Chinese investors smell more stimulus

It wasn’t pretty this week for American investors. The S&P posted its worst weekly loss since 2012. The Nasdaq Composite notched its worst two-day turn since 2011 as the tech-heavy index slid 1.3% to finish the week down more than 3%.

It wasn’t pretty this week for American investors. The S&P posted its worst weekly loss since 2012. The Nasdaq Composite notched its worst two-day turn since 2011 as the tech-heavy index slid 1.3% to finish the week down more than 3%.

For many of the previously high-flying stocks bearing the brunt of the recent beating, things were worse. Twitter lost 7.2% during the week and mobile-gaming firm King Digital—which has had a hard run since its recent IPO—fell another 7.5%. Tesla fell 4%. Amazon.com lost 3.5%. (Facebook actually managed a nice gain.)

If the US tech sector wants to feel better, it could look at Japan. With the yen strengthening, the wheels really seem to be coming off the Abenomics trade that made Japanese stocks some of the world’s best performers last year.

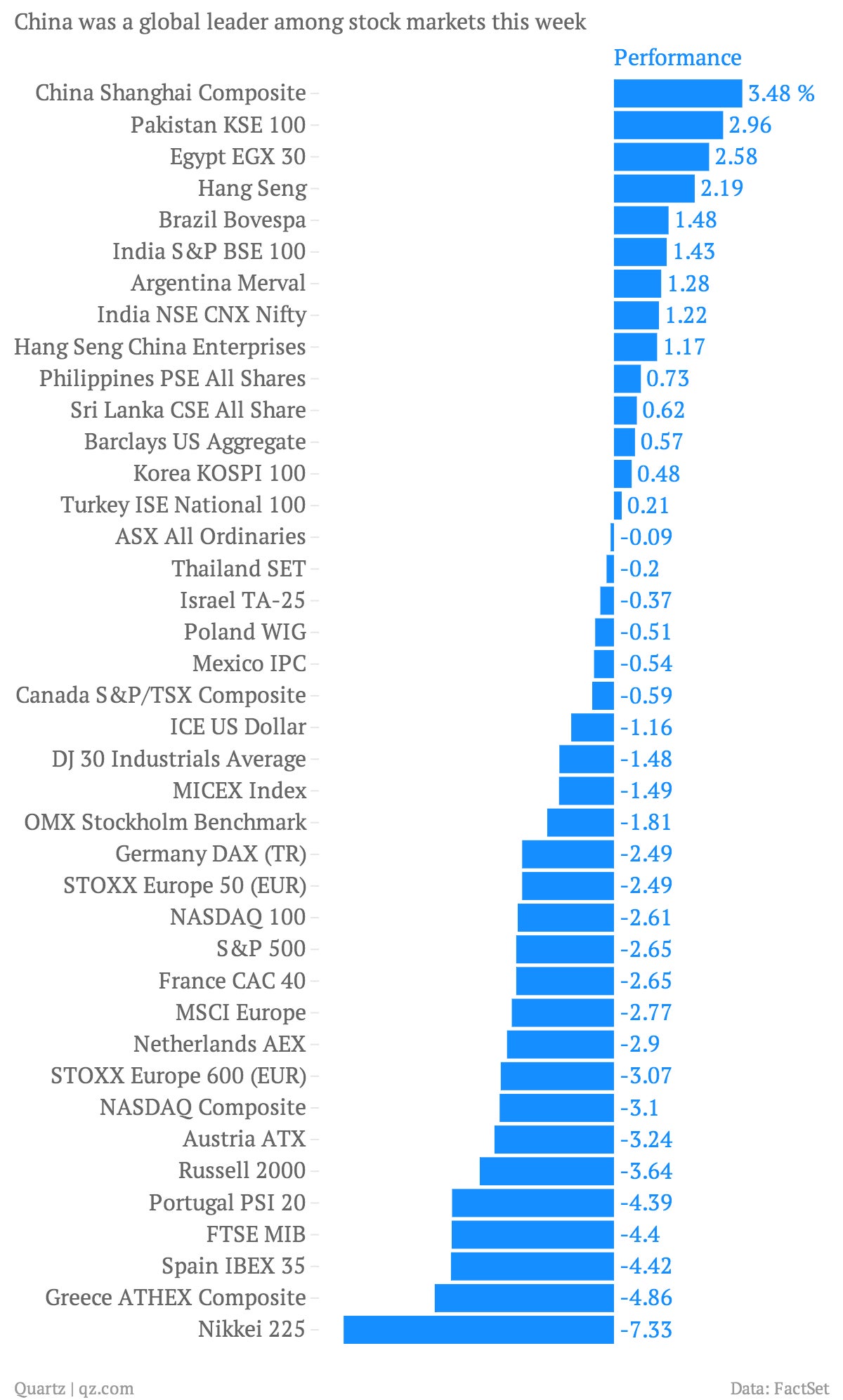

How things change. In 2014, Japanese equities are having some of the worst runs globally. And that was certainly the case this week, as the Nikkei 225 fell another 7.3% to bring it down more than 14% this year.

The big winner of the week? China. The mainland benchmark Shanghai Composite Index rose 3.5% on the week, its best weekly performance in more than two months. Chinese markets got a lift from an announcement that there would soon be increased linkages allowing equity trading between Hong Kong and mainland China. The rise of Chinese markets—despite less than sizzling economic data this week—suggests investors are betting that the mini-stimulus the government just announced could be the start of a broader push at propping up growth in the People’s Republic.