Nike’s gigantic World Cup bet is already paying off

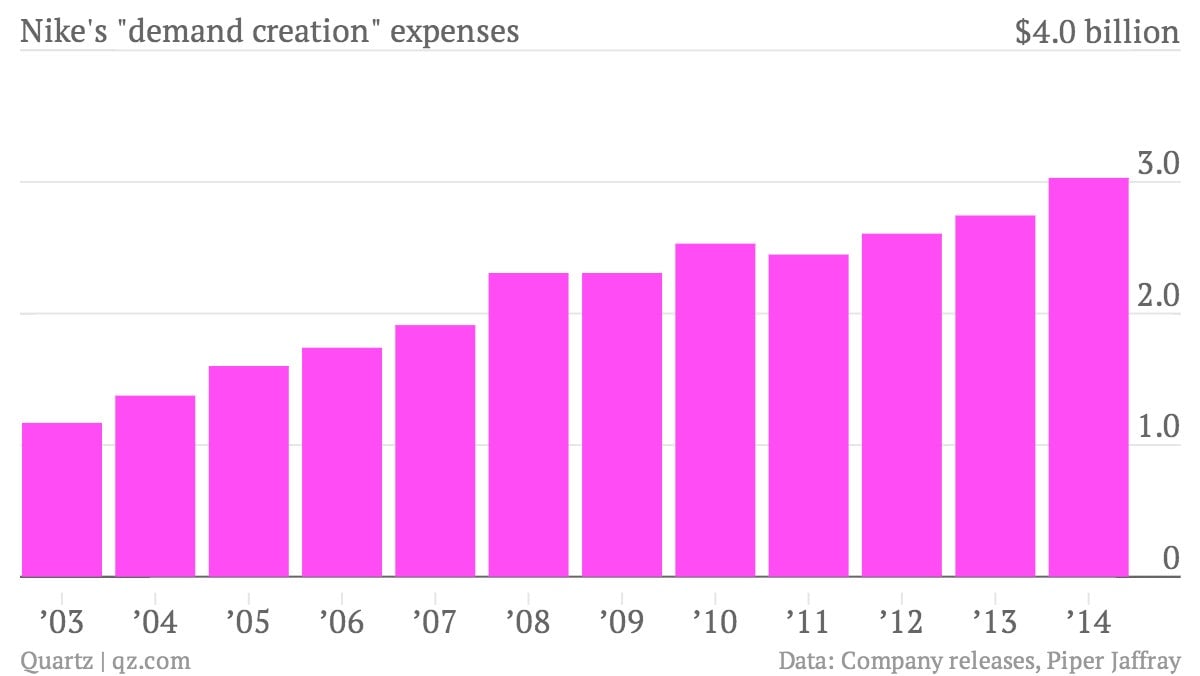

Nike really is going all out for the World Cup. The company confirmed in its quarterly earnings, released overnight, that it is spending more than ever before on advertising and endorsement deals.

Nike really is going all out for the World Cup. The company confirmed in its quarterly earnings, released overnight, that it is spending more than ever before on advertising and endorsement deals.

“Demand creation” expenses (the company’s nauseating corporate jargon for such costs) were up 36% during its fiscal fourth quarter from a year earlier, driven by the World Cup. They hit $876 million, bringing full-year demand creation costs to $3.031 billion. That’s up exactly $500 million from 2010, the last World Cup year.

It’s not hard to understand why. Nike’s global business in soccer cleats and equipment generated $2.3 billion in revenue for the company last year, up 21% from a year earlier. The company noted that it even saw ”double-digit” growth in soccer-related revenue in historically soccer-averse North America, where it makes nearly half of its total revenue. The company is expecting its total revenue to grow at a “low-double-digit” rate this quarter, “driven by tremendous energy around the World Cup.”

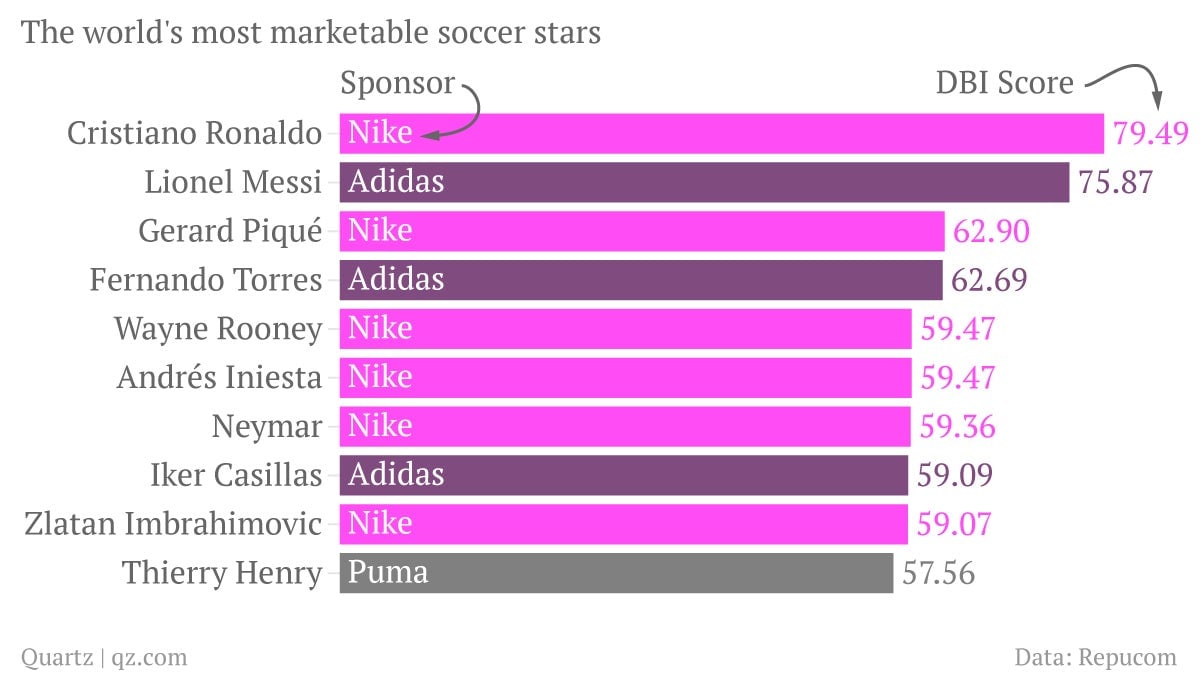

As we discussed earlier this month, Nike has pursued a different strategy to its shoe and sportswear rival brand, Adidas. The German company is an official sponsor of the World Cup: Its balls are used in matches, and its logo is emblazoned across sideboards.

But Nike may be getting more bang for its buck in Brazil. The company has sponsored some prominent individual teams (including that of the host nation, Brazil) and more individual star players than Adidas has. (The chart below ranks players by their scores on the Davie-Brown Index (DBI), which measures consumer perceptions of celebrities.)