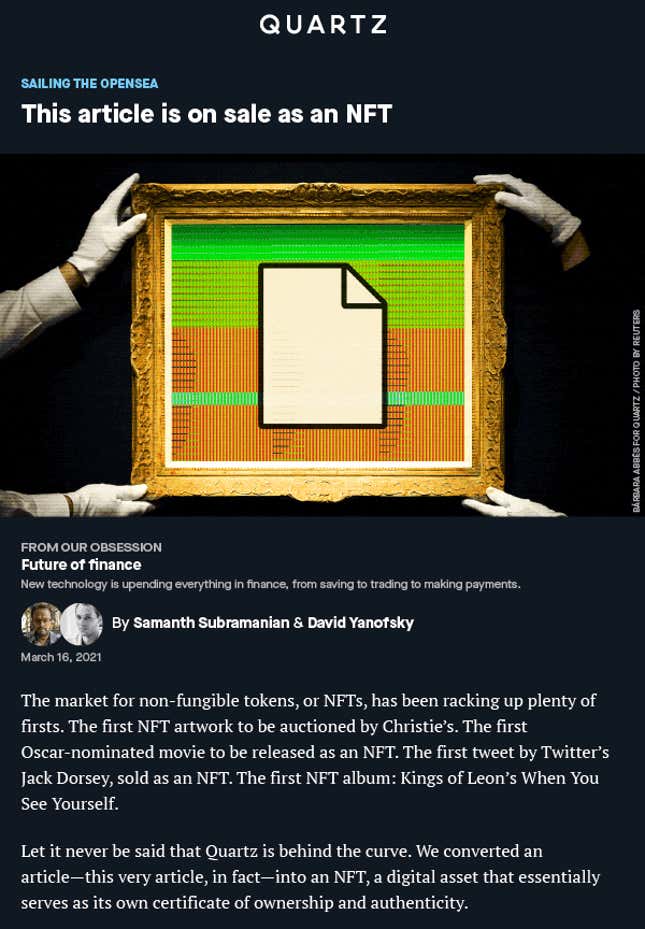

In a four-day auction, the owner of an art gallery specializing in non-fungible tokens (NFTs) paid Quartz 1 Ethereum ($1,800) for the first-ever news article sold as an NFT. The proceeds of the sale will be contributed to the Lauren Brown Fellowship at the International Women’s Media Foundation, which supports women journalists from underrepresented backgrounds.

The buyer, who goes by zonted on the OpenSea NFT marketplace, lists dozens of NFT artworks in its gallery of the same name. The buyer who spent $69 million for an NFT artwork by the digital artist Beeple is also already in the business of acquiring NFTs to sell on at profit.

What the NFT buyer actually bought

As with all NFTs, zonted bought a digital representation of our news article, its uniqueness confirmed by the Ethereum blockchain. In essence, the purchase is about the transaction hash: a long, unique string of letters and numbers that references the transfer of the minted NFT to the purchaser. (The 64-character value representing ours ended 882f5) The hash signifies ownership. Another unique identifier is the token ID, a string of numbers that, in the case of our NFT, ended 94113.

Since the value of the NFT lies in these identifiers, their solely virtual existence can feel precarious. If OpenSea, for example, were to shut shop, the data in its servers might vanish—which, in turn, means that the tokenized reference to the digital file and to the uniqueness of the NFT will be broken. In that eventuality, the only thing zonted will have on hand is the file that we created as a digital representation of the article. It would be like owning a Picasso with no means of authenticating it.

The Quartz NFT was a hand-designed image file in an SVG format. Think of it like a trading card. The front of a basketball card, for instance, holds an image and basic information about the player. What Quartz sold had the story’s headline, the names of the authors, the text of the piece, and a QR code linking to the story on our website.

While there’s no flipping a digital object over to see more detailed information, we embedded into the file information about the post not typically seen: the authors’ email addresses and Twitter handles, for example; the person who last edited the post before the token was created; and other metadata contained in our story database.

The listing and transaction fees for our NFT

It cost Quartz roughly $250 to conduct these transactions. This included a $200 “gas fee” at the time of listing, paid to “mint” the NFT on the blockchain, and a $50 fee to transfer the token’s ownership on to zonted.

These fees had to be paid in Ethereum. On the day of the listing, Metamask’s payment gateway to buy Ethereum with debit cards was—at least for us—not working. As a result, we scrambled to create accounts on the Coinbase cryptocurrency exchange (which require, among other things, holding up your driving license or your passport to your computer’s webcam to verify your identity), buy Ethereum, transfer it to the Metamask wallet, and fund the gas fees through this circuitous route.

The bidding was plodding. In about 12 hours, Quartz had received three offers The third was zonted’s. And there the action languished until March 22, when the auction closed.

OpenSea took a 2.5% commission on the sale. Quartz will, additionally, earn 10% of any secondary sales conducted of its NFT.

The carbon footprint of an NFT sale

We tried to work out the carbon footprint of creating and selling our NFT. One web site that promised to calculate the footprint of a work of crypto-art was shut down on March 12. “Unfortunately, the information on this website has been used as a tool for abuse and harassment, so I am taking the site offline,” its founder said in a statement.

Another site, carbon.fyi, allows users to figure out the carbon footprint of a particular Ethereum address. Quartz’s Metamask transactions were responsible for the equivalent 267 kg of carbon dioxide emissions. In comparison, a flight from London to Rome and back generates 234 kg of carbon dioxide per passenger. We purchased a 1,000 kg carbon offset from Offsetra for £5 ($7) that is based on the building of wind turbines in Honduras.

What is a news article really worth?

The listing and sale of the first-ever NFT article generated a small measure of buzz within the news media industry. It also attracted one insight from Joshua Benton, the founder of the Nieman Journalism Lab at Harvard, who compared the current, cash-rich market for NFTs with the struggles that media organizations often face to draw and keep subscribers:

“But no matter how absurd this sale, or how high the final price, it’s a reminder: The value of news as a product only rarely lines up with what the market will pay for it. Our new friends n00bmind, jarzod, and zonted are apparently willing to pay good money for a screenshot of a news story. But what are the odds they also complain about the $10/month paywall they hit the other day clicking a link on Twitter?”

Consumers appear to determine value on at least two planes: one that involves the sticker price, and one that feels inherent to the worth of a product or a service.

The two don’t always meet, and in heated markets—such as the current rush for NFTs—one kind of dizzying valuation always prompts a comparison to a more sedate counterpart. If GameStop stock rockets towards $1,000 per share, are other, similar stocks undervalued? If a digital artwork sells for $69 million, is the physical ownership of art not as important as we think? And if a digital representation of an article can sell for $1,800, what is the article worth?