As the worst of the pandemic ebbs in many countries, big-box retailers whose sales soared amid lockdowns and social distancing are getting a glimpse of what the “recovery” might do to their continued growth. For Costco, all signs point to success—as shoppers feel more comfortable going out in the world, a good number are spending money at Costco in person.

On Thursday, the company reported earnings for the 12-week quarter ended on May 9. Sales increased 21.7% over the previous quarter, with net sales totaling $44.4 billion. Its e-commerce sales still grew 41% this quarter, but that growth was slower than in previous quarters.

Even with the pandemic boost, you might argue that Costco breaks too many rules of retail to justify its runaway success. It charges people to shop. Its stores are warehouses, with products displayed on industrial pallets. It sells products in huge quantities at deep discounts—there’s no use popping by for milk and eggs—and it has fewer types of each product in stock.

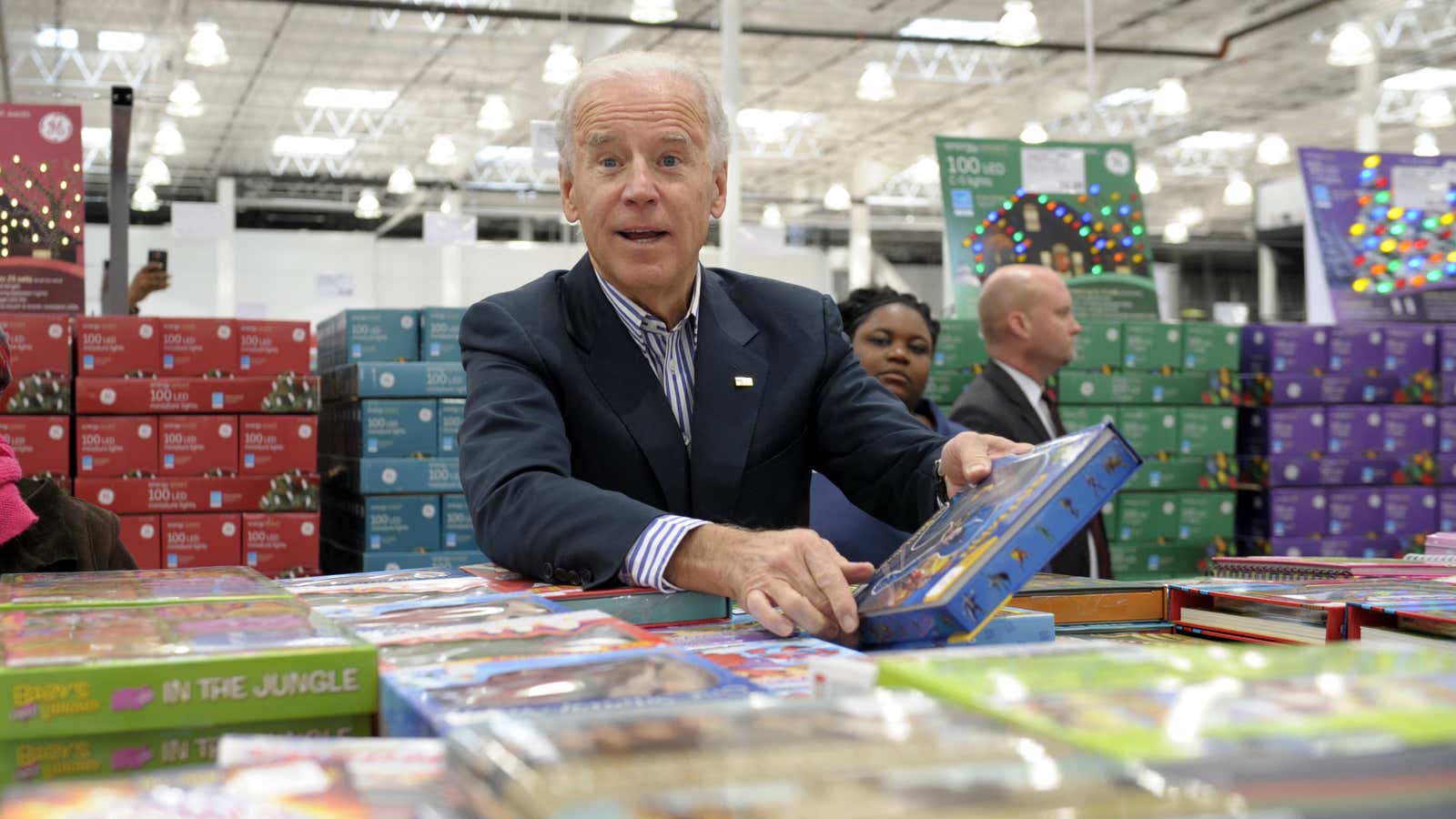

And yet it works: Shoppers regularly leave having spent more than they expected to, and people who can keep a level head at Safeway or Stop & Shop find themselves checking out at Costco with carts full of romaine hearts, steaks, gallon jugs of salad dressing, and 80-roll pallets of paper towels. There’s just one caveat to Costco’s magic: The retailer’s almost uncanny ability to sell people things they may not need leans heavily on the power of in-person shopping.

Costco’s business model

Costco has two main revenue streams: membership fees ($60/year minimum) and sales, which includes sales of its in-house brand of consumer goods, Kirkland Signature. This model isn’t particularly unique, but is wildly effective when combined with Costco’s grasp of shopper psychology. Let’s break it down.

💰 A reputation for discounts. The economics are pretty simple: Costco can sell things on the cheap because it too is buying goods at a discount and in bulk, and because 25% of its sales come from Kirkland products. Costco’s markups are also lower than its competitors’.“ [We] seek to maintain what we believe is a perception among our members of our ‘pricing authority’ on quality goods,” reads the company’s most recent annual report (pdf). Psychologists have found that, if people think they’re getting a deal, they’re more likely to spend. They’re also motivated to recoup their membership fee by feeling like they’re saving money.

