US banks are elbowing their European competitors out of the bond-trading business

So uncertain is the global economy’s outlook that investors are losing their appetites for fixed-income trading—and the slew of US banks that broker those bets are losing revenue. But as bad as the epic decline in fixed-income trading has been for them, it’s the European banks that are really taking it on the chin.

So uncertain is the global economy’s outlook that investors are losing their appetites for fixed-income trading—and the slew of US banks that broker those bets are losing revenue. But as bad as the epic decline in fixed-income trading has been for them, it’s the European banks that are really taking it on the chin.

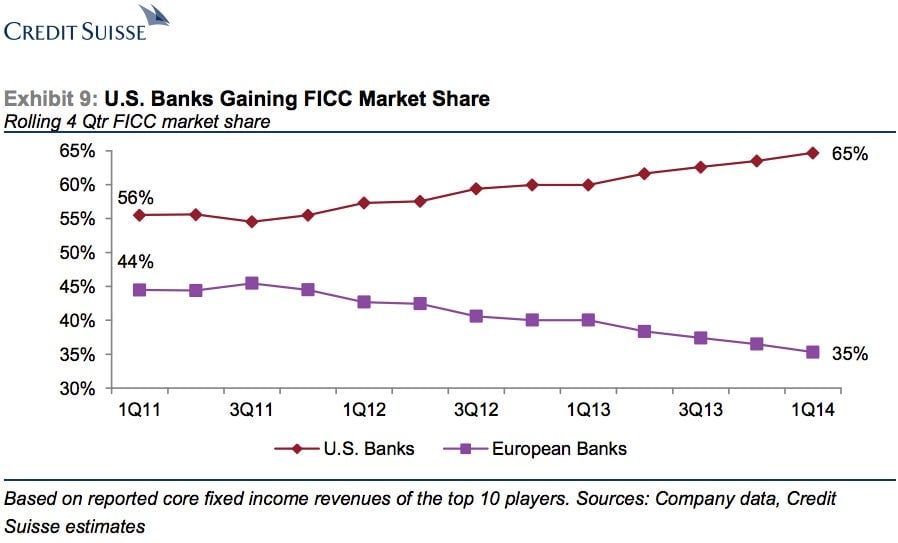

In fact, US banks have been scooping up market share in the embattled area of fixed income, currencies, and commodities (FICC), widening their already significant 12-percentage-point lead over European competitors in FICC trading to a 30-percentage-point margin, as you can see in this Credit Suisse chart:

It’s not that European banks are exactly putting up a fight, though. One reason for the widening gap between FICC trading in US and Europe could be the fact that, unlike their American rivals, European banks are still undergoing some painful resizing in the broader business of banking. Firms like Barclays and Royal Bank of Scotland have been both slimming down their investment banking business—and as a result, the trading operations therein—exemplifying the steady European retreat in trading. (Both had set up significant US beachheads in order to compete with US banks; Barclays’s acquisition of Lehman Brothers in 2008 and RBS’s purchase of Citizens Financial in the late ’80s represented their most significant moves.) The same story has played out at giant Swiss financial giants like UBS and Credit Suisse.

This European retrenchment may be good news for firms like Goldman Sachs, which have vowed to stay in the trading game, if the FICC business stages a turnaround. The risk is that trading may never return to being the moneymaker it was once.