Rohan Pavuluri wants more Americans to file for bankruptcy—and to talk about it.

As co-founder and CEO of nonprofit tech startup Upsolve, he wants to make the process accessible to people, just as the framers of America’s Constitution originally intended. Though bankruptcy laws for individuals have been in the books on-and-off in the US since around 1800, the stigma associated with debt and financial hardship keeps many Americans in need from benefiting from those protections, he says.

“We don’t think it’s immoral for companies to file for bankruptcy. We think of it as a market tool to address something beyond their control. But when individuals do it, we think of it as a moral failing,” Pavuluri says.

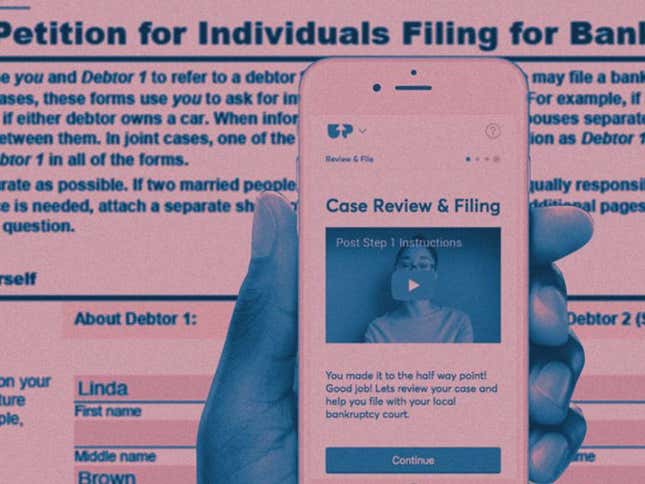

Filing for bankruptcy in the US can cost hundreds of dollars in legal and processing fees. Upsolve started in 2019 with an app that helps individuals through the process simply, and for free. Since then, it says that it has helped to clear around $400 million and counting in debt. Now it has launched an online forum for anyone facing financial distress, to share their struggles and get support from fellow community members and Upsolve experts.

Quartz spoke with Pavuluri to discuss the app’s success, the stigma of bankruptcy in the US, and what companies can do to support employees going through financial hardship. This interview has been edited for clarity.

Quartz: It seems like a lot of what Upsolve is trying to confront are systemic issues plaguing people in the US—medical debt, student debt, the cost of divorce, the complexity of the legal system. In some ways, the app and forum feel a bit like a Band-Aid on a wound.

Pavuluri: In the near term, we want to maximize our impact by helping as many low income families as possible overcome their debt, reenter the economy, stop wage garnishment, improve their credit, [and] start working again. But in the long term, our goal is to use the power that we’re building among our user base, the credibility that we’re building given our direct impact, [and] the understanding of these underlying systemic problems to fight for systemic reform.

That is how we think about Upsolve in the near-term: focus on having as much impact with our direct services in the form of our education, our software, our community. And in the long term, actually change the system itself to be more open and accessible and equitable.

Reforming the legal system in the US won’t be easy, given that its fee system is built on complexity. How do you even think about a reforming a system that profits on being complicated?

We think of legal fees in areas of poverty law as modern day poll taxes that permeate American democracy, and the complexity within the legal system, as modern day literacy tests. Our attitude is that what first needs to happen is a narrative shift. We need to think of these barriers not just as inconveniences, but actually gross civil rights injustices that are taking place before our eyes. And people need to be outraged at this civil rights crisis that’s happening in America, where low-income families—we pretend they have rights, but they really don’t, when it comes to overcoming their debt through bankruptcy, or needing protection against abusive landlords and creditors, or needing to get restraining orders.

For all these areas of the law, if you can’t afford the legal fees, you don’t have these rights, and low-income people do not have these rights. So the first thing that needs to happen is we need to talk about these issues differently. We need to challenge this notion that every legal problem needs a lawyer, because as long as that narrative exists in America, we’ll never have equal rights under the law.

Then what we need to do is pass reform, either through legislation or litigation. We need to challenge the complexity that exists within these systems. We need to require basic user testing in courts, and we really need to redesign processes, forms, courts under the assumption that people won’t have lawyers. Because it makes no sense to assume that people will have lawyers for these areas of the law that are driven by lack of financial stability. The Upsolve bankruptcy app shouldn’t need to exist.

