In many cities, the area populated by foreign embassies and consulates is the most upscale. In London, for example, diplomats cluster around St James’s Park and Regents Park. But in Hong Kong, office rents have become so expensive that foreign consulates are moving out (paywall) of the Chinese territory’s high-end Central district.

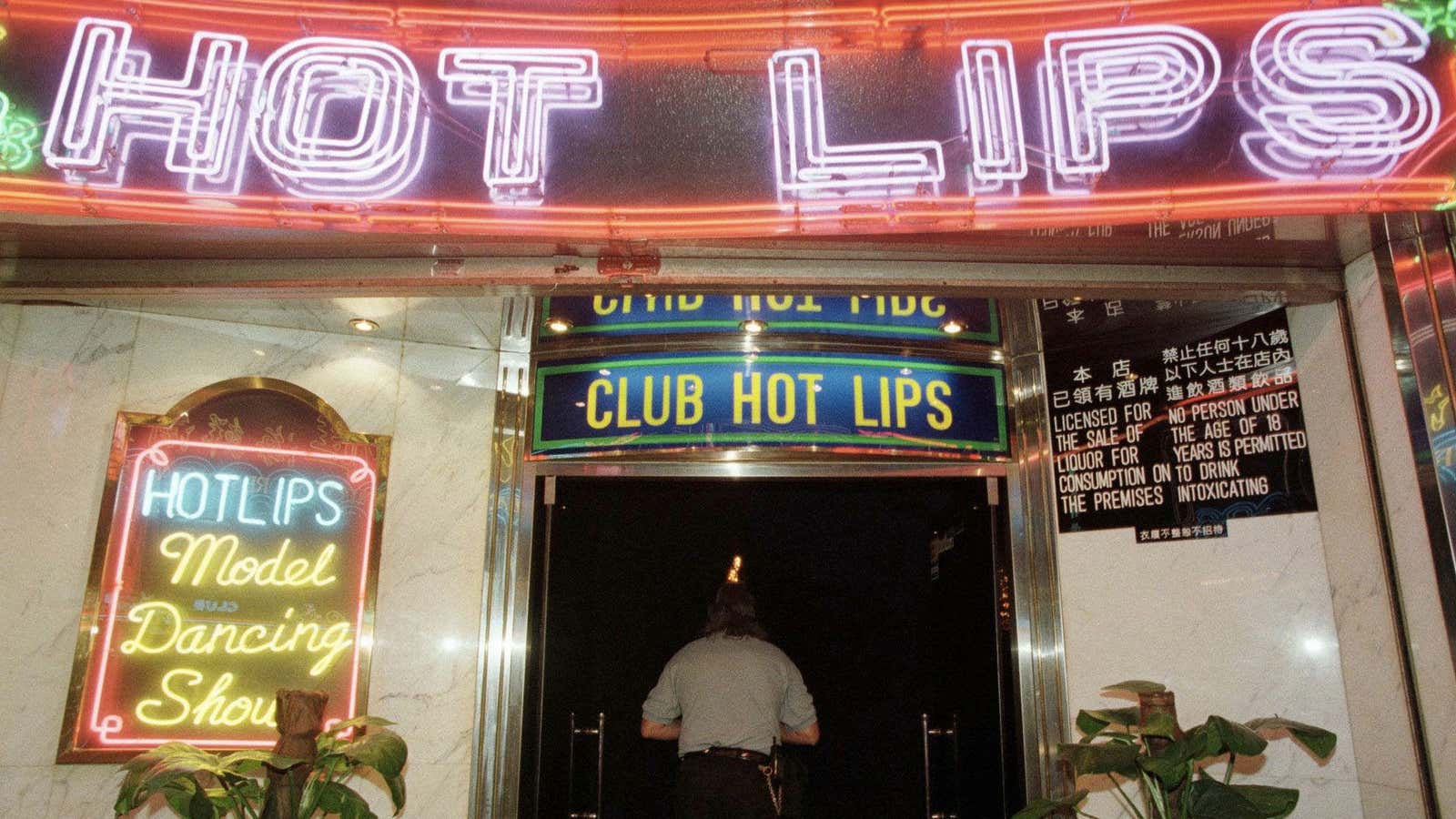

Sweden’s consulate has quit the Hong Kong Club Building, the location of the territory’s most prestigious members’ club and moved to Wan Chai, a seedy part of Hong Kong known for its red light district, which was immortalised in the novel The World of Suzie Wong and is a popular port of call for drunken financiers and visiting sailors. A joke often told by Hong Kong expats is: “I’ve never been to Wan Chai, as far as I can remember.” Revellers tend to end up there in the early hours of the morning, when other bar districts have closed.The streets are often littered with half eaten kebabs. Prostitutes and girlie bar promoters roam around all day looking for business while the bars, which never seem to shut, blast out loud music. Office rents here, according to the South China Morning Post, are some 40% below what they cost in Central.

Meanwhile Canada’s Hong Kong consulate is leaving Central for Quarry Bay, a suburb on the edge of Hong Kong Island that is fast becoming a cheap alternative for company headquarters.

No surprise, then, that Hong Kong is now the world’s most expensive office market, according to a study by real estate consultants CBRE released in July. The reason is that while foreign banks and companies have rushed to take advantage of China’s fast growing economy, the territory’s property developers have kept supply extremely tight to keep prices high. Hong Kong’s government has no problem with such behaviour. It encourages a high land price policy, so it can get rich on stamp duty revenues while keeping official rates of income tax tantalisingly low (most professionals pay around 11%).

Probably because they are worried about a China slowdown and the effect this may have on Hong Kong land values, developers in the Chinese territory are set to restrict office space further. A new CBRE survey shows that supplies of commercial property set for Hong Kong over the next nine years will not meet half of anticipated demand. Hong Kong has an office space “crisis”, the Wall Street Journal proclaimed in an October 30 blog post. It added “Companies seeking office space in Hong Kong are all dressed up, with nowhere to go.” That is not quite true. They can still follow the open minded Swedish diplomats into the welcoming arms of Wan Chai.