Making money just got a little bit tougher on Wall Street. Already ravaged by declines in their core trading operations, banks are facing threats to their moneymaking operations from an arcane segment of the market for financial instruments known as derivatives.

New regulatory rules under the Dodd–Frank Wall Street Reform and Consumer Protection Act, aimed at bolstering the safety of the markets in the wake of the 2008 financial crisis, could see banks lose $4.5 billion in annual revenues, according to a recent McKinsey & Co. report (pdf). That figure represents about 35% of the $13 billion the industry generates annually from derivative products, the report notes.

Regulators argue that such derivatives were at the heart of problems that caused trouble at firms like the giant insurer American International Group, which took an $85-billion bailout from the US government. In order to prevent a replay of that type of collapse, they’re pushing for certain kinds of derivatives, known as swaps, to be traded on a central clearinghouse. (It’s sort of like a stock exchange for swaps.)

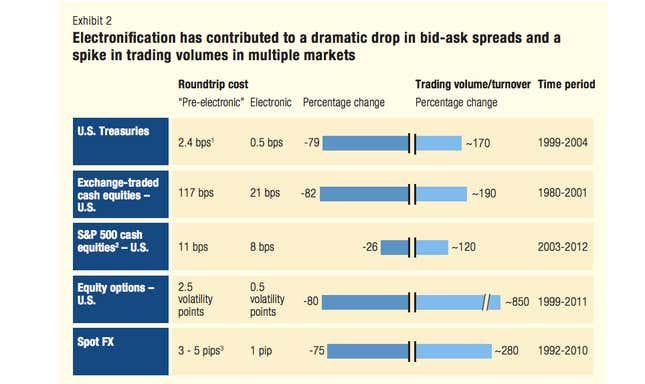

That might make the system safer. But it also shines light on an area of the market that has typically been in the shadows. And shedding more light on the swap agreements opens banks up to competition, which can make it harder to charge hefty fees for arranging swap agreements. This cuts into the area’s profitability. McKinsey has a good chart noting the impacts on fees of introducing electronic, automated platforms on other exchanges.

Banks have argued that there are certain types of derivative agreements that can’t be conducted on exchanges. But for regulators, the stability of the giant swaps market trumps banks’ worries about profits. McKinsey’s Roger Rudisuli told Bloomberg that banks need to figure out ways to tackle the loss of revenues. “If they don’t do anything,” he said, “their profitability goes away.”