Processed meat is of notoriously questionable nutritional value, but that hasn’t stopped a bidding war from breaking out over a major producer of hot dogs, sausages and lunch-meats.

In the past few weeks, two of America’s biggest chicken companies, Tyson Foods and Pilgrim’s Pride, have fought for control of Hillshire Brands—think Hillshire Farms lunch meat, Ball Park franks and Jimmy Dean sausages—that was known as Sara Lee up until a few years ago.

The quick rundown of the situation is as follows: Pilgrim’s Pride, the world’s second biggest chicken producer (and subsidiary of Brazilian meat giant JBS, which has a 75% stake in the firm) raised its bid on Hillshire to $6.7 billion yesterday, topping Tyson’s earlier $6.1 billion offer—itself an increase over Pilgrim’s $5.5 billion opening gambit.

Now Hillshire, which had itself previously bid $5.3 billion for packaged-foods maker Pinnacle Foods, has commenced private talks with its two suitors.

Tyson, one of America’s biggest chicken companies, says it wants Hillshire in part to enter the breakfast market—in corporate-speak, an “attractive and fast-growing daypart” where it has little presence today. As we have recently discussed , America’s fast food giants are battling for control of the market to serve you your first meal of the day on the go. For its part, JBS and Pilgrim’s focus, or at least a part of it, seems to be on expanding Hillshire’s brands into international markets. This might explain why.

Despite repeated links between processed meat and health risks in recent years, Americans still consumed $20.8 billion worth of “chilled processed meats” (processed meats sold in the self-service shelves of retail outlets, including ham, bacon, and sausages) last year, according to Euromonitor. In volume terms, this is 3.37 million tonnes, up 2.5% from 2012 —maybe it’s something to do with bacon—but practically unchanged from where it was in 2003.

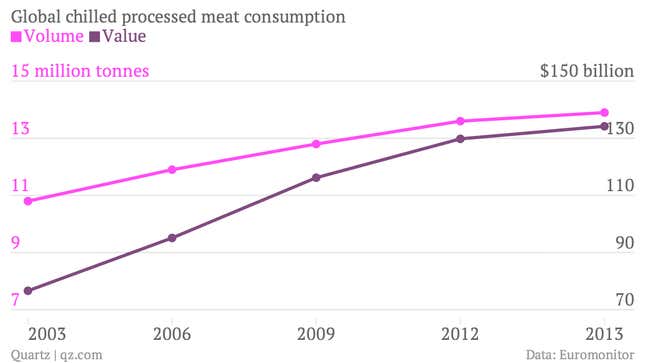

Around the world, it’s a different story: last year 13.9 million tonnes worth of chilled processed meats were consumed globally, up 22% from 2003, and worth some $134 billion, nearly double the value sold a decade earlier.

The growth might be explained by rising emerging market demand for western style food (paywall), the same dynamic that has played out in other consumer sectors in recent years.

Either way, whoever emerges victorious in the battle for Hillshire Brands will be buying into a business with robust demand and a chance to benefit from the world’s growing appetite for artificially-preserved meat.