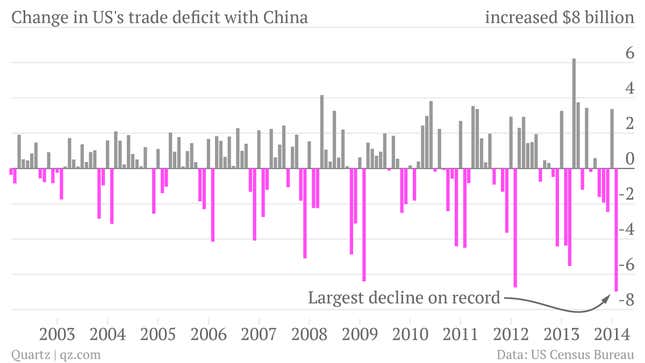

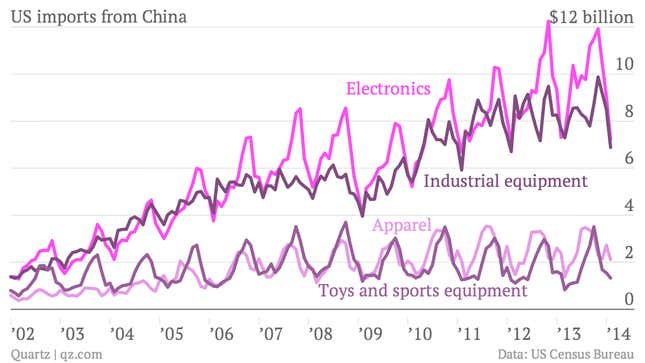

The US trade deficit expanded to its widest level in five months in February. It’s common currency in the US to blame big trade deficits on China and all its manufacturing, but in fact, in February the US’s goods trade deficit with China shrank, according to data from the US Census Bureau released on April 3. And not only that; it shrank by more than in any other month since at least January 2002—the earliest data in the Census Bureau’s database. The sharp decline has very little to do with international policy, US manufacturing or a Chinese economic bubble. Simply, US imports of Chinese goods are significantly more seasonal than exports of American goods to China. February is often when US imports are at their lowest. The Chinese sent the US $1.6 billion less industrial equipment, including $1.05 billion less data processing equipment; and $1.8 billion less electronics, including $422 million less worth cell phones and $176 million less of televisions and parts. All of which exhibit seasonal trade flows. In effect, February is when the US recovers from the holiday import binge. It’s possible that this seasonal effect was compounded by the fact that the yuan began to fall against the dollar in February as the Peoples’ Bank of China moved the currency’s trading band, making goods from China cheaper to American buyers. The yuan fell 1.4% in February and has weakened another 1.1% since then, bringing down the overall value of Chinese imports when they cross the US border and are counted in the Census Bureau’s statistics. But the value of imports in February fell 19.5%, so the yuan had little do with it.