When the first installment of the enhanced Child Tax Credit was sent out on July 15, it marked a historic first for US social policy. For the first time, eligible households are getting direct cash payments for raising children rather than a credit on their annual taxes. The annual value of the benefit is up to $3,000 for each child 6 to 17, and $3,600 for children under 6.

The change, enacted as part of the American Rescue Plan, makes the US program more similar to how other wealthy nations give money to support parents and caregivers. Whether universal or income-based, 108 countries around the world have some form of periodic cash benefit program for children and families, according to a Unicef report. These policies have been effective in reducing child poverty.

Among wealthier nations, the US provides some of the lowest direct support to families with children compared to the size of its economy. It has reduced this spending over time.

While the US government does have social safety net programs directed at families, like SNAP and WIC, they are limited in their scope and in who can use them. These programs ultimately have not done much to change the child poverty rate in the US, which still remains one of the highest among developed nations.

A new model for child poverty programs

The new child tax credit more closely resembles a universal child benefit policy. It is unprecedented for the US in its universality—it reaches about 90% of families—and for its lack of restrictions—it’s cash.

“It’s definitely a departure from the past.” says Sophie Collyer, a poverty and social policy researcher at Columbia University.

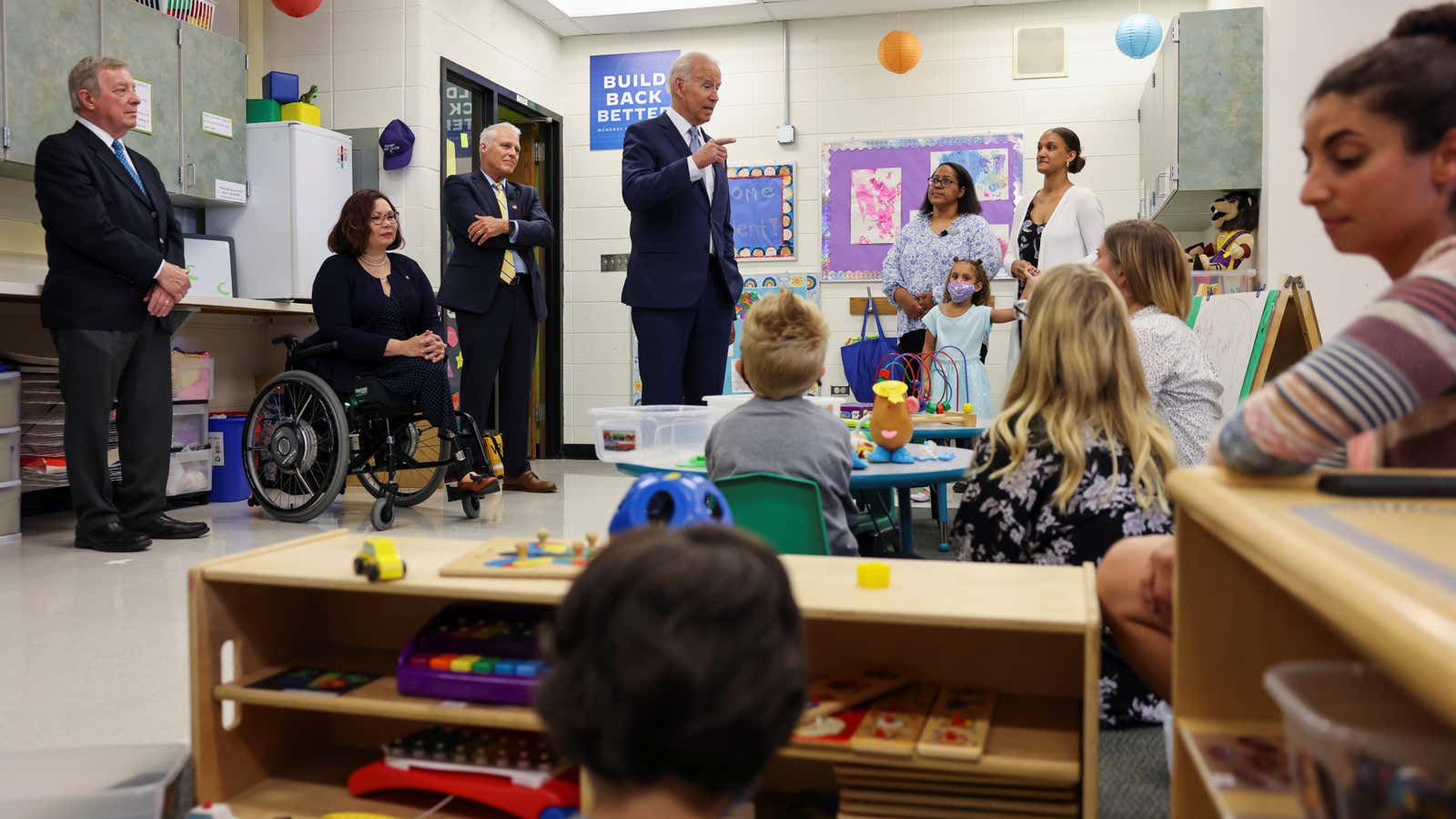

The monthly payments are only being made in 2021. However, language to make them permanent through 2025 is included in the American Families Plan, president Biden’s $1.8 trillion proposal for investments in childcare, education, and healthcare. An extension of the current model, Collyer says, is the only way to feel the impacts of a child allowance policy in the US.

“We have a child allowance for 2021. Without an extension, we’ll see the impact for this year, but over time it’ll completely evaporate.”