There have been a lot of outraged headlines about just how much it cost Yahoo to fire its COO, Henrique de Castro, whom it let go in January after just 15 months on the job. A $109 million “golden parachute”? Yahoo had to “spend $58 million“? But these headline figures are a little bit misleading.

What it actually cost Yahoo to fire de Castro, according to a company filing yesterday, was a little under $1.18 million (p. 101). That’s $1.14 million for 12 months’ salary and bonus, plus another $29,491 for unused vacation and $7,652 to cover his medical insurance for another year. So where did these eye-popping numbers come from?

First, de Castro made an estimated $45 million in pay and stock that vested during his tenure. That money was already paid up when he was fired. Then, his severance agreement promised him all of his outstanding stock options. These included a large grant to make up for Google options he gave up by leaving Google before he could exercise them—known as a “make-whole” package. The company granted him options with a target value of $20 million to make up for that Google stock.

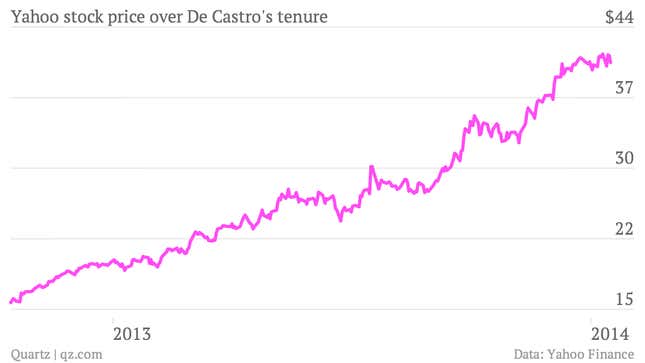

Yahoo’s exceptional performance (mostly due to its investment in Alibaba) over the last year, and the fact that he was fired on January 16, when stock was near a high point at $40.43, meant that the make-whole package ended up being worth $31.18 million (p. 83). Initial and performance awards, also based on stock, ended up being valued at $9.62 million and $16.04 million respectively. De Castro also received a bit more than $1 million in cash, bringing the total value of his severance to $58 million.

The timing, then, was not under Yahoo’s control. Nobody could have known at the time de Castro was hired that he would get fired 15 months later, or that the stock would have tripled meanwhile.

Nonetheless, there are real questions about how Yahoo structured de Castro’s compensation. The cost ended up being so high and his tenure so short that shareholders filed a lawsuit last month calling the compensation package “egregious and wasteful.” The suit claims a breach of fiduciary duty, that the board members failed to inform themselves about how much de Castro would be entitled to receive, that it wasted corporate assets, and that the disclosure of his pay wasn’t adequate. The suit also files a claim against de Castro for unjust enrichment.

The plaintiffs calculated de Castro was entitled to walk away with about $127 million in total, which is higher than what he actually got, but the suit makes some important points:

- That severance package would be on the high end for a CEO, let alone a COO after 15 months

- Mayer announced that de Castro wouldn’t be replaced, which raises doubts about how essential he was in the first place

- The pay structure was so complicated that it was hard to tell what exactly de Castro was due

The suit seeks damages and restitution in favor of Yahoo, as well as an order demanding the company reform its governance and internal procedures. Yahoo will file a motion to dismiss the case. “Say on Pay” rules enacted as part of financial reform have lead to more lawsuits over disclosures of executive pay.

Golden parachutes (pdf) and long term equity compensation are a way to try and align an executive’s incentives with shareholders. And make-whole stock awards aren’t uncommon. This is an instance where both backfired.