The “Michael Lewis effect“—in which a book by the best-selling business writer has helped make not only his fortune but those of the people he writes about—may have struck again. A formerly little-known electronic trading firm, IEX Group—the company depicted as the good guy in Lewis’ recent best-selling book Flash Boys—is attracting interest from unnamed venture investors, the Wall Street Journal reported today (paywall).

Sources described the talks to Quartz as in the “very preliminary stages.” The Journal reports that IEX could seek investments in its trading platform that value the company at as much as $300 million. The firm may use its new funds to help it turn into a full-fledged exchange, which would put it in league with bigger exchanges like BATS Global Markets, Nasdaq OMX and the NYSE Euronext. A spokesman for IEX Group declined to comment on the firm’s plans.

Lewis’s book paints the financial world as unfairly tilted to the advantage of high-frequency trading firms, who use speed and super-charged computers to gain advantages over average investors. Lewis cast IEX Group and its founder, Brad Katsuyama (pictured above with his wife, Ashley), as one of the few firms trying to level the playing field. Other exchanges weren’t so pleased, as this feisty exchange between Katsuyama and BATS president William O’Brien depicts:

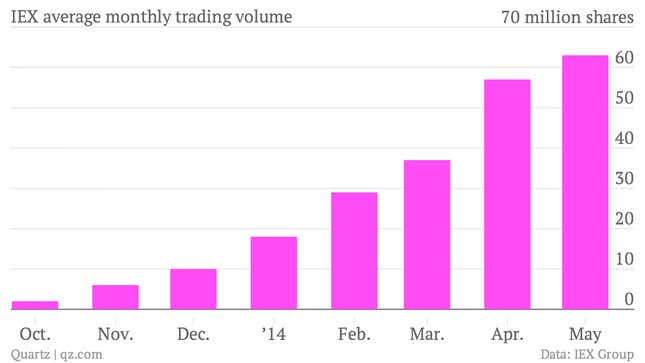

Still, the controversy seems only to have fueled IEX Group’s growth. The platform has seen its average monthly volume of shares traded jump by more than 70% since Lewis’s book was released in March. That sort of growth is music to the ears of venture investors. IEX also received an endorsement from powerhouse investment bank Goldman Sachs.

Quartz wrote about the firm last year, and explained how it uses a complex system to, in effect, slow down its trades in order to foil the super-fast HFT traders. So far, Lewis’s book hasn’t been a boon to other HFTs. One such firm, Virtu Financial, shelved its plans to take itself public, citing negative attention in the wake of Flash Boys. Sources tell Quartz that Virtu is still likely to launch its IPO in the coming months.