After the worst of the Great Recession, it didn’t take long for the subprime market to start growing again in the US.

Subprime auto loans—that is car loans made to people with shaky credit histories—have been growing fast over the last few years. In 2009, about 17% of the auto loans bundled up into bonds known as asset-backed securities (or ABS, similar to the mortgage-backed securities that crashed the financial system) were subprime. By the first quarter of 2014, that figure had swollen to 31%, according to data from Citi analysts.

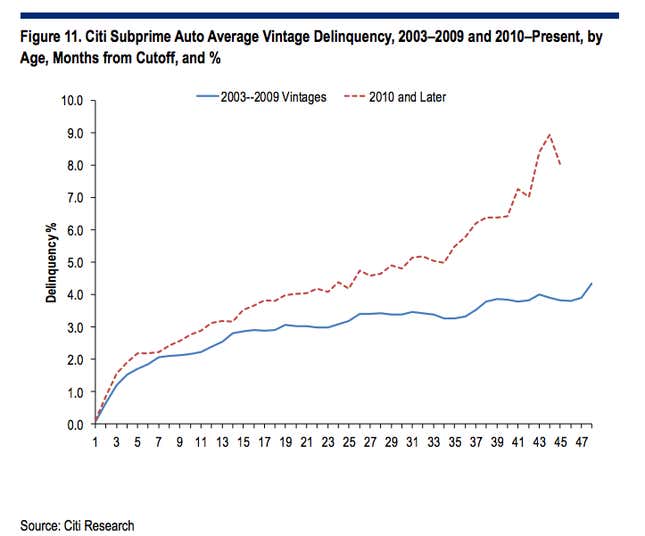

And now some of those borrowers are falling behind on payments. Citigroup analysts spotlighted the trend in a recent note—though it’s somewhat strange, they pointed out, as most American households’ balance sheets are currently improving. ”The deterioration is quite striking in relation to the 2003–2009 period, when households were relatively worse off,” Citi analysts wrote.

Credit Suisse analysts, too, noted the deterioration in payments. “This leads us to forecast rising losses in subprime in 2014-16, although this is tempered by the fact that the underlying economy is still growing,” they noted.

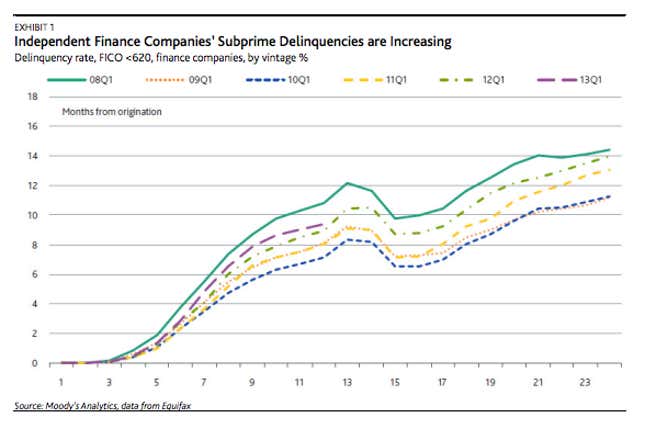

Moody’s analysts also identified the issue in a recent report. And they write that there have been some signs—such as rising credit scores on used car loans—that lenders might be getting more reluctant to extend subprime loans. “There are still some metrics, though, such as rising loan-to-values and lengthening loan terms, that suggest that lenders are still willing to take on increasing risk by catering to cash-strapped customers. Since lenders will likely continue to vie for borrowers, we don’t expect a major slowdown in subprime lending,” they wrote.

So is the US on the verge of another subprime-driven financial crisis? Hardly. There’s far less US auto debt outstanding than mortgage debt ($8.2 trillion in mortgages at the end of the first quarter, versus $875 billion in auto loans.)

It’s not even clear whether any lenders will get hurt by the trend of rising delinquencies (though borrowers who lose their cars will feel the pain). It should be noted, though, that giant American bank Wells Fargo—which distinguished itself by prudently sidestepping the worst of the US home-lending binge—has become a big player in auto loans in recent years.