China is cheapening the yuan for scarier reasons than usual

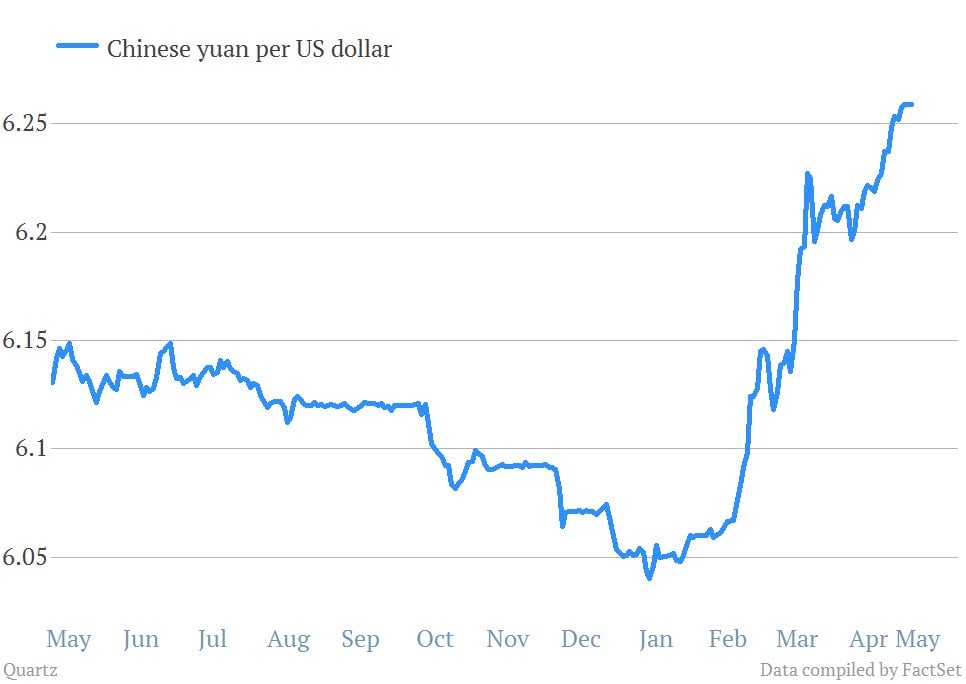

The sharp drop in the yuan’s value that started in mid-February 2014 has riled up US government officials who suspect that the People’s Bank of China is helping Chinese exporters at the expense of everyone else. But it has remained a bit of a mystery who was actually behind that drop—the PBoC or traders.

The sharp drop in the yuan’s value that started in mid-February 2014 has riled up US government officials who suspect that the People’s Bank of China is helping Chinese exporters at the expense of everyone else. But it has remained a bit of a mystery who was actually behind that drop—the PBoC or traders.

Until now, that is. New clues out from the PBoC show that it had been cheapening the currency all along. The big news, however, isn’t that the PBoC is up to its old tricks again. More worrying are new hints that a big rationale behind the move is deflation setting in throughout China.

First, a little background on the PBoC’s yuan-management habits. To maintain its desired yuan value, the PBoC buys foreign currencies from Chinese exporters and foreign investors, likely offering more yuan per $1 than the market would. Since 2005, this practice has allowed the yuan’s value to rise nearly 30%. Then on February 17, the yuan reversed its steady climb, followed by a still bigger drop in March.

