Vladimir Putin is now pushing around the markets, as well as his neighbors

The prospect of outright war between Russia and Ukraine seemed a real possibility this week (though the tensions have eased a bit), and that made for some interesting dynamics in the markets.

The prospect of outright war between Russia and Ukraine seemed a real possibility this week (though the tensions have eased a bit), and that made for some interesting dynamics in the markets.

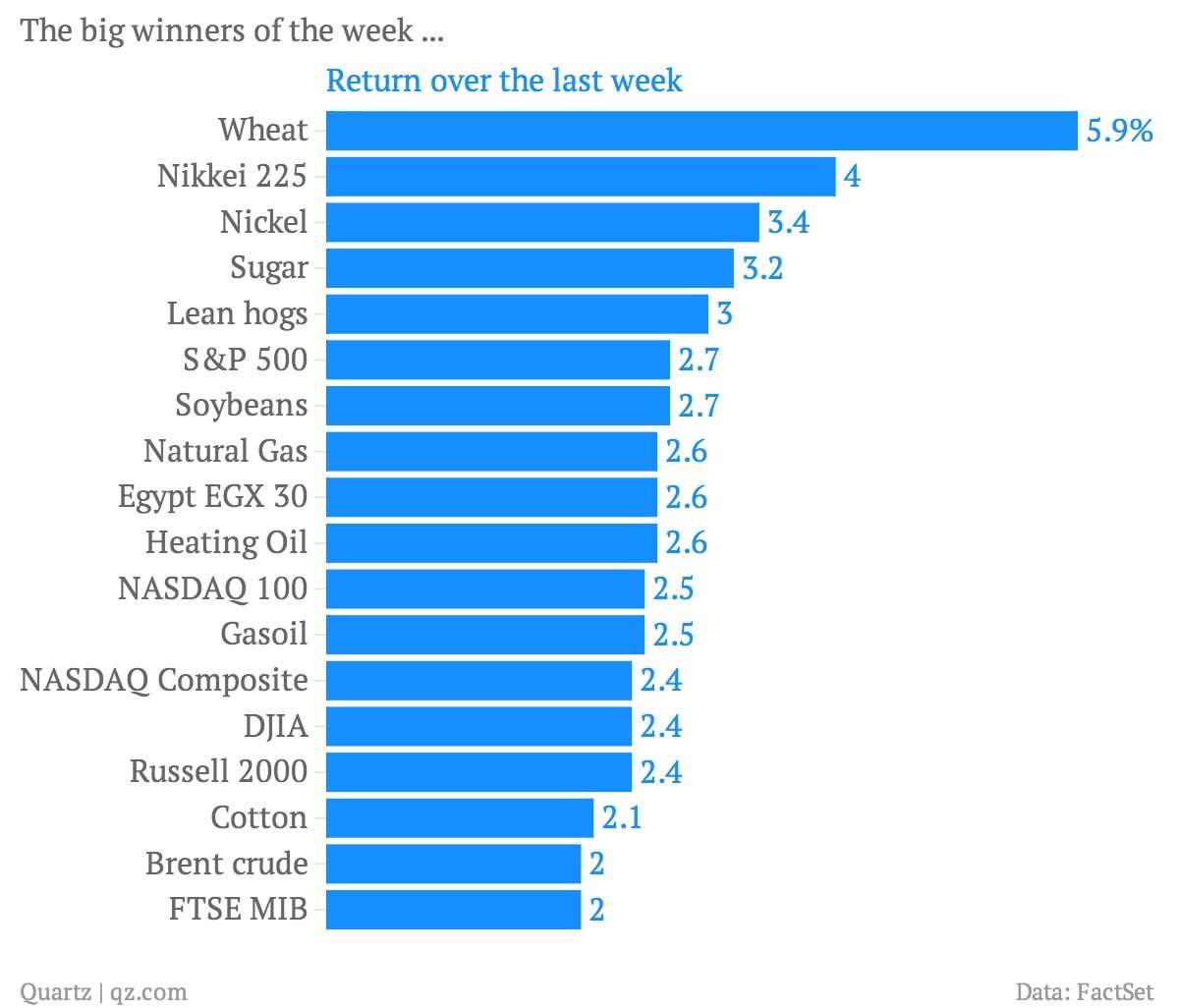

Ukraine is a substantial supplier of the grain, and wheat prices surged to the top of Quartz’s weekly look at how different asset classes fared. Russia’s OAO Norilsk Nickel is the world’s largest producer of that basic ingredient for stainless steel. And prices for that raw material also surged during the week. Nickel prices hit 14-month highs this week (paywall) amid concern that Russian producers could face sanctions that disrupt supplies.

Of course, Russia wasn’t the only market mover. Japan’s Nikkei rose as the yen weakened against the US dollar. The US S&P 500 posted its best week since July on solid outlooks from companies reporting earnings, including GE. The Nasdaq Composite gained as the recent tech selloff seemed to run out of steam. Italy’s FTSE MIB gained thanks to an ongoing rally among its once-beleaguered banks.