Family Dollar, the second largest chain of retail discount stores in America, which cater to mostly low-income consumers, became the latest company to incur the wrath of Carl Icahn on Friday.

Icahn wants to meet with the company’s management to discuss “strategies to enhance shareholder value,” which could include new operating initiatives or “strategic alternatives” at the company. It’s not clear yet what this means, but investors are betting Icahn will get his way (he usually does), and they’re optimistic about his advice: shares in the company are up by more than 14% this morning.

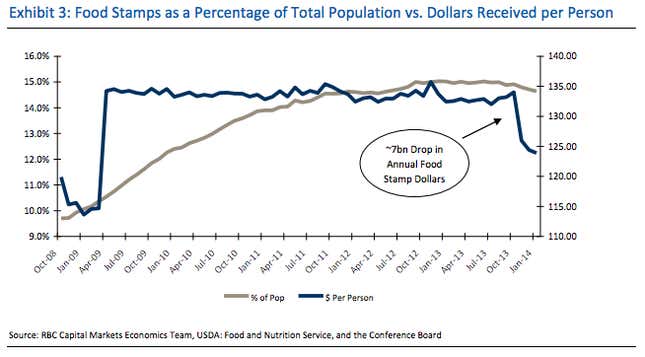

The entire “dollar store” segment, which includes Dollar Tree and Dollar General, has been struggling amid pressure on the low-income Americans that shop at their stores. “The ongoing labor recovery for this customer base continues to be very sluggish, as it generally has not benefited from rising asset values and is also feeling the extra pinch of declining government subsidies,” RBC Capital Markets said in a note this morning. A cut in food stamp benefits, among other reductions in benefits, is squeezing poor and working-class Americans.

But Family Dollar has underperformed its rivals for company-specific reasons as well: Its stores are less productive than its competitors are, and also more concentrated in urban areas, which, according to RBC, means the chain has failed to benefit from “trade-down” customers (paywall)—higher-income shoppers looking for a bargain—like the more rural-focused Dollar General has.

Family Dollar on Friday said it is “open to dialogue with all shareholders,” but this morning the company adopted a so-called “poison pill” anti-takeover defense that would make it trigger the issuance of new shares once an investor owns more than 10% of the company (making it more difficult for that investor to gain control of the company without paying a premium). Icahn and his associated investors own 9.4%.

Icahn might propose the sale of the business to a rival, such as Dollar General or even Wal-Mart, RBC speculates. But even if the hedge fund investor’s latest trade is just about making a lot of noise, generating attention and getting out, few would bet against him.