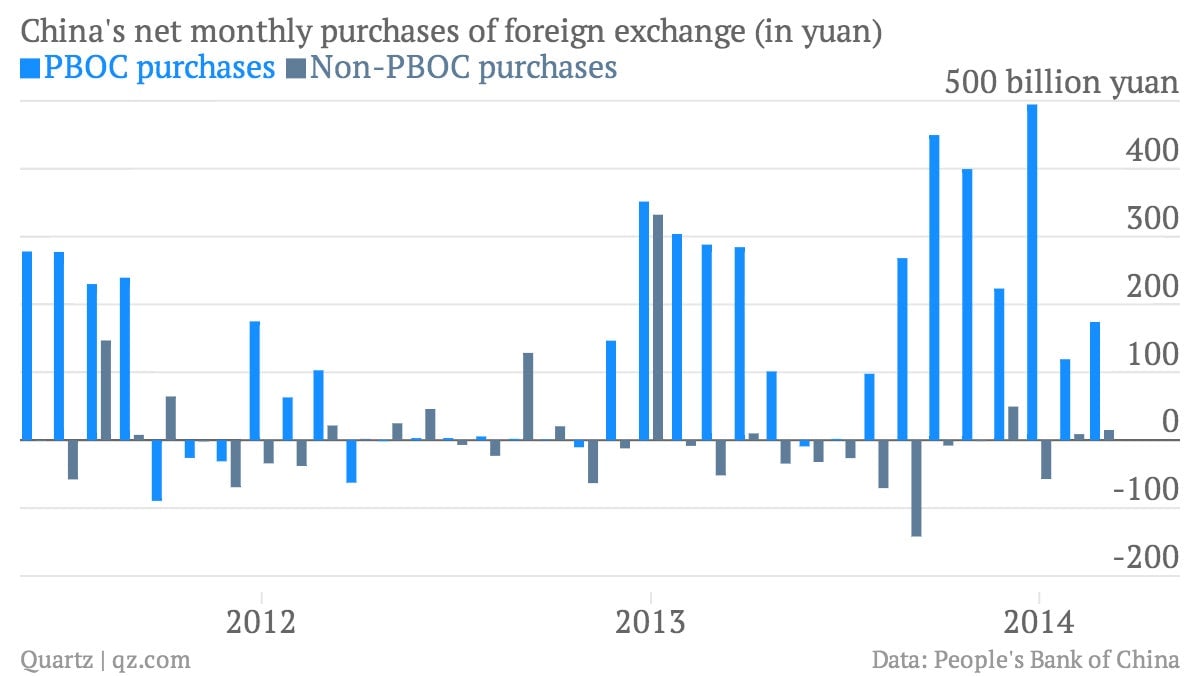

Some have blamed currency speculators for the yuan’s dive (more on that here). But new data shows the PBoC paid 174 billion yuan ($28 billion) for foreign currencies in March, more than nine-tenths of all foreign exchange purchases in China that month.

Here’s where things get weird though. When the PBoC buys dollars from exporters—and gives them more yuan than the market rate—it pumps extra yuan into the Chinese economy. Since that surge of cash could cause prices to rise perilously fast, the PBoC normally “sterilizes” its FX purchases, issuing yuan bonds to absorb the extra liquidity sloshing around the system.

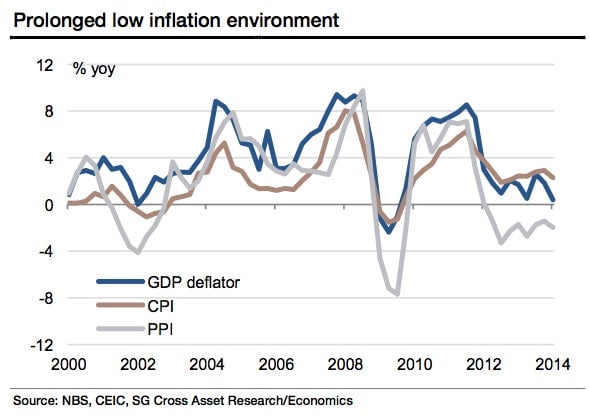

Not in March, though, reports China Real Time. Economists think the PBoC’s declining to sterilize might be because extra money in the system pushes down interest rates—something China could use right about now, given that it’s hovering on the brink of deflation:

Now normally, falling prices suggest that that companies and households are paying down debt. That’s not what’s happening in China, though, says Wei Yao, Société Générale economist. Credit is still growing at twice the pace of GDP—meaning some pretty aggressive borrowing is still going on. That investment should be flowing into the economy, driving up prices. So why isn’t it?

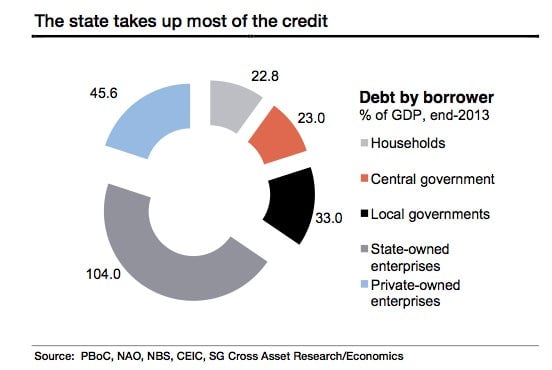

Probably, says Yao, because it’s the state sector that’s still borrowing like crazy, investing in projects that don’t make money.

So what’s the PBoC to do? Some economists recommend the normal cure for this ill: cut rates and encourage lending. SocGen’s Yao, however, is skeptical. Not only will “opening the credit tap will still favor the less-efficient state sector,” she says, but if China is to implement its promised financial reforms, it will need highish rates to prevent a lending binge that typically happens when government-coddled banks suddenly have to compete for business (this proved catastrophic in Japan, for instance).

It’s good, then, that the PBOC is not directly loosening rates. Its yuan-cheapening, however, is risky, says Yao, since it could drive capital out of China. And that sucking-up of money supply would be disastrous for a economy that lives on liquidity.