If this is what it takes to do a deal in France, Alstom could be the last big takeover for a while

Directors at the French industrial group Alstom will consider competing offers for parts of their business this weekend. That’s because a $16.9-billion offer by GE for Alstom’s energy operations expires on Monday (June 23). Also on the table is a joint proposal from Siemens and Mitsubishi Heavy Industries, which they say values Alstom’s energy business more highly but features less cash than GE’s offer.

Directors at the French industrial group Alstom will consider competing offers for parts of their business this weekend. That’s because a $16.9-billion offer by GE for Alstom’s energy operations expires on Monday (June 23). Also on the table is a joint proposal from Siemens and Mitsubishi Heavy Industries, which they say values Alstom’s energy business more highly but features less cash than GE’s offer.

Although the ultimate decision lies with Alstom’s board, it is clear that the people actually calling the shots are elsewhere in Paris. The French government has forcefully inserted itself into the takeover battle, threatening to veto any deal that threatens French jobs or national sovereignty in an ever-expanding range of “strategic industries.” Economy minister Arnaud Montebourg (pictured above), in particular, was incensed to learn (from a Bloomberg News report) that a French “industrial jewel” had the nerve to sell itself to a foreign firm without his approval.

And so executives from GE, Siemens, and Mitsubishi have spent a lot of time wooing French officials in recent weeks, adding increasingly convoluted clauses to the terms of their offers. As of yesterday, GE’s once-straightforward bid now takes the form of three joint ventures with Alstom in power grids, renewables, and nuclear technologies. A pledge to create 1,000 new jobs in France will be “enforced through an independent auditor and financial penalties if the goal is not achieved,” GE added.

Whereas the American group’s initial offer in late April dwelled mostly on the financial merits of the deal, GE boss Jeff Immelt is now taking a different tack. His company’s tweaked proposal “creates jobs, establishes headquarters decision-making in France and ensures that the Alstom name will endure,” he said in a statement. Most notably, the French government will have veto power on decisions made by the nuclear joint venture’s management. Today the state doesn’t hold any direct stake in Alstom.

If anything, the initial Siemens-Mitsubishi bid, announced earlier this week (pdf), was so tailored toward pleasing the state that it baffled the markets with its complexity. The German and Japanese groups revamped their offer today (pdf), simplifying the proposal in addition to chucking in a bit more cash for good measure. Still, the three-way deal features an elaborate mix of joint ventures and asset swaps with Alstom’s various power and transport units. For its part, Mitsubishi says it will create 1,000 new jobs and Siemens 1,000 apprenticeships. Siemens has already pledged to guarantee the jobs of French workers it takes on for at least three years.

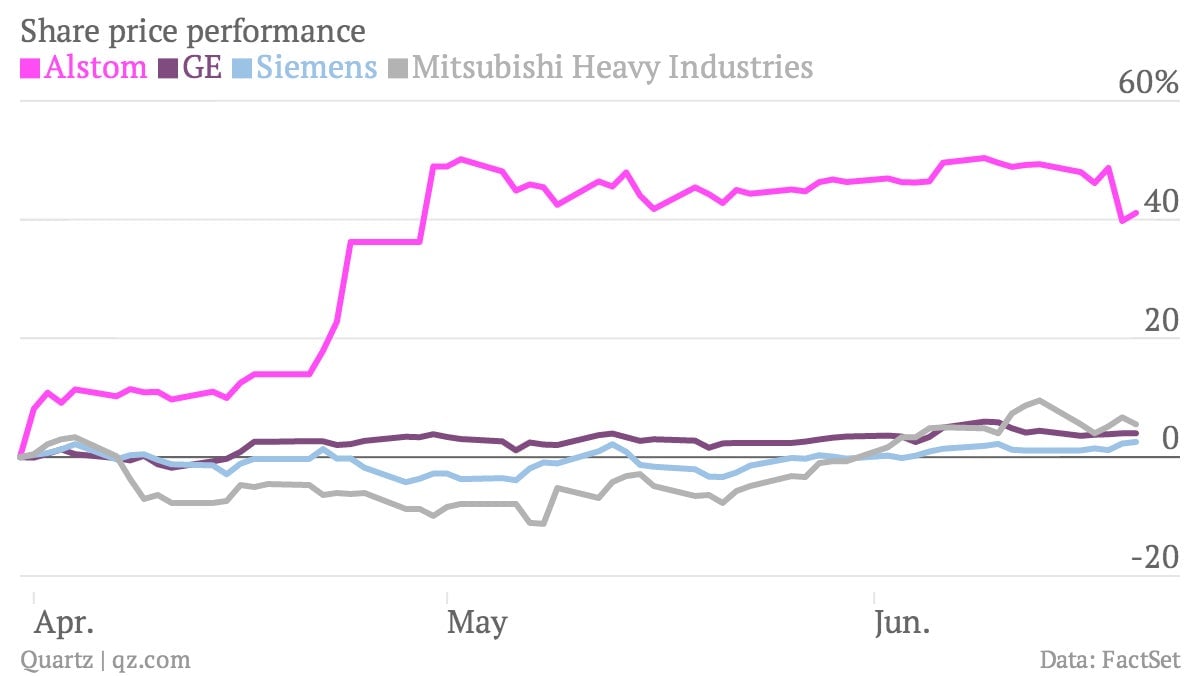

Alstom’s share price jumped on the news of GE’s initial interest in a takeover, but it hasn’t budged much since, despite the supposedly sweetened offers from its suitors:

The muted market reaction to the “bidding war” is a clear sign that, at this point, politics have trumped economics. For other companies interested in acquiring anything deemed remotely sensitive in France—which in addition to the energy and transport industries has in the past included yogurt, bottled water, and online video—the Alstom saga might make them think twice. The embattled French government is keen for foreign firms to splash cash on local companies, but reluctant to relinquish control in return.