This is the bank to watch for a Chinese credit implosion

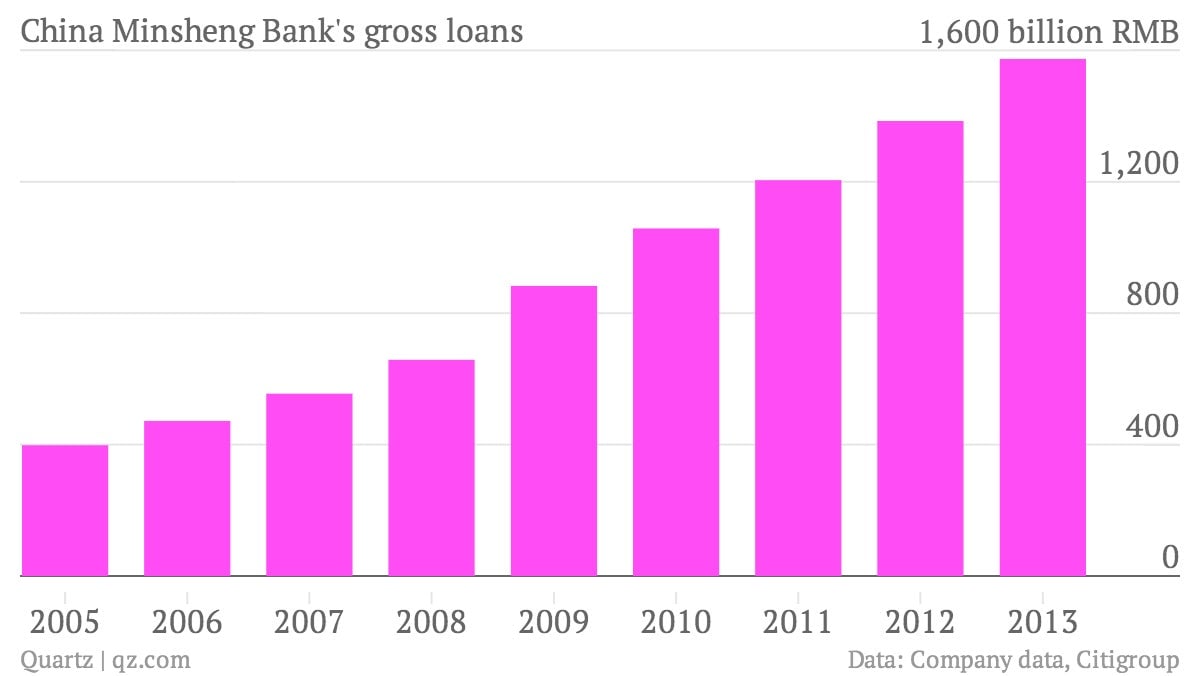

China Minsheng Bank has been growing fast since it became the mainland’s first privately-owned commercial bank in 1996, serving the private companies and small businesses that state-owned banks have notoriously neglected.

China Minsheng Bank has been growing fast since it became the mainland’s first privately-owned commercial bank in 1996, serving the private companies and small businesses that state-owned banks have notoriously neglected.

That fast growth is coming back to bite Minsheng now though—the bank is China’s most at-risk financial institution, according to a growing chorus of analysts and rating agencies.

- Minsheng has the lowest Tier 1 capital ratio in the sector, analysts from Citigroup wrote March 30, and “is most leveraged and most exposed to off balance sheet exposures.”

- Minsheng suffers from a “volatile business strategy, rapid growth, large exposure to micro-enterprises, high counter-party risk from greater interbank lending, including to some smaller, weaker financial institutions, thinning liquidity and modest loss-absorption capacity,” Fitch Ratings analysts said when they downgraded the bank in December.

- Minsheng “is the most aggressive one by far,” CLSA analysts wrote April 1.

The most obvious sign of trouble is that Minsheng’s impaired loan totals are rising steadily, up more than 27% from the end of 2012 to the end of 2013 to 13.4 billion yuan. As a percentage of total loans they’ve also risen to 0.85%.

And the true picture is more grim, because Minsheng wrote off 4 billion yuan of non-performing loans, and transferred another 7 billion off the bank’s balance sheet. Without those write-offs and transfers, Minsheng’s underlying NPL formation rate would have been 135% higher, Citi analysts concluded.

Minsheng is, in some ways, the most progressive and nimble of China’s banks. Under chairman Dong Wenbiao, Minsheng has aggressively lent to everyone from small dairy farmers to rickshaw tour operators to big private real estate developers, customers that China’s state banks have mostly shunned. That puts it at “ground zero” as China tries to modernize its financial system, as the Wall Street Journal explained last year.

But Minsheng’s relatively short history, and the truncated history of private big business in China overall, may not have prepared the bank for the slowdown that China’s economy is now facing. “You have a scenario where these guys have never gone through a credit cycle,” Bernstein Research analyst Mike Werner told Quartz, referring to Minsheng and other private Chinese banks.

The bank is now heavily exposed to some of the country’s sickliest sectors.

- Minsheng Bank’s bad loans with the steel trade in Shanghai area “accounted for 50% of the bad loans in the entire steel industry,” an unnamed industry insider told Caixin last year (link in Chinese), and bank has lent 3 billion yuan or more to the troubled Highsee Iron and Steel Group, China’s largest private steelmaker.

- The behind-schedule ship building industry is giving Minsheng “a big headache,” a bank executive told Reuters, because the ship builders’ foreign clients are demanding refunds from the bank.

- Minsheng has 300 billion yuan in “wealth management products,” or 9% of its total assets, JP Morgan estimates. These off-balance sheet loans are often used to fund risky development projects.

Even without those questionable loans, smaller Chinese banks like Minsheng have it tough. They are under pressure to make loans to local governments and political big shots, who often own stakes in the bank, Werner said. Unlike big state-owned banks, they don’t have any implicit government support if they get overwhelmed by bad loans. To make matters even worse, deposits are shrinking industry-wide, as internet companies (described as “vampires” by banks) offer higher-yielding investments and the Chinese government encourages new private banks to enter the market.

“They are just riding the tide,” Werner said. “If the tide goes out, there’s little they can do to protect themselves.”