JPMorgan just threatened to cut investment banker pay

Investment bankers may want to hold off on buying that extra pair of Gucci loafers this year.

Investment bankers may want to hold off on buying that extra pair of Gucci loafers this year.

That’s because banker pay (paywall) is at risk of being cut. Indeed, JPMorgan Chase’s top finance executive, Marianne Lake, said the sprawling bank may take an axe to investment bank compensation if a slowdown in trading, which has hurt the firm’s overall revenues, doesn’t reverse course. She didn’t specify by how much the firm might cut pay if trading headwinds persist.

Lake made the comments yesterday at a conference. And her gloomy remarks echoed similar sentiments expressed by Morgan Stanley boss James Gorman at the same conference the previous day. Gorman said the investment bank would aim to boost its own returns by paying out bankers a smaller share of the overall revenues.

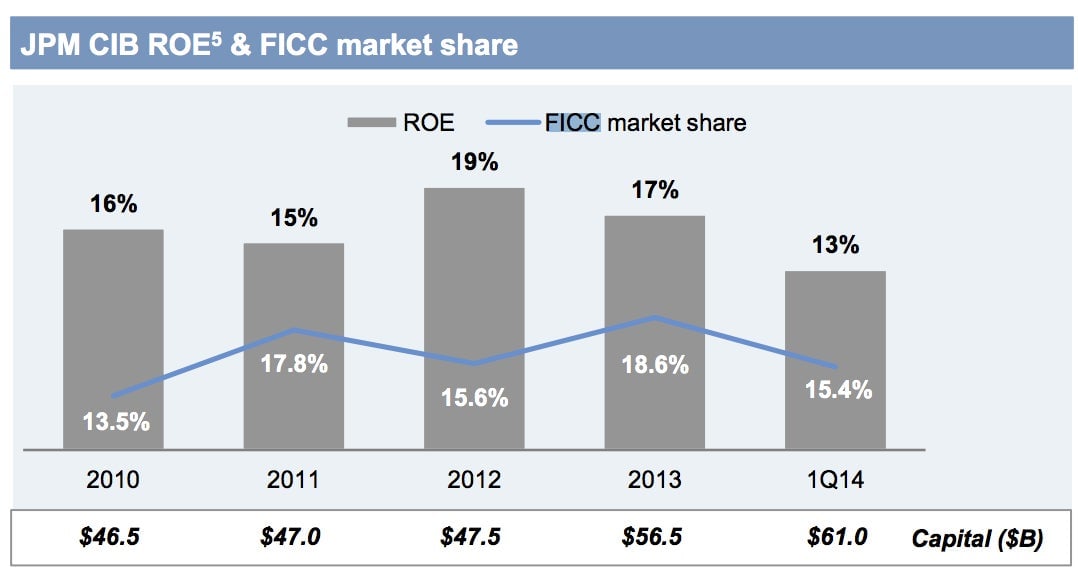

The statements by both banking chieftains come as the investment banking universe is combatting a downturn in trading activity in areas, like fixed income, currencies, and commodities, that once drove massive profits at firms like Morgan Stanley, JPMorgan and Goldman Sachs.

A chart from Lake’s presentation shows how returns, or return on equity (otherwise known as ROE, a measure of bank performance) at JPMorgan’s commercial and investment bank (CIB), have shrunk from 19% two years ago to 13% in the first quarter this year.

It’s worth noting that although banker pay may be cut, compensation as a share of revenue may actually increase if revenues fall faster than pay. But given the leaner return on equity at big banks, rising compensation ratios wouldn’t be looked at too kindly by shareholders.