It’s gotten expensive being a European bank in the US.

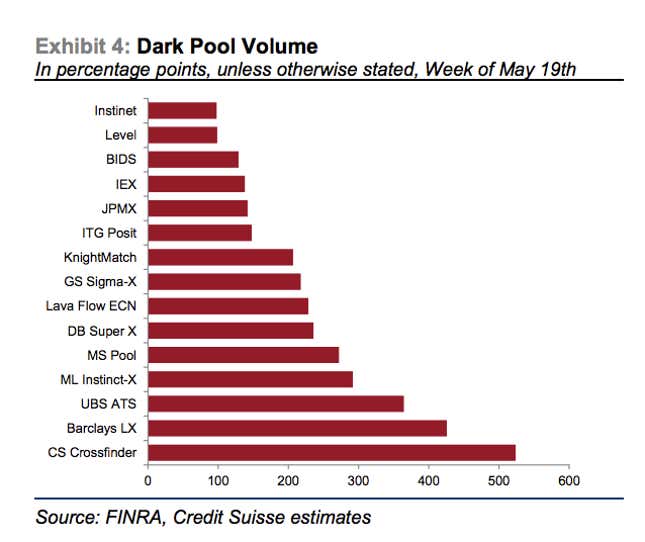

Take Barclays for example. The UK financial institution is being sued by the New York attorney general’s office. The attorney general alleges that Barclays gave unfair advantages to high-frequency traders, who use powerful computers to make lightning-quick trades in the market on the bank’s proprietary trading platforms, known as dark pools. Barclays runs one of the largest dark pools on Wall Street, which allows investors to buy and sell blocks of shares out of the public eye until the transaction is completed.

According to a source familiar with the matter, the attorney general’s office used information from an unnamed whistleblower as well as internal Barclays emails as a basis for the case.

“We take these allegations very seriously,” spokesman Mark Lane said in a statement. “Barclays has been cooperating with the New York Attorney General and the SEC and has been examining this matter internally. The integrity of the markets is a top priority of Barclays.”

The regulator launched a sweeping probe into the private trading platforms at Barclays, Credit Suisse and Goldman Sachs early last month. The suit against Barclays comes as a number of European bank officials have been grousing (paywall) about the aggressive tack US financial enforcers have been taking against European institutions. That’s particularly as the US pursues multi-billion-dollar money laundering charges against French bank BNP Paribas. Here’s a list of European banks that have taken it on the chin from US officials.