Tesla can’t reach global battery supremacy without a friend

Why hasn’t Tesla announced a partner yet for its much vaunted gigafactory? The question is beginning to be asked, and not just by investors.

Why hasn’t Tesla announced a partner yet for its much vaunted gigafactory? The question is beginning to be asked, and not just by investors.

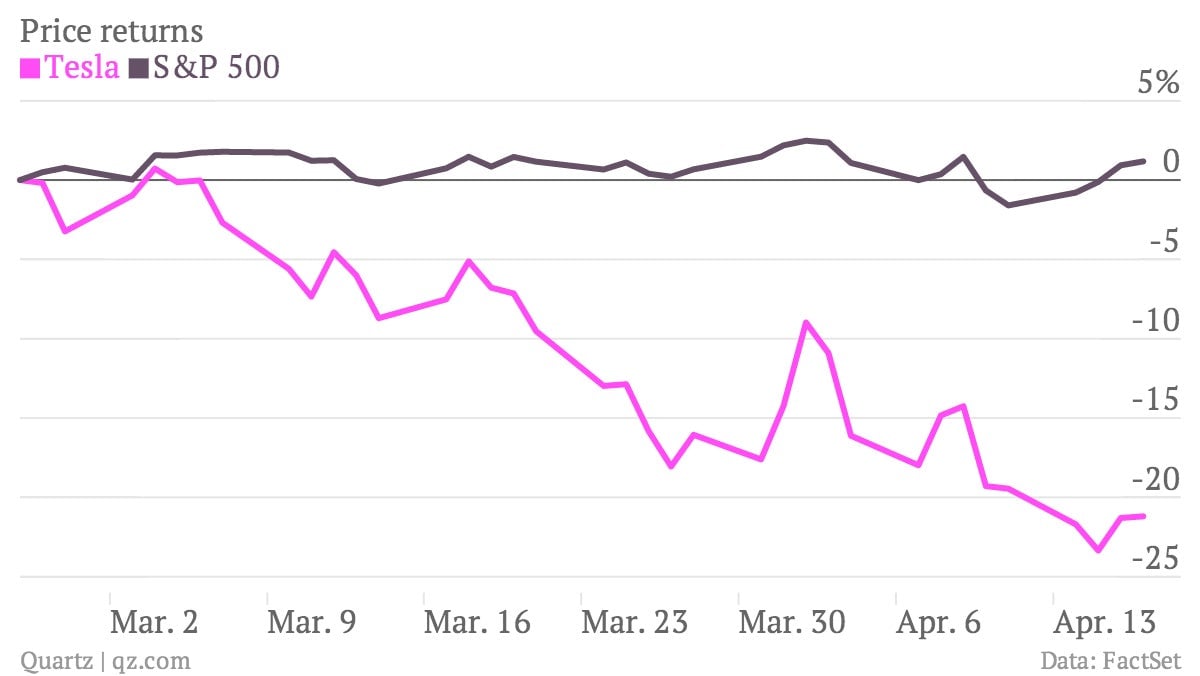

Tesla’s share price has underperformed the market by a wide margin since it unveiled its plans to build the world’s biggest lithium-ion battery factory on Feb 26. Although, to be fair, it has also been one of the hardest-hit stocks in the recent sell off that thus far, nobody has been able to convincingly explain.

Each day that passes without Tesla announcing a partner—which will be expected to help fund the project and produce the batteries—the more the uncertainty mounts. It’s creating concern about the launch of Gen 3, Tesla’s next model of electric car which is expected to sell for just $35,000 and take the company to the mainstream. “If six months pass without measurable progress on the factory, must investors push back expectations for Gen 3 launch, or worse?” Morgan Stanley asked in a note this week. ”Does Musk’s Gigafactory make sense?” the MIT Technology Review exclaimed.

Tesla has historically partnered with Panasonic for the lithium-ion batteries used in its existing vehicles, so the Japanese company would be seen as a logical choice to be involved in the new project. Yet it has been non-committal on its potential role. “The investment risk is definitely larger,” Panasonic’s president told reporters last month. There has also been wild speculation that Apple might want to be involved.

“We are gratified by the level of enthusiasm our plans for the Gigafactory have generated from suppliers throughout the battery industry,” a spokeswoman for Tesla said in an email. “Since our announcement in late February, there has been tremendous interest from potential partners in collaborating on all aspects of the project. This has led us to take additional time to evaluate new inquiries along with our ongoing partnership discussions.”

The announcement of the first partner for the factory will be a “watershed moment” for Tesla, Morgan Stanley analysts say, and not just because any partner will be expected contribute a large portion of the $5 billion needed to fund it. (Tesla is putting in about $2 billion.)

“For an established cell player to commit here implies they were sufficiently convinced by the calculations of Tesla’s engineers to open up its own supply chain, cooperate with rivals and change their place in the industry,” Morgan Stanley wrote. “In our view, such an announcement would represent giga-validation.”

Tesla expects the gigafactory to be producing more batteries than the entire industry by 2020. Analysts, those at Morgan Stanley among them, believe these batteries could end up being used for a lot more than just Tesla vehicles, and this belief is one of the factors underpinning the electric car maker’s astronomical valuation.

Not everyone agrees. The format of batteries (paywall) Tesla uses aren’t used by any other automaker (though they are used in laptops.) But a partner for the gigafactory would be a big vote of confidence for Elon Musk and his huge ambitions.