Corporate America’s mountain of cash just shrank by a huge amount

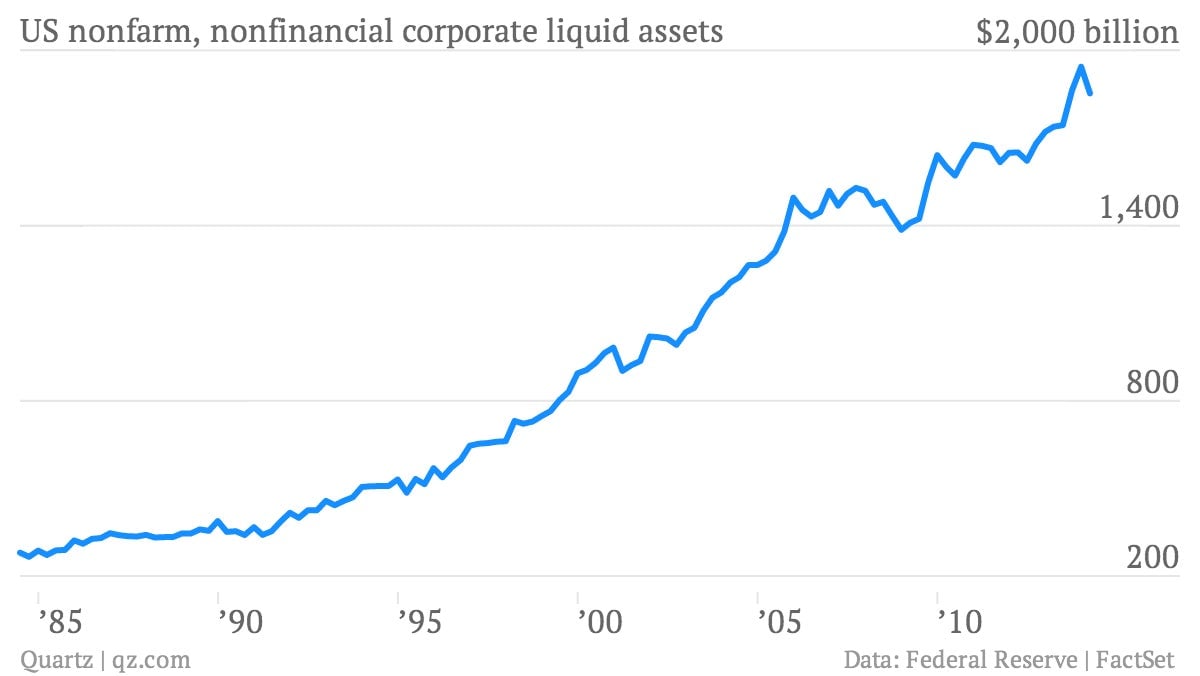

A central question in the lackluster US recovery has been when will corporations feel confident enough to stop socking away historically unprecedented amounts of cash?

A central question in the lackluster US recovery has been when will corporations feel confident enough to stop socking away historically unprecedented amounts of cash?

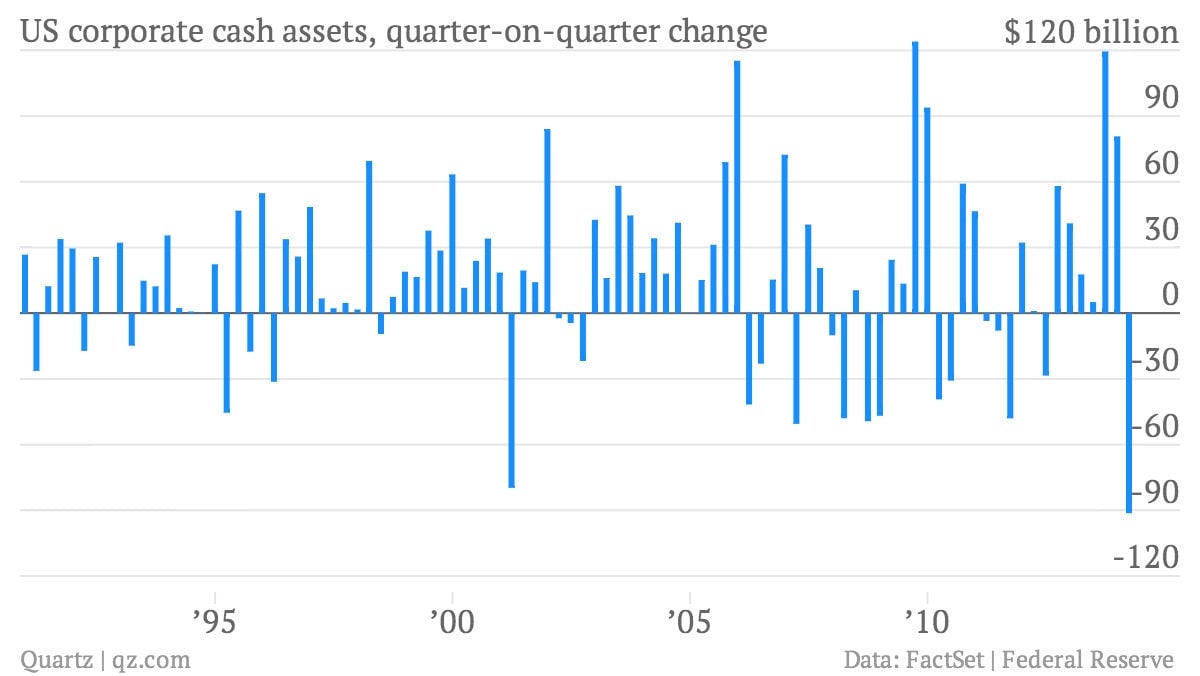

The first quarter of 2014 may be the answer. Just-released numbers from the Federal Reserve show that the cash hoard of non-financial corporations shrank sharply in the first three months of the year.

The quarter-on-quarter decline of roughly $91 billion was the largest—in nominal terms—on record.

Does this mean that the long-awaited return of corporate investment has finally arrived? Well, it’s hard to tell. Corporate business investment—or capital expenditure—has actually been growing for a while now, though not at a particularly fast clip. And it’s unclear whether this downturn was a one-quarter event—perhaps driven by some of the massive merger and acquisition moves recently—or a more durable trend.

But if that money is finally moving out of corporate coffers and back into the economy, this would be a nice little development for the US.