So long, Noto. One of the main drivers in Goldman Sachs’ IPO machinery, tech banker Anthony Noto, just walked out the door, the Financial Times reports. Noto will leave banking to join hedge fund Coatue Management, which has offices in New York and Menlo Park, California.

The move is unexpected because Noto had become one of Goldman’s brightest stars in advising clients in technology and internet IPOs and mergers and acquisitions. In fact, Noto is credited with helping to nab the much sought after IPO of Twitter last year, catapulting Goldman to tops on the tech IPO league table in 2013 after trailing Morgan Stanley and JPMorgan the year prior. Morgan scored lead underwriting roles in the stock offerings of Facebook and LinkedIn.

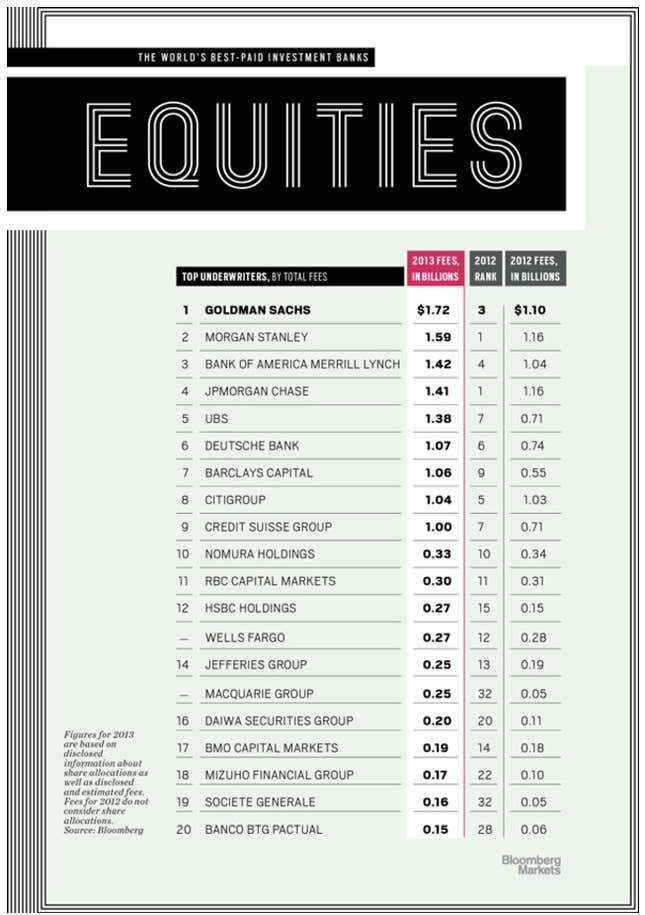

Here’s where Goldman landed last year, according to Bloomberg research:

Goldman’s equity business generated $1.72 billion in fees, with tech offerings comprising a significant chunk of that total, according to Bloomberg. Noto blazed an unusual path to the upper echelons of Goldman. He first joined the firm in 1999 and was named partner five years later. He then left to become chief financial officer at the National Football League, only to return to the firm in 2010 as co-head of its technology, media, and telecom practice—a title he held alongside Dan Dees.

As reported by Recode.net, a bit of revamping of Goldman’s tech team will occur in the wake of Noto’s leaving, with execs Simon Holden, Nick Giovanni, and Michael Ronen being named co-chief Operating officers of Goldman’s tech group, reporting to Dees, according to an internal Goldman memo.

Noto’s departure is another high-profile exit from banking into the more lightly regulated hedge fund sector in the wake of increased bank regulation. Earlier this year, JPMorgan Chase saw Michael Cavanagh, one of Chase’s possible successors to CEO Jamie Dimon, leave to join private equity firm Carlyle Group. Neither Goldman nor Coatue returned requests for comment immediately.