🤩 The thrill of discovery. The aisles at Costco aren’t labeled, which tempts (forces?) shoppers to walk down each one. That makes them more likely to encounter what Costco calls its “triggers and treasures.” Triggers are household staples like paper towels and laundry detergent, which make up about 75% of its inventory. The other 25% are treasures—exciting or surprising merchandise like TVs, fine wine, or jewelry—that tempt and excite consumers.

🤔 Limited inventory. Consumers who choose between six types of jam are more likely to buy it than those choosing between 30 types, a landmark 2000 study found (pdf). “Making people decide…that causes confusion and they ultimately decide to walk away,” Pam Danziger, a marketing consultant, said in a documentary about Costco. That’s why Costco only offers one or two items in each category.

🤑 Free samples. Everyone loves free samples—even retailers. Samples can boost sales up to 2,000% and move inventory that shoppers might not naturally go for. Still, Costco has elevated the sample to an art form. There are shopper blogs about favorite sample options, and some say the samples are their main reason for coming into the store. Costco’s samples went on hiatus during the pandemic, but the retailer has started slowly bringing them back.

⏲️ Wanna hang out? Costcos aren’t just warehouses of goods; many have gas stations and pharmacies, beauty salons and travel agencies. These ancillary services rake in substantial dough: about 16% (pdf) of the company’s $166 billion in revenue in 2020. They’re also part of what powers Costco’s in-person shopping experience. “[Ancillary services are] one of the key pillars on which old world brick-and-mortar retailers can transform their models to gain new customers and increase the visitation rates of existing customers,” writes retail expert Robin Lewis. “It’s also a strategy that cannot be easily implemented by e-commerce, [like] the apocalypse messenger, Amazon.”

How much is Costco membership?

$60: The least expensive annual Costco membership in the US (pdf)

803: Costco locations across 12 countries as of Dec. 31, 2020 (pdf)

$100,000+: Annual income of the average US Costco member (Walmart’s is $76K)

43: Average age of a Costco member, which is below the population average but above that of many of its competitors, such as Target

105,500: Global Costco members in 2020 (pdf)

91%: Annual renewal rate of US Costco members (88% globally) (pdf)

11%: Average markup on products at Costco, vs. 25-50% at most other retailers

4,000: Items (or “stock keeping units”) each Costco warehouse carries, compared to 15,000-60,000 at your average grocery store

$75 billion: Value of Costco’s in-store Kirkland brand, according to a recent report from UBS

Costco’s competition

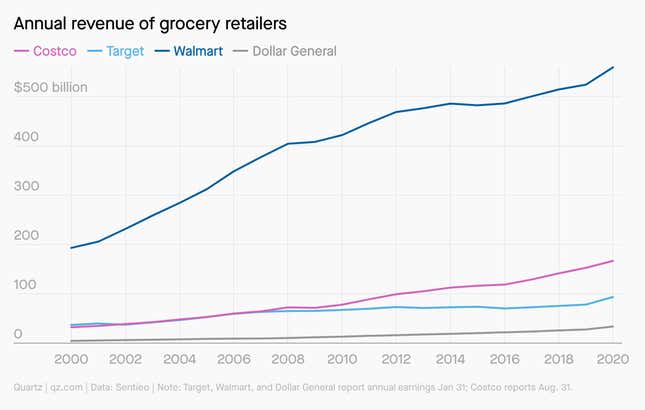

Compared to a behemoth like Walmart, Costco doesn’t look like much. But its revenue is consistently higher than competitors that include Target and Dollar General.

The pandemic has also been good to Costco: Revenue was up 9% in 2020—Costco’s fiscal 2020 ended last August—and 15% year-over-year in its most recent quarter, which ended in February. In April, Costco’s same-store sales were up 33% over last April.

Pop quiz

Which is Costco’s most popular item, according to a 2012 documentary?

🥐 Croissants

🧻 Toilet paper

👖 Jeans

🥩 Steak

Why Costco’s hot-dog combos still cost $1.50

“If you raise the [price of the] effing hot dog, I will kill you.” —Costco co-founder Jim Sinegal

A hot dog and soda at the Costco food court will run you $1.50, and it’s been that way since 1985. (With inflation, the combo should go for $3.65 today.) To keep the price down, Costco moved hot dog production in-house in 2009. CEO Craig Jelinek reportedly once considered raising the price of the combo, to which co-founder Sinegal reacted with the threat above. The price stayed, and in fiscal year 2019 Costco sold 151 million combos, bringing in $226.5 million.

Costco’s e-commerce strategy

Costco has had an e-commerce offering since 1998 (pdf), but online shopping isn’t yet a substantial part of its business. The pandemic helped—e-commerce sales grew 50% in 2020, and were up 76% year-over-year in Costco’s most recent quarter—but the company hasn’t quite recreated the unique in-store experience online.

Perhaps it doesn’t need to: The heart of Costco’s strategy still depends on in-person retail. According to the company’s most recent annual report (pdf), its margins online aren’t as good as in-store sales; that’s why it opened 16 new warehouses in 2020. Even as foot traffic slowed at some of its competitors—many of whom, like Costco, got into curbside delivery—Costco saw shoppers spending more in stores during the pandemic.

“Ultimately, we still want our members to come into the warehouse,” CFO Richard Galanti said during a December 2020 earnings call. “When they come in, they see the items and they are more likely to buy some of those items.”

Answer 🔑 : Even before the pandemic, toilet paper was Costco’s most popular item. A 30-roll package of Kirkland signature bath tissue retails for $19.99.