This article has been corrected and its headline has been changed, due to an error that materially affected the article’s central claim.

China’s Alibaba Group has tapped the New York Stock Exchange Euronext to list itshighly-anticipated initial public offering, Bloomberg reports. It’s something of blow to the prestige of Nasdaq OMX, which has been a de facto home for technology IPOs for decades.

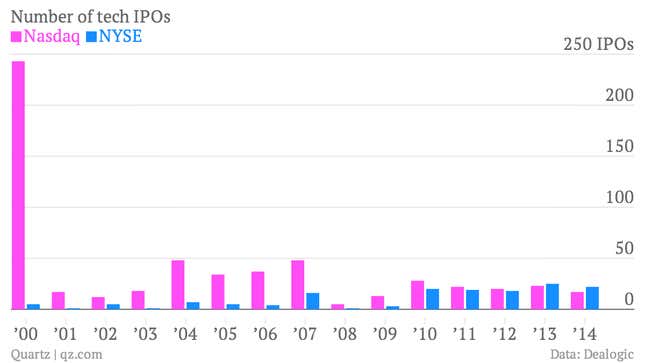

Blue-chip tech companies including Microsoft, Facebook, and Google have chosen Nasdaq. And its edge in tech listings has been dramatic at times: Nasdaq was home to 243 tech IPOs in 2000 compared to just five at the NYSE.

But, so far this year, the NYSE has had 22 tech IPOs compared to Nasdaq’s 17, according to Dealogic. Last year, the NYSE had two more tech IPOs than Nasdaq. The trend started taking hold in 2010 but gained serious traction after Nasdaq’s embarrassing gaffes with Facebook’s IPO (paywall) in 2012. Here’s a chart of the number of tech companies the two exchanges have listed over the past decade and half:

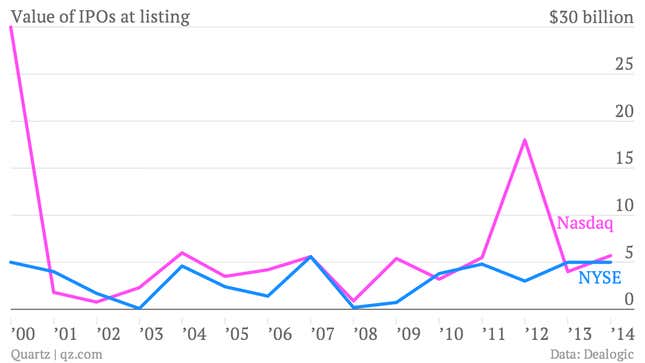

In terms of deal value, Nasdaq is still slightly ahead of its closest rival so far this year, with $5.7 billion worth of public offerings to NYSE’s $5 billion. For 2013, it was a little behind:

Over a longer period of time, Nasdaq is still way ahead of its counterpart. The total value of Nasdaq’s listed tech IPOs is about $98 billion from 2000 to 2014, while the NYSE has registered $47 billion in the same period. But the gap might be starting to close.

Correction: This article originally said that tech IPOs on the Nasdaq in 2014 were worth $97 billion, and those on the NYSE were worth $48 billion, and therefore asserted that the Nasdaq still had a big lead over the NYSE despite its lower number of deals. These were in fact the totals for 2000-2014, which also significantly weakened that assertion. We have changed the headline and the second chart, and some of the text, to reflect the actual data.