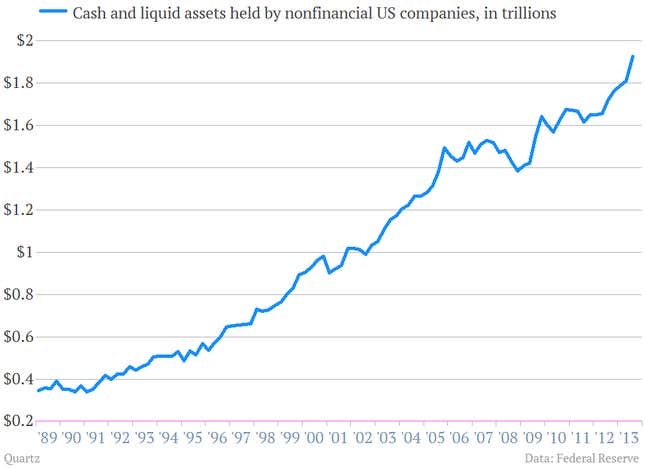

We know it’s hard. But please avert your gaze from the $1.9 trillion pile of cash that US corporations control.

That buildup doesn’t mean that companies aren’t investing for the future, as some—including your humble scribe—may have suggested in the past.

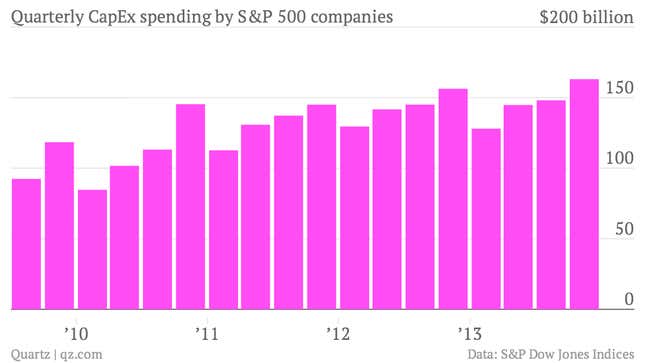

US corporations are indeed plowing money into long-term business investment projects—known to the cognoscenti as capital expenditures. According to S&P index analysts, companies in the S&P 500 are expected to have spent more than $163 billion in corporate investment in the fourth quarter of 2013, once the final tally is done. That’s a new record high, and a 4.4% increase over the fourth quarter of 2012.

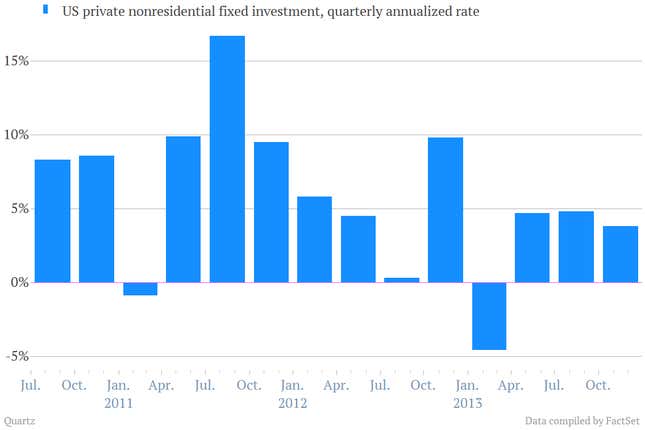

Other measures of business spending—such as the private nonresidential fixed investment component of GDP—show roughly the same thing, a 4-5% increase over last year.

So exactly who in the corporate firmament is doing all this spending? Among S&P 500 companies, analysts say that oil and gas businesses, as well as firms in the telecom industry—specifically Verizon and AT&T—are leading the way.