Once they swaggered, but now they’ve shriveled.

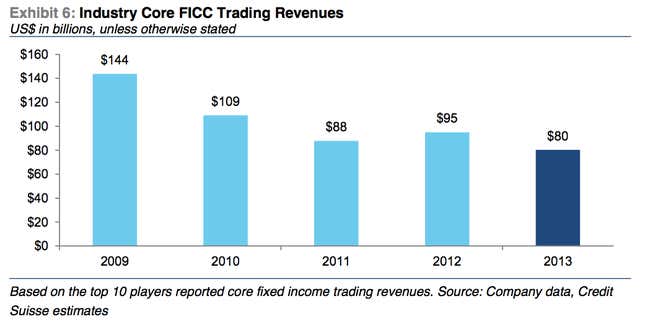

Fixed-income, currencies, and commodities trading units (FICC) generated $144 billion in revenue for the top 10 banks in 2009. Last year, that figure was $80 billion, down 44% from the peak, according to a recent research report by Credit Suisse analysts.

The report highlights FICC activity at 10 big banks, including JPMorgan Chase, Citigroup, Bank of America, Deutsche Bank, and Goldman Sachs. And it attributes at least some of the decline in FICC trading revenue to a drop in the trading of government bonds, complex derivative interest rate securities, and esoteric debt like commercial and home loans. We’ve already noted a similar declining trend in FICC at banks like Goldman Sachs, where FICC once represented 60% of the firm’s overall revenue.

Here’s a look at the decline in trading revenue over the past four years, based on Credit Suisse’s research:

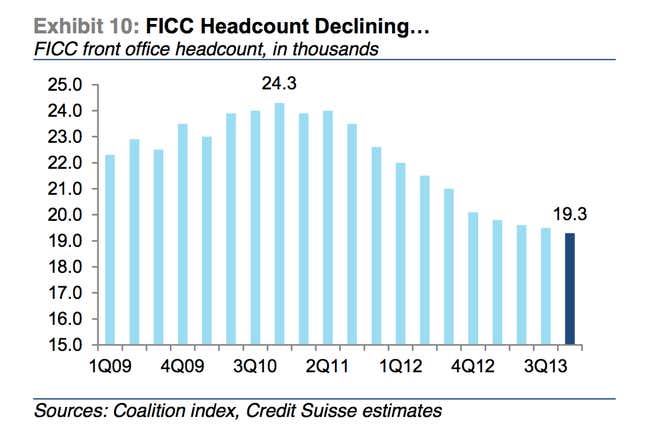

And when trading revenue disappears, so do traders. Credit Suisse data indicates headcount fell by nearly 21% from its peak at the end of 2010:

Some of the slowdown in FICC can be attributed to new regulation like the Volcker rule, which keeps banks from using their own capital to make speculative investments. Regulatory scrutiny is a reason why firms like Morgan Stanley and JPMorgan are also cutting down on their commodities activities.

These trends aren’t likely to end anytime soon. Firms like JPMorgan and Citigroup have already signaled that they are expecting to see fixed-income trading down significantly, which could contribute to weak first-quarter results.