And third, we need to open up who can provide legal advice and legal services in America. The current system, where we’ve restricted the supply of help that’s available by only allowing lawyers to provide legal advice, guarantees that we will never have equal rights under the law. There’s just not enough supply of help that’s available to meet the demand. As long as the current restrictions and anti-civil rights policies in every single state exist that stop other professionals, whether it’s clergy members, or social workers, or community organizers from providing legal advice. These are the systemic issues that we are excited to work on.

Do you see Upsolve as a tool to fight some of the systemic injustices, i.e. is Upsolve making a case for bankruptcy? Or is the focus more on making the process of bankruptcy less taboo and more accessible?

Bankruptcy is a civil legal right and a core part of the American identity. In America, when you hit hard times, we give you a second chance to get back on your feet. That’s what bankruptcy is about—it’s a lifeline to re-enter the economy. Most people don’t know this, but the Founding Fathers cared enough about having a system of bankruptcy that they put it in on our Constitution. The alternatives, which they wanted us to move past, were debtors prison and execution.

The thesis of Upsolve is that folks should be able to access the rights they’re already guaranteed. We focus on areas of the law like bankruptcy because it makes no sense to assume folks can afford legal fees. If they could afford the fees, they wouldn’t have the legal problem in the first place.

You used to run your community discussions on these issues through Facebook, what’s behind the choice to launch your own community forum?

We realized when you’re on your own, going through a legal process, it can be extremely lonely. And, especially if you’re low-income and you’re facing legal issues that have to do with your finances, like bankruptcy, there is this incredible stigma. We don’t talk about these issues in America openly. And that’s only exacerbated for low-income individuals. We realized we can’t just have an app. We need to support the people who are going through this process through community. Community will be important not just to help people understand and feel a sense of emotional belonging, but also will help them post-bankruptcy to get to work. People who are low-income and navigating job market don’t receive support in the same way that higher income folks do. So we want to build community to help people through legal processes on their own, but also through overcoming debt, reentering the job market.

A lot of users were uncomfortable on Facebook, especially if they’re connected to other friends. They don’t want people to know. Our big bet at Upsolve is moving beyond a transactional app for bankruptcy towards a platform for anybody who’s facing financial hardship.

I think in the long run, we’ll think about deputizing our own users on the issues that people face that have to do with debt and working, things like wage garnishment or credit. A lot of times, employers will stop people from getting jobs or will hold it against them if they have poor credit. Bankruptcy is a tool that can oftentimes help people actually relieve their debt and improve their credit. Inconsistent pay due to Covid has led people into financial distress, and then brought them to our community. Similarly, people have issues just figuring out how to get a car loan so that they can get to work, [or] people may get their car repossessed and lose their job. It’s expensive to be poor.

Do you see the forum as a way to encourage people to use Upsolve or to go further, and talk about how to get through debt like some of the popular personal finance boards on sites like Reddit?

This is broader than just using our tool. We are really inspired by [Reddit boards]r/poverty finance, r/personal finance, and we think that there is something unique we can contribute: a community that’s living on our website, but combined with professional, attorney-written content and actual tools and moderation. We think that we can provide a potentially more useful experience than some of the online communities that are fragmented on Facebook and Reddit.

Do you think companies have any responsibility to help people through these these experiences?

Not only do they have a moral responsibility, but I think that it’s in their financial interests. That is something that we want other people to understand: People who are in extreme debt or in the margins of our economy, they’re not really participating. They can’t get access to credit for banking or normal loans in the same way that everybody else can. They’re not productive customers for banks, for example. So what needs to happen is you need to rehabilitate folks and really bring them back into the economy.

I suppose I was thinking of the responsibility of companies to have financial advisers or to subsidize the ability of employees to get support. However, I remember McDonald’s did this and it completely backfired. In 2013, they offered staff a financial education tool and it instead revealed some of the major financial challenges facing fast food employees.

One of the problems with financial literacy is that it’s sometimes thought of as a substitute for addressing more systemic issues. I have no doubt that financial education is an important missing part of our education system. And really, what we’re trying to do at Upsolve is build a brand like Khan Academy or like Mayo Clinic, but for financial education and financial empowerment. So we are helping people who have problems, but we want to help them avoid the problems in the first place. So that’s what we’re trying to build.

I am really cognizant that financial education alone is not a solution to income inequality and the inequities within employment. But it’s often the narrative that this is the only solution. I don’t believe in that. That’s emblematic of this McDonald’s situation. I do think it’s a responsibility of employers themselves to help employees deal with debt. Whether it’s helping them with budgeting or whether it’s repaying on certain issues. Because again, it’s what creates a healthy workforce. People not worrying about their debt will be more productive.