The markets smell more QE, and not from the Fed

Everything is great! Everything!

Everything is great! Everything!

That’s pretty much the message the markets are screaming right now.

How’s that? Well, essentially all asset classes are doing incredibly well right now.

Stocks? The S&P 500 is up 3.5%, so far this year and it’s put up a string of supra-1900 closes in recent days, the highest ever for the index.

Commodities? They’re still roaring higher led by the likes of agricultural assets such as coffee, hogs, industrial metals such as nickel.

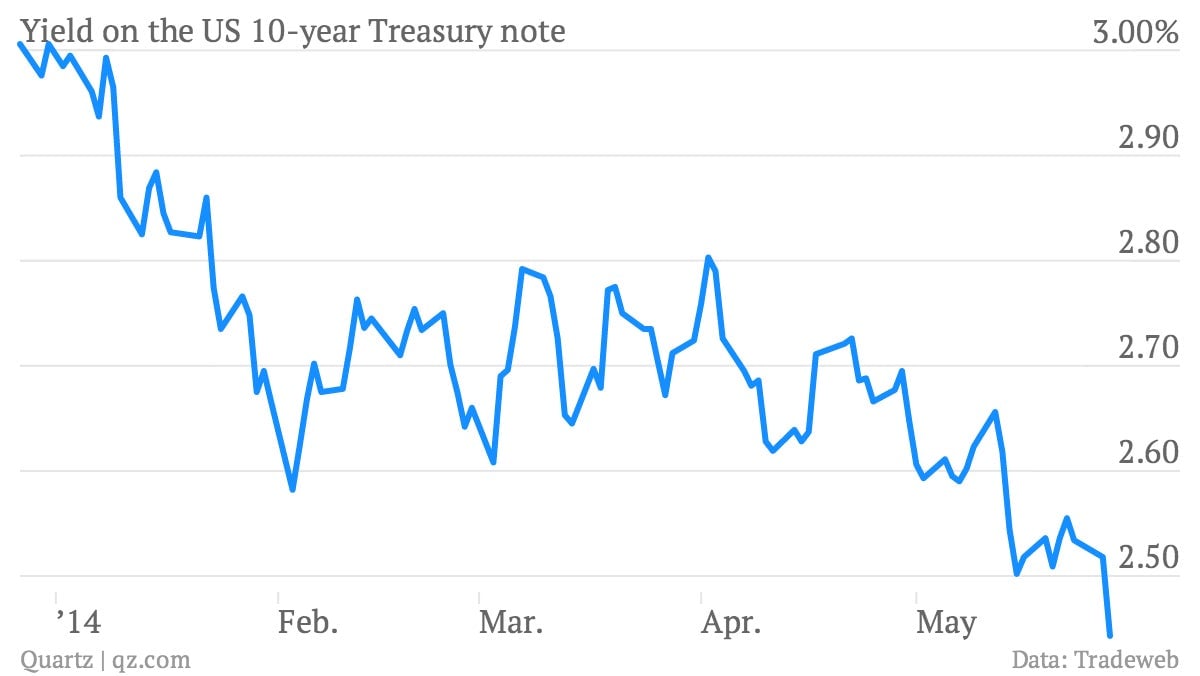

And bonds? Don’t even get me started on bonds. Bond prices have bucked broad expectations for a sell-off this, and instead engaged in a tremendous rally that has once again pushed yields on the benchmark 10-year Treasury note below 2.5%.

Such coordinated moves between asset classes would be somewhat surprising to sticklers for market fundamentals. Theory would predict that rising equity and commodity prices would be more consistent with a strong economic backdrop that pushes up the risks of inflation. In other words, if the stock and commodity markets are right. Bonds prices are too high. And if the bond market is right—a rallying bond market is usually consistent muted economic growth—that means that the stock market and commodities should be wrong. In other words, everything can’t be fine at the same time.

Of course, market theorists often miss the point. Over the last few years we’ve seen several instances when all sorts of asset classes rallied inconsistently. And we usually saw them in the run-up to a round of quantitative easing—or asset buying—from the Federal Reserve.

But isn’t the Fed moving away from QE now? Well, yes. It is, it’s already tapering off its bond buying.

But QE isn’t just for the Fed. In fact, there’s all sorts of signs that the ECB is about to pick up the QE baton just as the Fed looks ready to hand it off. ECB chief Mario Draghi essentially said he’s willing to embrace any number of unorthodox approaches to staving off deflation in the euro zone.

From the look of the markets, investors are taking him at his word. And that means the markets could be set up for a wicked sell-off if Draghi and the ECB don’t come through with actual action at its June 5 meeting.